Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Janet just graduated from college, has a job she's scheduled to begin in 3 months and has decided to treat herself to 6 weeks

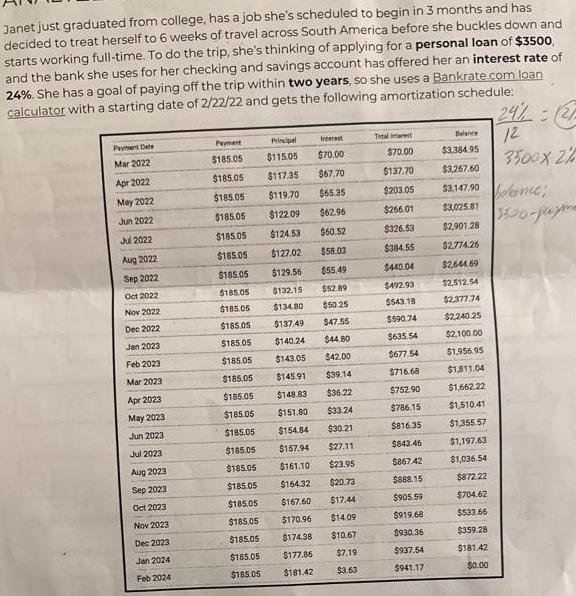

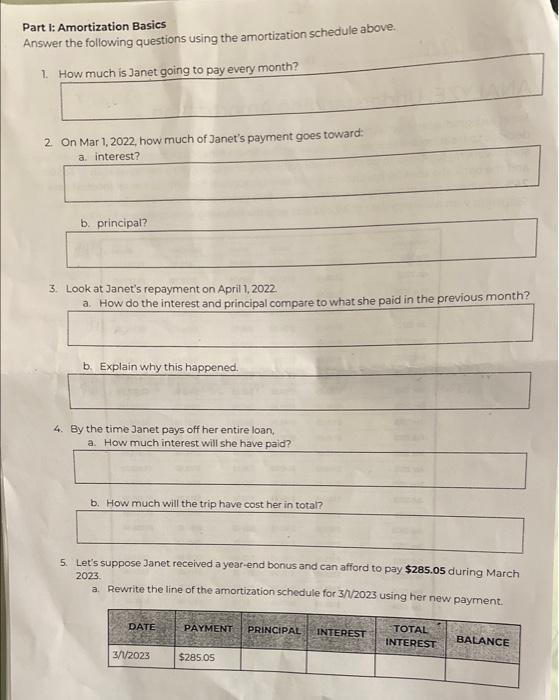

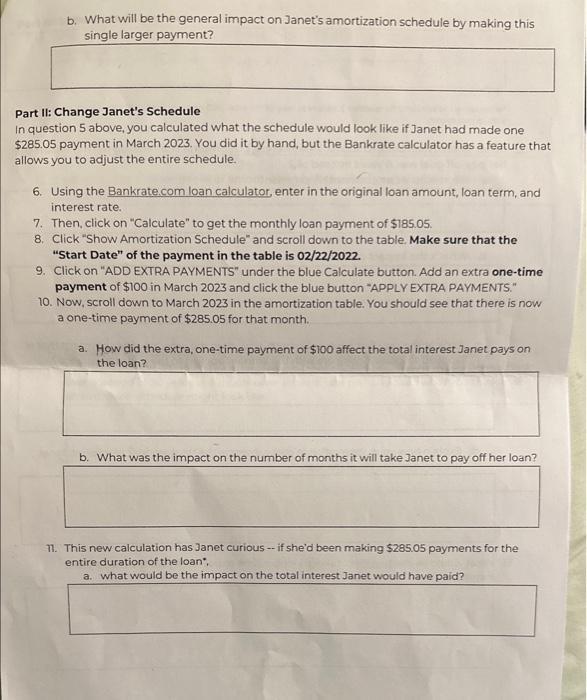

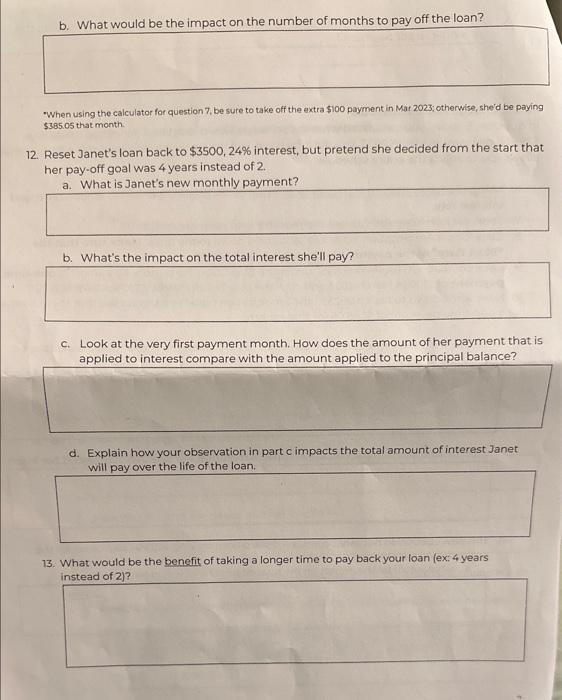

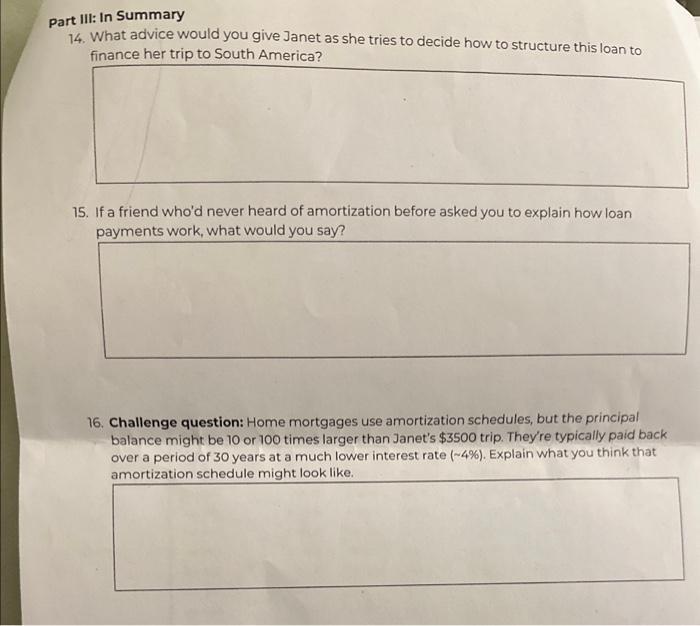

Janet just graduated from college, has a job she's scheduled to begin in 3 months and has decided to treat herself to 6 weeks of travel across South America before she buckles down and starts working full-time. To do the trip, she's thinking of applying for a personal loan of $3500, and the bank she uses for her checking and savings account has offered her an interest rate of 24%. She has a goal of paying off the trip within two years, so she uses a Bankrate.com .loan calculator with a starting date of 2/22/22 and gets the following amortization schedule: Payment Dete Mar 2022 Apr 2022 May 2022 Jun 2022 Jul 2022 Aug 2022 Sep 2022 Oct 2022 Nov 2022 Dec 2022 Jan 2023 Feb 2023 Mar 2023 Apr 2023 May 2023 Jun 2023 Jul 2023 Aug 2023 Sep 2023 Oct 2023 Nov 2023 Dec 2023 Jan 2024 Feb 2024 Payment Principal $185.05 $115.05 $185.05 $117.35 $185.05 $119.70 $185.05 $122.09 $185.05 $124.53 $185.05 $127.02 $129.56 $132.15 $134.80 $137.49 $140.24 $143.05 $145.91 $148.83 $151.80 $154.84 $157.94 $161.10 $164.32 $167.60 $170.96 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $174.38 $177.86 $181.42 Interest $70.00 $67.70 $65.35 $62.96 $60.52 $58.03 $55.49 $52.89 $50.25 $47.55 $44.80 $42.00 $39,14 $36.22 $33.24 $30.21 $27.11 $23.95 $20.73 $17.44 $14.09 $10.67 $7.19 $3.63 Total intarest $70.00 $137.70 $203.05 $256.01 $326.53 $384.55 $440.04 $492.93 $543.18 $590.74 $635.54 $677.54 $716.68 $752.90 $786.15 $816.35 $843.46 $867.42 $888.15 $905.59 $919.68 $930.36 $937.54 $941.17 Balance $3,384.95 $3,267.60 $3,147.90nce; $3,025.81 $2,901.28 $2,774.26 $2,644.69 $2,512.54 $2,377.74 $2,240.25 $2,100.00 $1,956.95 $1,811.04 $1,662.22 $1,510.41 $1,355.57 $1,197.63 $1,036.54 24%2F 12 3500x 27 $872.22 $704.62 $533.66 $359.28 $181.42 $0.00 3520-payme Part I: Amortization Basics Answer the following questions using the amortization schedule above. 1. How much is Janet going to pay every month? 2. On Mar 1, 2022, how much of Janet's payment goes toward: a interest? b. principal? 3. Look at Janet's repayment on April 1, 2022. a. How do the interest and principal compare to what she paid in the previous month? b. Explain why this happened. 4. By the time Janet pays off her entire loan, a. How much interest will she have paid? b. How much will the trip have cost her in total? 