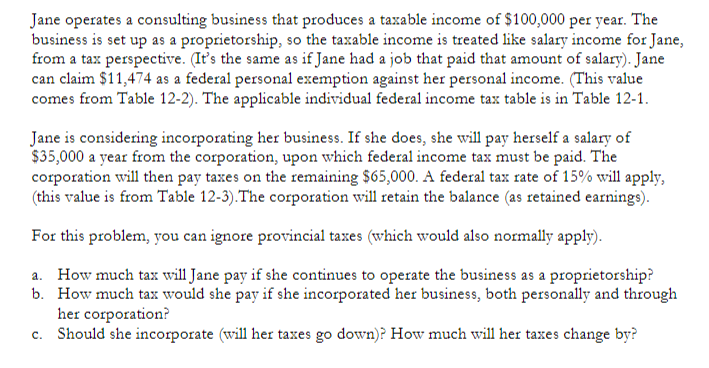

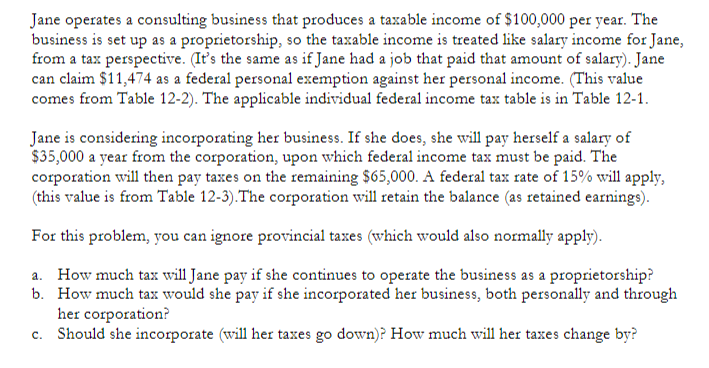

Jane operates a consulting business that produces a taxable income of $100,000 per year. The business is set up as a proprietorship, so the taxable income is treated like salary income for Jane, from a tax perspective. (It's the same as if Jane had a job that paid that amount of salary). Jane can claim $11,474 as a federal personal exemption against her personal income. (This value comes from Table 12-2). The applicable individual federal income tax table is in Table 12-1. Jane is considering incorporating her business. If she does, she will pay herself a salary of $35,000 a year from the corporation, upon which federal income tax must be paid. The corporation will then pay taxes on the remaining $65,000. A federal tax rate of 15% will apply, (this value is from Table 12-3). The corporation will retain the balance (as retained earnings). For this problem, you can ignore provincial taxes (which would also normally apply). 2. How much tax will Jane pay if she continues to operate the business as a proprietorship? b. How much tax would she pay if she incorporated her business, both personally and through her corporation c. Should she incorporate will her taxes go down)? How much will her taxes change by? Jane operates a consulting business that produces a taxable income of $100,000 per year. The business is set up as a proprietorship, so the taxable income is treated like salary income for Jane, from a tax perspective. (It's the same as if Jane had a job that paid that amount of salary). Jane can claim $11,474 as a federal personal exemption against her personal income. (This value comes from Table 12-2). The applicable individual federal income tax table is in Table 12-1. Jane is considering incorporating her business. If she does, she will pay herself a salary of $35,000 a year from the corporation, upon which federal income tax must be paid. The corporation will then pay taxes on the remaining $65,000. A federal tax rate of 15% will apply, (this value is from Table 12-3). The corporation will retain the balance (as retained earnings). For this problem, you can ignore provincial taxes (which would also normally apply). 2. How much tax will Jane pay if she continues to operate the business as a proprietorship? b. How much tax would she pay if she incorporated her business, both personally and through her corporation c. Should she incorporate will her taxes go down)? How much will her taxes change by