Question

Janet just graduated from college, has a job she's scheduled to begin in three months and has decided to treat herself to six weeks of

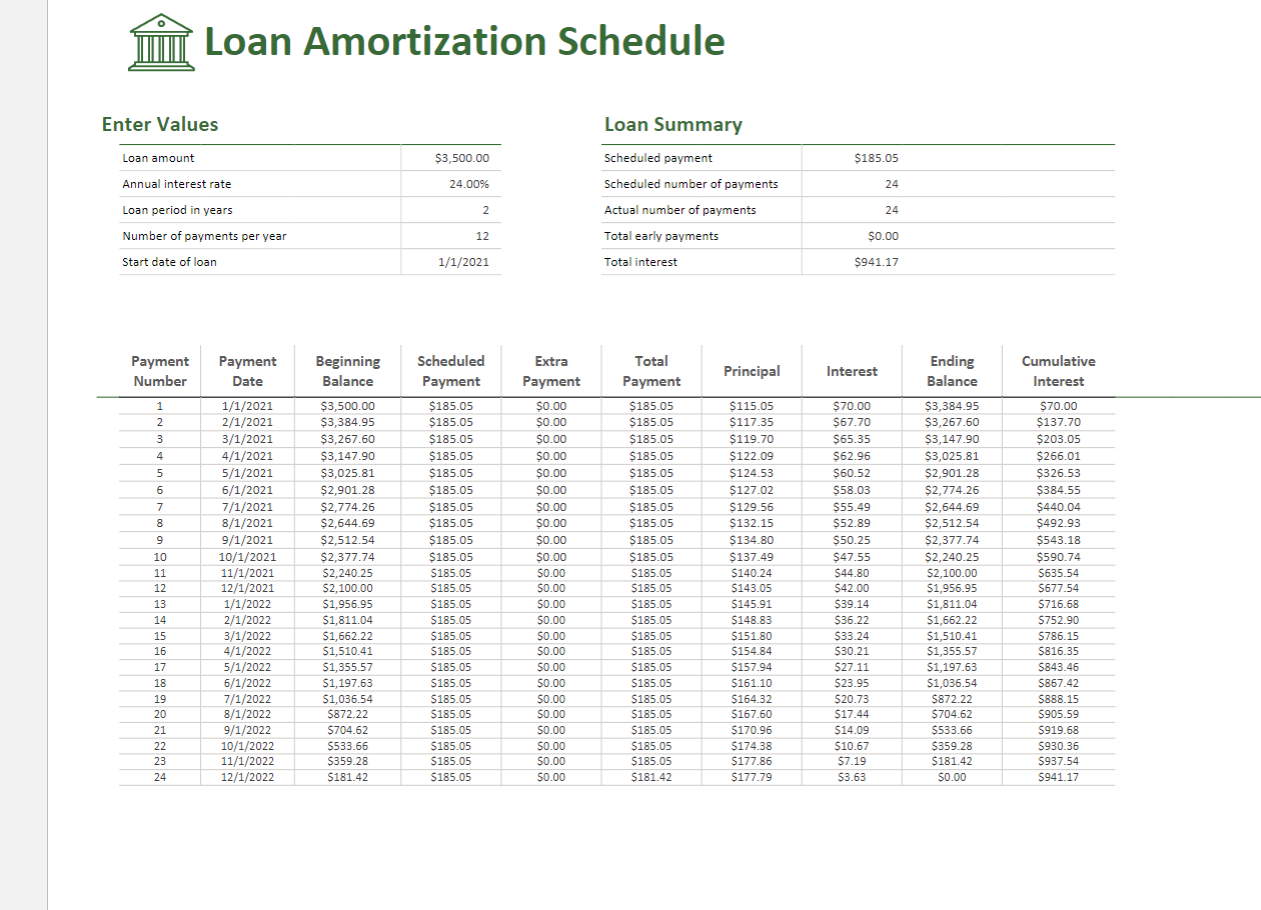

Janet just graduated from college, has a job she's scheduled to begin in three months and has decided to treat herself to six weeks of travel across South America before she buckles down and starts working full-time. To do the trip, she is thinking of applying for a personal loan of $3,500, and the bank she uses for her checking and savings account has offered her an interest rate of 24%. She has a goal of paying off the trip within two years, so she uses this,

Janet just graduated from college, has a job she's scheduled to begin in three months and has decided to treat herself to six weeks of travel across South America before she buckles down and starts working full-time. To do the trip, she is thinking of applying for a personal loan of $3,500, and the bank she uses for her checking and savings account has offered her an interest rate of 24%. She has a goal of paying off the trip within two years, so she uses this,

1.How much is Janet going to pay every month?

2.On January 1, 2021, how much of Janet's payment goes toward interest?

3.On January 1, 2021, how much of Janet's payment goes toward principal?

4.By the time Janet pays off her entire loan, how much interest will she have paid?

5.By the time Janet pays off her entire loan, how much will the trip have cost her in total? (Loan Amount + Cumulative Interest)

6. Let's suppose that Janet received a year-end bonus and can afford to make an extra payment of $100 during January 2022. What would the Principal be for January 2022?

7. Let's suppose that Janet received a year-end bonus and can afford to make an extra payment of $100 during January 2022. What would the INTEREST be for January 2022?

8. Let's suppose that Janet received a year-end bonus and can afford to make an extra payment of $100 during January 2022. What would the Total Interest be for January 2022?

9. Let's suppose that Janet received a year-end bonus and can afford to make an extra payment of $100 during January 2022. What would the Balance be for January 2022?

1.How much is Janet going to pay every month?

2.On January 1, 2021, how much of Janet's payment goes toward interest?

3.On January 1, 2021, how much of Janet's payment goes toward principal?

4.By the time Janet pays off her entire loan, how much interest will she have paid?

5.By the time Janet pays off her entire loan, how much will the trip have cost her in total? (Loan Amount + Cumulative Interest)

6. Let's suppose that Janet received a year-end bonus and can afford to make an extra payment of $100 during January 2022. What would the Principal be for January 2022?

7. Let's suppose that Janet received a year-end bonus and can afford to make an extra payment of $100 during January 2022. What would the INTEREST be for January 2022?

8. Let's suppose that Janet received a year-end bonus and can afford to make an extra payment of $100 during January 2022. What would the Total Interest be for January 2022?

9. Let's suppose that Janet received a year-end bonus and can afford to make an extra payment of $100 during January 2022. What would the Balance be for January 2022?

1.How much is Janet going to pay every month?

2.On January 1, 2021, how much of Janet's payment goes toward interest?

3.On January 1, 2021, how much of Janet's payment goes toward principal?

4.By the time Janet pays off her entire loan, how much interest will she have paid?

5.By the time Janet pays off her entire loan, how much will the trip have cost her in total? (Loan Amount + Cumulative Interest)

6. Let's suppose that Janet received a year-end bonus and can afford to make an extra payment of $100 during January 2022. What would the Principal be for January 2022?

7. Let's suppose that Janet received a year-end bonus and can afford to make an extra payment of $100 during January 2022. What would the INTEREST be for January 2022?

8. Let's suppose that Janet received a year-end bonus and can afford to make an extra payment of $100 during January 2022. What would the Total Interest be for January 2022?

9. Let's suppose that Janet received a year-end bonus and can afford to make an extra payment of $100 during January 2022. What would the Balance be for January 2022?

Loan Amortization Schedule Enter Values Loan Summarv

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started