5. Let's suppose Janet received a year-end bonus and can afford to pay $285.05 during March 2023 a. Rewrite the line of the amortization schedule for 3/1/2023 using her new payment. DATE 3/1/2023 PAYMENT PRINCIPAL INTEREST $285.05 TOTAL INTEREST BALANCE b. What will be the general impact on Janet's amortization schedule by making this single larger payment? Part II: Change Janet's Schedule In question 5 above, you calculated what the schedule would look like if Janet had made one $285.05 payment in March 2023. You did it by hand, but the Bankrate calculator has a feature that allows you to adjust the entire schedule. 6. Using the Bankrate.com loan calculator, enter in the original loan amount, loan term, and interest rate. 7. Then, click on "Calculate" to get the monthly loan payment of $185.05. 8. Click "Show Amortization Schedule" and scroll down to the table. Make sure that the "Start Date" of the payment in the table is 02/22/2022. 9. Click on "ADD EXTRA PAYMENTS" under the blue Calculate button. Add an extra one-time payment of $100 in March 2023 and click the blue button "APPLY EXTRA PAYMENTS." 10. Now, scroll down to March 2023 in the amortization table. You should see that there is now a one-time payment of $285.05 for that month. a. How did the extra, one-time payment of $100 affect the total interest Janet pays on the loan? 40 b. What was the impact on the number of months it will take Janet to pay off her loan? 11. This new calculation has Janet curious -- if she'd been making $285.05 payments for the entire duration of the loan", a. what would be the impact on the total interest Janet would have paid? b. What would be the impact on the number of months to pay off the loan? "When using the calculator for question 7, be sure to take off the extra $100 payment in Mar 2023; otherwise, she'd be paying $385.05 that month. 12. Reset Janet's loan back to $3500, 24% interest, but pretend she decided from the start that her pay-off goal was 4 years instead of 2. a. What is Janet's new monthly payment? b. What's the impact on the total interest she'll pay? c. Look at the very first payment month. How does the amount of her payment that is applied to interest compare with the amount applied to the principal balance? d. Explain how your observation in part c impacts the total amount of interest Janet will pay over the life of the loan. 13. What would be the benefit of taking a longer time to pay back your loan (ex: 4 years instead of 2)? Part III: In Summary 14. What advice would you give Janet as she tries to decide how to structure this loan to finance her trip to South America? 