Question

Janice Morgan, age 24, is single and has no dependents. Janice works as an employee from Worldwide Publishing and also as a freelance writer. In

Janice Morgan, age 24, is single and has no dependents. Janice works as an employee from Worldwide Publishing and also as a freelance writer. In January 2018, Janice opened her own office located at 2751 Waldham Road, Pleasant Hill, NM 88135. She called her freelance writing business Writers Anonymous. Both Writers Anonymous and Janice operate on the cash basis. She lives at 132 Stone Avenue, Pleasant Hill, NM 88135. Her Social Security number is 123-45- 6789. During 2018, Janice reported the following income and expense items connected with her business Writers Anonymous (a sole proprietorship):

Income from sale of articles Rent Utilities Supplies

Insurance Travel (assume fully deductible) Meals (client meetings) Meals (Used by Janice while on business travel) Country Club (Used to entertain clients) Client entertainment expenses

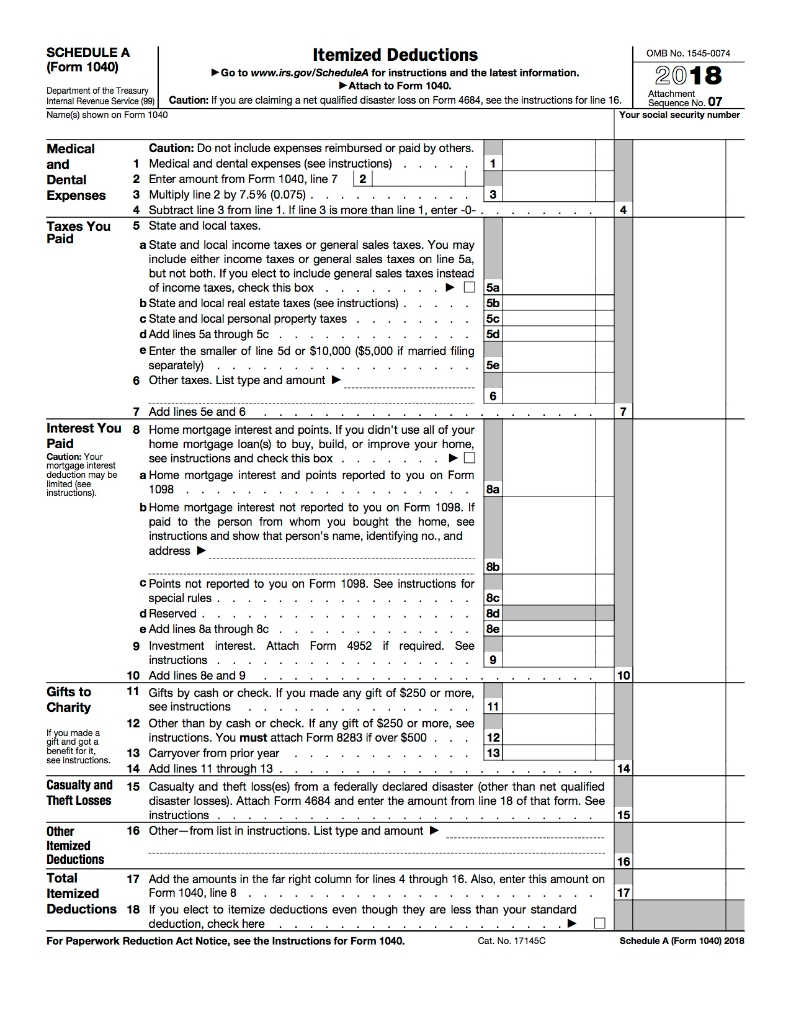

Janice has the following personal items:

Wages from Worldwide Publishing Interest from checking account from First Bank Home mortgage interest paid to First Bank

75,000 23,500 7,900 1,800 5,000 2,300 600 600 4,000 1,000

$110,000 4,000 10,000

(Secured by principal residence, acquisition debt) Home Equity Line of Credit 3,000

(Secured by principal residence, used to pay off credit cards)

Property taxes on personal residence Charitable contributions Federal income tax withholding State income tax withheld

4,000 10,700 27,000

8,500

During the year, Janice invested $15,000 (tax basis and at-risk basis) into XYZ limited partnership (a passive investment). Her share of the limited partnership income for the year was $6,000, and Janice received a $8,000 distribution from XYZ limited partnership.

