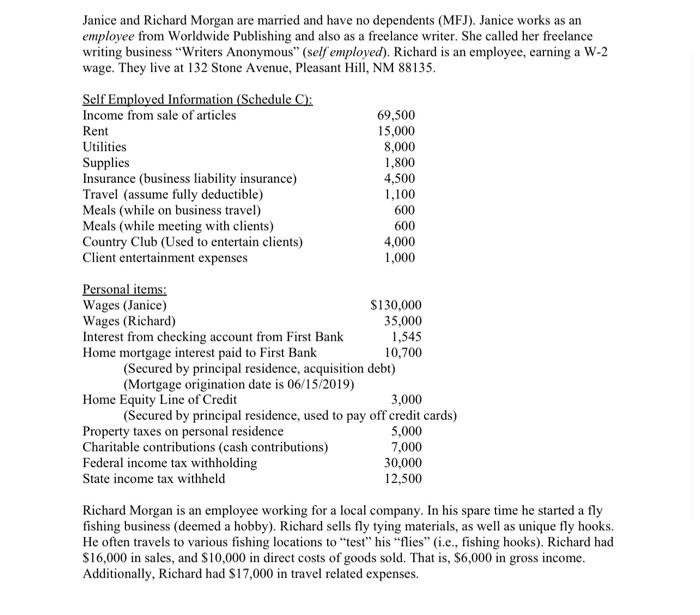

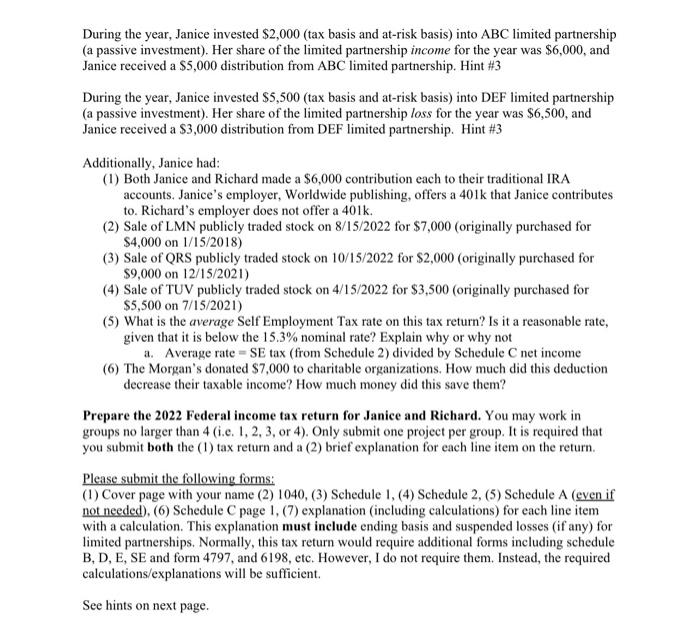

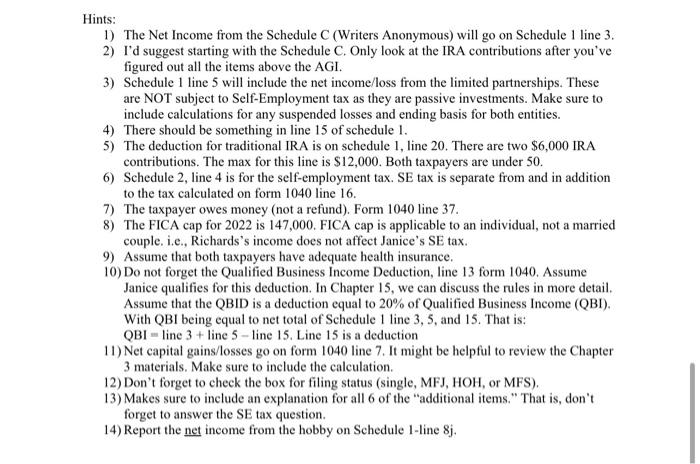

Janice and Richard Morgan are married and have no dependents (MFJ). Janice works as an employee from Worldwide Publishing and also as a freelance writer. She called her freelance writing business "Writers Anonymous" (self employed). Richard is an employee, earning a W-2 wage. They live at 132 Stone Avenue, Pleasant Hill, NM 88135. Richard Morgan is an employee working for a local company. In his spare time he started a fly fishing business (deemed a hobby). Richard sells fly tying materials, as well as unique fly hooks. He often travels to various fishing locations to "test" his "flies" (i.e., fishing hooks). Richard had $16,000 in sales, and $10,000 in direct costs of goods sold. That is, $6,000 in gross income. Additionally, Richard had $17,000 in travel related expenses. During the year, Janice invested $2,000 (tax basis and at-risk basis) into ABC limited partnership (a passive investment). Her share of the limited partnership income for the year was $6,000, and Janice received a $5,000 distribution from ABC limited partnership. Hint #3 During the year, Janice invested $5,500 (tax basis and at-risk basis) into DEF limited partnership (a passive investment). Her share of the limited partnership loss for the year was $6,500, and Janice received a $3,000 distribution from DEF limited partnership. Hint \#3 Additionally, Janice had: (1) Both Janice and Richard made a $6,000 contribution each to their traditional IRA accounts. Janice's employer, Worldwide publishing, offers a 401k that Janice contributes to. Richard's employer does not offer a 401k. (2) Sale of LMN publicly traded stock on 8/15/2022 for $7,000 (originally purchased for $4,000 on 1/15/2018 ) (3) Sale of QRS publicly traded stock on 10/15/2022 for $2,000 (originally purchased for $9,000 on 12/15/2021 ) (4) Sale of TUV publicly traded stock on 4/15/2022 for $3,500 (originally purchased for $5,500 on 7/15/2021 ) (5) What is the average Self Employment Tax rate on this tax return? Is it a reasonable rate, given that it is below the 15.3% nominal rate? Explain why or why not a. Average rate =SE tax (from Schedule 2) divided by Schedule C net income (6) The Morgan's donated $7,000 to charitable organizations. How much did this deduction decrease their taxable income? How much money did this save them? Prepare the 2022 Federal income tax return for Janice and Richard. You may work in groups no larger than 4 (i.c. 1, 2,3, or 4). Only submit one project per group. It is required that you submit both the (1) tax return and a (2) brief explanation for each line item on the return. Please submit the following forms: (1) Cover page with your name (2) 1040, (3) Schedule 1, (4) Schedule 2, (5) Schedule A (even if not needed), (6) Schedule C page 1, (7) explanation (including calculations) for each line item with a calculation. This explanation must include ending basis and suspended losses (if any) for limited partnerships. Normally, this tax return would require additional forms including schedule B, D, E, SE and form 4797 , and 6198 , etc. However, I do not require them. Instead, the required calculations/explanations will be sufficient. See hints on next page. Hints: 1) The Net Income from the Schedule C (Writers Anonymous) will go on Schedule 1 line 3. 