15. If a friend who'd never heard of amortization before asked you to explain how loan payments work, what would you say? 16. Challenge question: Home mortgages use amortization schedules, but the principal balance might be 10 or 100 times larger than Janet's $3500 trip. They're typically paid back over a period of 30 years at a much lower interest rate (~4%). Explain what you think that amortization schedule might look like. Janet just graduated from college, has a job she's scheduled to begin in 3 months and has decided to treat herself to 6 weeks of travel across South America before she buckles down and starts working full-time. To do the trip, she's thinking of applying for a personal loan of $3500, and the bank she uses for her checking and savings account has offered her an interest rate of 24%. She has a goal of paying off the trip within two years, so she uses a Bankrate.com .loan calculator with a starting date of 2/22/22 and gets the following amortization schedule: Payment Dete Mar 2022 Apr 2022 May 2022 Jun 2022 Jul 2022 Aug 2022 Sep 2022 Oct 2022 Nov 2022 Dec 2022 Jan 2023 Feb 2023 Mar 2023 Apr 2023 May 2023 Jun 2023 Jul 2023 Aug 2023 Sep 2023 Oct 2023 Nov 2023 Dec 2023 Jan 2024 Feb 2024 Payment Principal $185.05 $115.05 $185.05 $117.35 $185.05 $119.70 $185.05 $122.09 $185.05 $124.53 $185.05 $127.02 $129.56 $132.15 $134.80 $137.49 $140.24 $143.05 $145.91 $148.83 $151.80 $154.84 $157.94 $161.10 $164.32 $167.60 $170.96 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $174.38 $177.86 $181.42 Interest $70.00 $67.70 $65.35 $62.96 $60.52 $58.03 $55.49 $52.89 $50.25 $47.55 $44.80 $42.00 $39,14 $36.22 $33.24 $30.21 $27.11 $23.95 $20.73 $17.44 $14.09 $10.67 $7.19 $3.63 Total intarest $70.00 $137.70 $203.05 $256.01 $326.53 $384.55 $440.04 $492.93 $543.18 $590.74 $635.54 $677.54 $716.68 $752.90 $786.15 $816.35 $843.46 $867.42 $888.15 $905.59 $919.68 $930.36 $937.54 $941.17 Balance $3,384.95 $3,267.60 $3,147.90nce; $3,025.81 $2,901.28 $2,774.26 $2,644.69 $2,512.54 $2,377.74 $2,240.25 $2,100.00 $1,956.95 $1,811.04 $1,662.22 $1,510.41 $1,355.57 $1,197.63 $1,036.54 24%2F 12 3500x 27 $872.22 $704.62 $533.66 $359.28 $181.42 $0.00 3520-payme Part I: Amortization Basics Answer the following questions using the amortization schedule above. 1. How much is Janet going to pay every month? 2. On Mar 1, 2022, how much of Janet's payment goes toward: a interest? b. principal? 3. Look at Janet's repayment on April 1, 2022. a. How do the interest and principal compare to what she paid in the previous month? b. Explain why this happened. 4. By the time Janet pays off her entire loan, a. How much interest will she have paid? b. How much will the trip have cost her in total? 5. Let's suppose Janet received a year-end bonus and can afford to pay $285.05 during March 2023 a. Rewrite the line of the amortization schedule for 3/1/2023 using her new payment. DATE 3/1/2023 PAYMENT PRINCIPAL INTEREST $285.05 TOTAL INTEREST BALANCE b. What will be the general impact on Janet's amortization schedule by making this single larger payment? Part II: Change Janet's Schedule In question 5 above, you calculated what the schedule would look like if Janet had made one $285.05 payment in March 2023. You did it by hand, but the Bankrate calculator has a feature that allows you to adjust the entire schedule. 