During the year, Janice also invested $4,000 (tax basis and at-risk basis) into ABC limited partnership (a passive investment). Her share of the limited partnership loss for the year was $6,000, and Janice received a $1,000 distribution from ABC limited partnership.

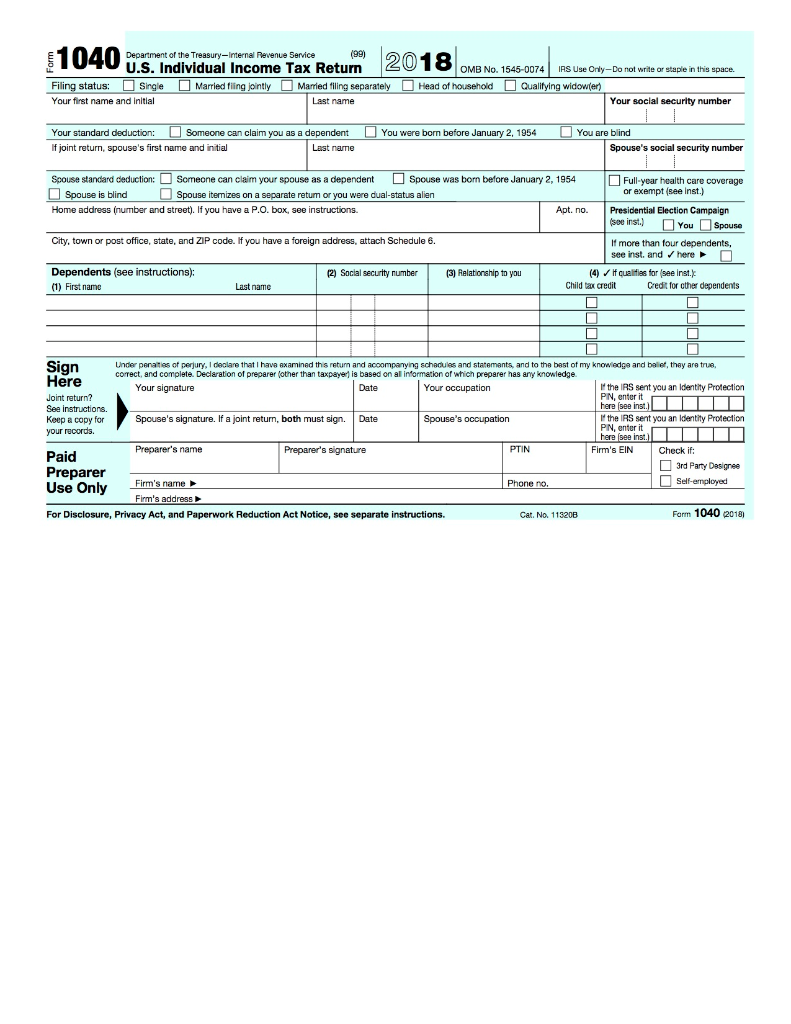

Prepare the 2018 Federal income tax return for Janice Morgan. You may work in groups no larger than 3 (i.e. 1, 2, or 3). Submit one tax return per group.

