Question

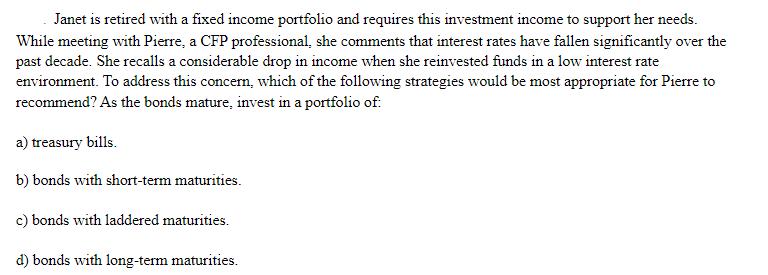

Janet is retired with a fixed income portfolio and requires this investment income to support her needs. While meeting with Pierre, a CFP professional,

Janet is retired with a fixed income portfolio and requires this investment income to support her needs. While meeting with Pierre, a CFP professional, she comments that interest rates have fallen significantly over the past decade. She recalls a considerable drop in income when she reinvested funds in a low interest rate environment. To address this concern, which of the following strategies would be most appropriate for Pierre to recommend? As the bonds mature, invest in a portfolio of: a) treasury bills. b) bonds with short-term maturities. c) bonds with laddered maturities. d) bonds with long-term maturities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Given Janets concern about the impact o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Project Management A Systems Approach To Planning Scheduling And Controlling

Authors: Harold Kerzner

12th Edition

1119165350, 9781119165354

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App