6. Using the Bankrate.com loan calculator, enter in the original loan amount, loan term, and interest rate. 7. Then, click on "Calculate" to get the monthly loan payment of $185.05. 8. Click "Show Amortization Schedule" and scroll down to the table. Make sure that the "Start Date" of the payment in the table is 02/22/2022. 9. Click on "ADD EXTRA PAYMENTS" under the blue Calculate button. Add an extra one-time payment of $100 in March 2023 and click the blue button "APPLY EXTRA PAYMENTS." 10. Now, scroll down to March 2023 in the amortization table. You should see that there is now a one-time payment of $285.05 for that month. a. How did the extra, one-time payment of $100 affect the total interest Janet pays on the loan? 40 b. What was the impact on the number of months it will take Janet to pay off her loan? 11. This new calculation has Janet curious -- if she'd been making $285.05 payments for the entire duration of the loan", a. what would be the impact on the total interest Janet would have paid? b. What would be the impact on the number of months to pay off the loan? "When using the calculator for question 7, be sure to take off the extra $100 payment in Mar 2023; otherwise, she'd be paying $385.05 that month. 12. Reset Janet's loan back to $3500, 24% interest, but pretend she decided from the start that her pay-off goal was 4 years instead of 2. a. What is Janet's new monthly payment? b. What's the impact on the total interest she'll pay? c. Look at the very first payment month. How does the amount of her payment that is applied to interest compare with the amount applied to the principal balance? d. Explain how your observation in part c impacts the total amount of interest Janet will pay over the life of the loan. 13. What would be the benefit of taking a longer time to pay back your loan (ex: 4 years instead of 2)? Part III: In Summary 14. What advice would you give Janet as she tries to decide how to structure this loan to finance her trip to South America? 15. If a friend who'd never heard of amortization before asked you to explain how loan payments work, what would you say? 16. Challenge question: Home mortgages use amortization schedules, but the principal balance might be 10 or 100 times larger than Janet's $3500 trip. They're typically paid back over a period of 30 years at a much lower interest rate (~4%). Explain what you think that amortization schedule might look like. Janet just graduated from college, has a job she's scheduled to begin in 3 months and