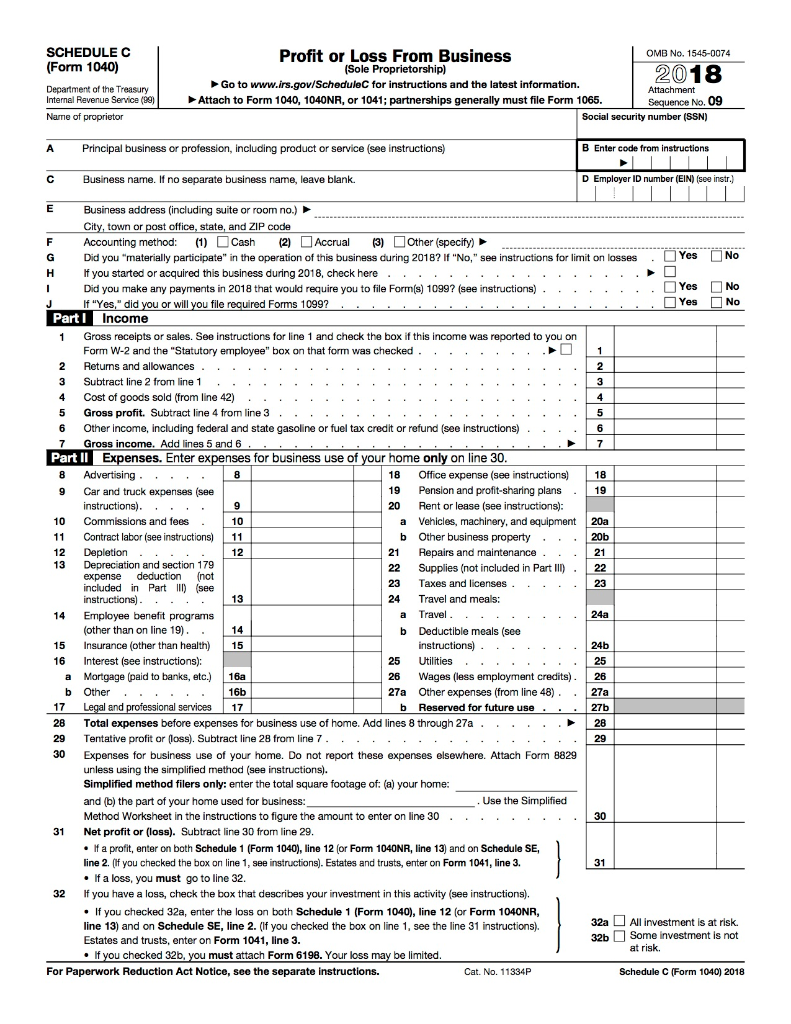

Please submit the following forms: (1) Cover page with student names (2) 1040, (3) Schedule 1, (4) Schedule 4, (5) Schedule A, (6) Schedule C page 1, (7) calculation/explanation of the taxable portion from the limited partnerships (must include loss carryforwards as well as their classification (passive vs. at-risk)), (8) calculation of self-employment tax, (9) calculation of tax.

Normally, this tax return would require additional forms (Schedule B, Schedule E, Schedule SE, Etc.). However, I do not require them. Instead, the required calculations/explanations will be sufficient.