2) I'd suggest starting with the Schedule C. Only look at the IRA contributions after you've figured out all the items above the AGI. 3) Schedule 1 line 5 will include the net income/loss from the limited partnerships. These are NOT subject to Self-Employment tax as they are passive investments. Make sure to include calculations for any suspended losses and ending basis for both entities. 4) There should be something in line 15 of schedule 1 . 5) The deduction for traditional IRA is on schedule 1 , line 20 . There are two $6,000 IRA contributions. The max for this line is $12,000. Both taxpayers are under 50 . 6) Schedule 2, line 4 is for the self-employment tax. SE tax is separate from and in addition to the tax calculated on form 1040 line 16. 7) The taxpayer owes money (not a refund). Form 1040 line 37. 8) The FICA cap for 2022 is 147,000. FICA cap is applicable to an individual, not a married couple. i.e., Richards's income does not affect Janice's SE tax. 9) Assume that both taxpayers have adequate health insurance. 10) Do not forget the Qualified Business Income Deduction, line 13 form 1040. Assume Janice qualifies for this deduction. In Chapter 15, we can discuss the rules in more detail. Assume that the QBID is a deduction equal to 20% of Qualified Business Income (QBI). With QBI being equal to net total of Schedule 1 line 3, 5, and 15. That is: QBI= line 3+ line 5 - line 15 . Line 15 is a deduction 11) Net capital gains/losses go on form 1040 line 7. It might be helpful to review the Chapter 3 materials. Make sure to include the calculation. 12) Don't forget to check the box for filing status (single, MFJ, HOH, or MFS). 13) Makes sure to include an explanation for all 6 of the "additional items." That is, don't forget to answer the SE tax question. 14) Report the net income from the hobby on Schedule 1-line 8j. Janice and Richard Morgan are married and have no dependents (MFJ). Janice works as an employee from Worldwide Publishing and also as a freelance writer. She called her freelance writing business "Writers Anonymous" (self employed). Richard is an employee, earning a W-2 wage. They live at 132 Stone Avenue, Pleasant Hill, NM 88135. Richard Morgan is an employee working for a local company. In his spare time he started a fly fishing business (deemed a hobby). Richard sells fly tying materials, as well as unique fly hooks. He often travels to various fishing locations to "test" his "flies" (i.e., fishing hooks). Richard had $16,000 in sales, and $10,000 in direct costs of goods sold. That is, $6,000 in gross income. Additionally, Richard had $17,000 in travel related expenses. During the year, Janice invested $2,000 (tax basis and at-risk basis) into ABC limited partnership (a passive investment). Her share of the limited partnership income for the year was $6,000, and Janice received a $5,000 distribution from ABC limited partnership. Hint #3 During the year, Janice invested $5,500 (tax basis and at-risk basis) into DEF limited partnership (a passive investment). Her share of the limited partnership loss for the year was $6,500, and Janice received a $3,000 distribution from DEF limited partnership. Hint \#3 Additionally, Janice had: (1) Both Janice and Richard made a $6,000 contribution each to their traditional IRA accounts. Janice's employer, Worldwide publishing, offers a 401k that Janice contributes to. Richard's employer does not offer a 401k. (2) Sale of LMN publicly traded stock on 8/15/2022 for $7,000 (originally purchased for $4,000 on 1/15/2018 ) (3) Sale of QRS publicly traded stock on 10/15/2022 for $2,000 (originally purchased for $9,000 on 12/15/2021 ) (4) Sale of TUV publicly traded stock on 4/15/2022 for $3,500 (originally purchased for $5,500 on 7/15/2021 ) (5) What is the average Self Employment Tax rate on this tax return? Is it a reasonable rate, given that it is below the 15.3% nominal rate? Explain why or why not a. Average rate =SE tax (from Schedule 2) divided by Schedule C net income (6) The Morgan's donated $7,000 to charitable organizations. How much did this deduction decrease their taxable income? How much money did this save them? Prepare the 2022 Federal income tax return for Janice and Richard. You may work in groups no larger than 4 (i.c. 1, 2,3, or 4). Only submit one project per group. It is required that you submit both the (1) tax return and a (2) brief explanation for each line item on the return. Please submit the following forms: (1) Cover page with your name (2) 1040, (3) Schedule 1, (4) Schedule 2, (5) Schedule A (even if not needed), (6) Schedule C page 1, (7) explanation (including calculations) for each line item with a calculation. This explanation must include ending basis and suspended losses (if any) for limited partnerships. Normally, this tax return would require additional forms including schedule B, D, E, SE and form 4797 , and 6198 , etc. However, I do not require them. Instead, the required calculations/explanations will be sufficient. See hints on next page. Hints: 1) The Net Income from the Schedule C (Writers Anonymous) will go on Schedule 1 line 3. 2) I'd suggest starting with the Schedule C. Only look at the IRA contributions after you've figured out all the items above the AGI. 3) Schedule 1 line 5 will include the net income/loss from the limited partnerships. These are NOT subject to Self-Employment tax as they are passive investments. Make sure to include calculations for any suspended losses and ending basis for both entities. 4) There should be something in line 15 of schedule 1 . 5) The deduction for traditional IRA is on schedule 1 , line 20 . There are two $6,000 IRA contributions. The max for this line is $12,000. Both taxpayers are under 50 . 6) Schedule 2, line 4 is for the self-employment tax. SE tax is separate from and in addition to the tax calculated on form 1040 line 16. 7) The taxpayer owes money (not a refund). Form 1040 line 37. 8) The FICA cap for 2022 is 147,000. FICA cap is applicable to an individual, not a married couple. i.e., Richards's income does not affect Janice's SE tax. 9) Assume that both taxpayers have adequate health insurance. 10) Do not forget the Qualified Business Income Deduction, line 13 form 1040. Assume Janice qualifies for this deduction. In Chapter 15, we can discuss the rules in more detail. Assume that the QBID is a deduction equal to 20% of Qualified Business Income (QBI). With QBI being equal to net total of Schedule 1 line 3, 5, and 15. That is: QBI= line 3+ line 5 - line 15 . Line 15 is a deduction 11) Net capital gains/losses go on form 1040 line 7. It might be helpful to review the Chapter 3 materials. Make sure to include the calculation. 12) Don't forget to check the box for filing status (single, MFJ, HOH, or MFS). 13) Makes sure to include an explanation for all 6 of the "additional items." That is, don't forget to answer the SE tax question. 14) Report the net income from the hobby on Schedule 1-line 8j