has decided to treat herself to 6 weeks of travel across South America before she buckles down and starts working full-time. To do the trip, she's thinking of applying for a personal loan of $3500, and the bank she uses for her checking and savings account has offered her an interest rate of 24%. She has a goal of paying off the trip within two years, so she uses a Bankrate.com .loan calculator with a starting date of 2/22/22 and gets the following amortization schedule: Payment Dete Mar 2022 Apr 2022 May 2022 Jun 2022 Jul 2022 Aug 2022 Sep 2022 Oct 2022 Nov 2022 Dec 2022 Jan 2023 Feb 2023 Mar 2023 Apr 2023 May 2023 Jun 2023 Jul 2023 Aug 2023 Sep 2023 Oct 2023 Nov 2023 Dec 2023 Jan 2024 Feb 2024 Payment Principal $185.05 $115.05 $185.05 $117.35 $185.05 $119.70 $185.05 $122.09 $185.05 $124.53 $185.05 $127.02 $129.56 $132.15 $134.80 $137.49 $140.24 $143.05 $145.91 $148.83 $151.80 $154.84 $157.94 $161.10 $164.32 $167.60 $170.96 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $185.05 $174.38 $177.86 $181.42 Interest $70.00 $67.70 $65.35 $62.96 $60.52 $58.03 $55.49 $52.89 $50.25 $47.55 $44.80 $42.00 $39,14 $36.22 $33.24 $30.21 $27.11 $23.95 $20.73 $17.44 $14.09 $10.67 $7.19 $3.63 Total intarest $70.00 $137.70 $203.05 $256.01 $326.53 $384.55 $440.04 $492.93 $543.18 $590.74 $635.54 $677.54 $716.68 $752.90 $786.15 $816.35 $843.46 $867.42 $888.15 $905.59 $919.68 $930.36 $937.54 $941.17 Balance $3,384.95 $3,267.60 $3,147.90nce; $3,025.81 $2,901.28 $2,774.26 $2,644.69 $2,512.54 $2,377.74 $2,240.25 $2,100.00 $1,956.95 $1,811.04 $1,662.22 $1,510.41 $1,355.57 $1,197.63 $1,036.54 24%2F 12 3500x 27 $872.22 $704.62 $533.66 $359.28 $181.42 $0.00 3520-payme Part I: Amortization Basics Answer the following questions using the amortization schedule above. 1. How much is Janet going to pay every month? 2. On Mar 1, 2022, how much of Janet's payment goes toward: a interest? b. principal? 3. Look at Janet's repayment on April 1, 2022. a. How do the interest and principal compare to what she paid in the previous month? b. Explain why this happened. 4. By the time Janet pays off her entire loan, a. How much interest will she have paid? b. How much will the trip have cost her in total? 5. Let's suppose Janet received a year-end bonus and can afford to pay $285.05 during March 2023 a. Rewrite the line of the amortization schedule for 3/1/2023 using her new payment. DATE 3/1/2023 PAYMENT PRINCIPAL INTEREST $285.05 TOTAL INTEREST BALANCE b. What will be the general impact on Janet's amortization schedule by making this single larger payment? Part II: Change Janet's Schedule In question 5 above, you calculated what the schedule would look like if Janet had made one $285.05 payment in March 2023. You did it by hand, but the Bankrate calculator has a feature that allows you to adjust the entire schedule. 