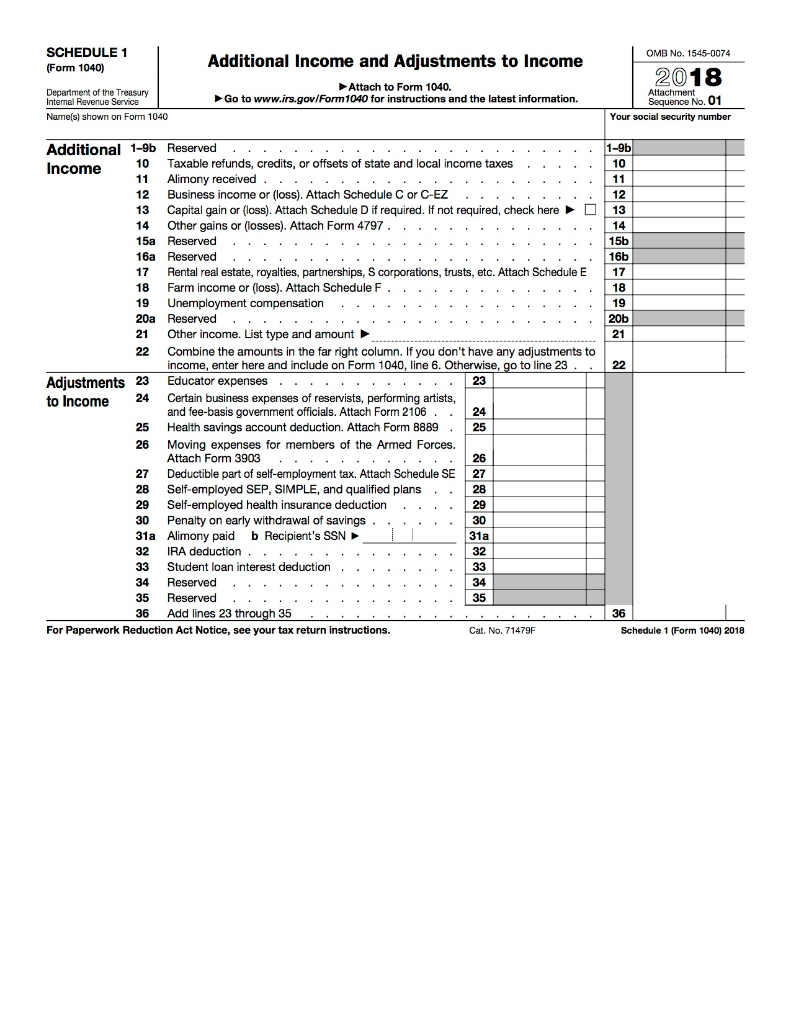

Schedule 1 Hints:

1) The Net income from the Schedule C (Writers Anonymous) will go on line 12

2) Line 17 will include the net income/loss from the limited partnerships. These are NOT

subject to Self-Employment tax.

3) There should be something in line 27

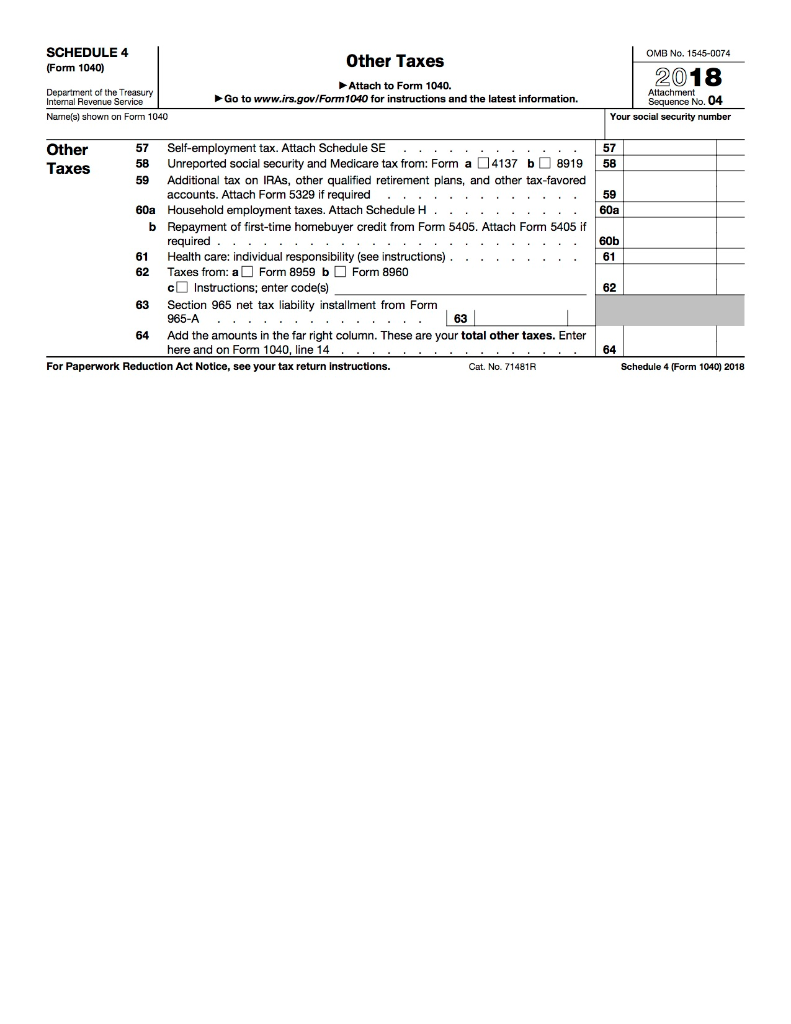

Other Hints:

4) Schedule 4, line 57 is for the self-employment tax. SE tax is separate from and in addition

to the tax calculated on form 1040 line 11.