6. Using the Bankrate.com loan calculator, enter in the original loan amount, loan term, and interest rate. 7. Then, click on "Calculate" to get the monthly loan payment of $185.05. 8. Click "Show Amortization Schedule" and scroll down to the table. Make sure that the "Start Date" of the payment in the table is 02/22/2022. 9. Click on "ADD EXTRA PAYMENTS" under the blue Calculate button. Add an extra one-time payment of $100 in March 2023 and click the blue button "APPLY EXTRA PAYMENTS." 10. Now, scroll down to March 2023 in the amortization table. You should see that there is now a one-time payment of $285.05 for that month. a. How did the extra, one-time payment of $100 affect the total interest Janet pays on the loan? 40 b. What was the impact on the number of months it will take Janet to pay off her loan? 11. This new calculation has Janet curious -- if she'd been making $285.05 payments for the entire duration of the loan", a. what would be the impact on the total interest Janet would have paid? b. What would be the impact on the number of months to pay off the loan? "When using the calculator for question 7, be sure to take off the extra $100 payment in Mar 2023; otherwise, she'd be paying $385.05 that month. 12. Reset Janet's loan back to $3500, 24% interest, but pretend she decided from the start that her pay-off goal was 4 years instead of 2. a. What is Janet's new monthly payment? b. What's the impact on the total interest she'll pay? c. Look at the very first payment month. How does the amount of her payment that is applied to interest compare with the amount applied to the principal balance? d. Explain how your observation in part c impacts the total amount of interest Janet will pay over the life of the loan. 13. What would be the benefit of taking a longer time to pay back your loan (ex: 4 years instead of 2)? Part III: In Summary 14. What advice would you give Janet as she tries to decide how to structure this loan to finance her trip to South America? 15. If a friend who'd never heard of amortization before asked you to explain how loan payments work, what would you say? 16. Challenge question: Home mortgages use amortization schedules, but the principal balance might be 10 or 100 times larger than Janet's $3500 trip. They're typically paid back over a period of 30 years at a much lower interest rate (~4%). Explain what you think that amortization schedule might look like.

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

1 How much is Janet going to pay every month Janet is going to pay 18505 every month 2 On Mar 1 2022 the breakdown of Janets payment is as follows a The interest portion is 7000 b The principal portio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started