5) The taxpayer has a refund.

6) The FICA cap for 2018 is 128,400, not 132,900

7) Assume that Janice has adequate health insurance.

8) Do not forget the Deduction for Qualified Business Income (new in 2018), line 9 form

1040. Assume Janice qualifies for this deduction. In Chapter 15, we can discuss the rules in more detail. Assume that the QBI is a deduction equal to 20% of Qualified Income. This deduction will go on 1040 line 9. Qualified income includes the net total of Schedule 1 line 12, 17, and 27. That is line 12 + line 17 line 27.

O 0 4 0 Department of the Treasury-Internal Revenue Service (99) U.S. Individual Income Tax Return Filing status: Single Married fling jointly Married filing separately Your first name and initial Last name I OMB No 1545-0074 IRS Use Only-Do not write or staple in this space. Head of household Qualifying widower) Your social security number You were born before January 2, 1954 Your standard deduction: Someone can claim you as a dependent If joint return, spouse's first name and initial Last name You are blind Spouse's social security number Spouse standard deduction: Someone can claim your spouse as a dependent Spouse was born before January 2, 1954 Spouse is blind Spouse itemizes on a separate retum or you were dual-status alien Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Full-year health care coverage or exempt Ree Inst.) Presidential Election Campaign isce inst.) You Spouse City, town or post office, state, and ZIP code. If you have a foreign address, attach Schedule 6. If more than four dependents, see inst. and heren (4) If qualities for see inst. Child tax credit Credit for other dependents (2) Social security number (3) Relationship to you Dependents (see instructions): (1) First name Last name Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and baile, they are true correct, and complete. Declaration of preparer other than taxpayer is based on al information of which preparer has any knowledge Here Your signature Date Your occupation the IRS sent you an Identity Protection Joint return? PN, enter it See instructions. here see inst. Keep a copy for Spouse's signature. If a joint return, both must sign. Date Spouse's occupation I the IRS sent you an Identity Protection your records. PN, enter it here see install Preparer's name Preparer's signature PTIN Firm's EIN Paid Check if: 3rd Party Desigree Preparer Use Only Firm's name Phone no. Self-employed Firm's address For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 113208 Form 1040 2018 OMB No. 1545-0074 SCHEDULE 1 (Form 1040) Additional Income and Adjustments to Income 2018 Attach to Form 1040. Go to www.irs.gov/Form 1040 for instructions and the latest information. Department of the Treasury Internal Revenue Service Name(s) shown on Form 1040 Attachment Sequence No. 01 Your social security number 1-9b 10 11 12 15b 16b 17 19 20b Additional 1-9b Reserved . . . . . . . . . . . . . . . . . . . . . . . . 10 Taxable refunds, credits, or offsets of state and local income taxes . . . . . Income 11 Alimony received. . . . . . . . . . . . . . . . . . . 12 Business income or (loss). Attach Schedule C or C-EZ . . . . . . . 13 Capital gain or loss). Attach Schedule D if required. If not required, check here 14 Other gains or losses). Attach Form 4797. . . 15a Reserved . . . . . . . . . . . . . . . . . . . 16a Reserved . . . . . . . . . . . . . . . . . . . 17 Rental real estate, royalties, partnerships. S corporations, trusts, etc. Attach Schedule E 18 Farm income or loss). Attach Schedule F . . . . . . . . . . . . . . 19 Unemployment compensation . . . . . . . . . . . . . . . . . 20a Reserved . . . . . . . . . . . . . . . . . . . . . 21 Other income. List type and amount 22 Combine the amounts in the far right column. If you don't have any adjustments to income, enter here and include on Form 1040, line 6. Otherwise, go to line 23. . Adjustments 23 Educator expenses ............ 23 to Income 24 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 . . 24 25 Health savings account deduction. Attach Form 8889 . 25 26 Moving expenses for members of the Armed Forces. Attach Form 3903 . . . . . . . . . . . . 26 27 Deductible part of self-employment tax. Attach Schedule SE 27 28 28 Self-employed SEP, SIMPLE, and qualified plans.. 29 Self-employed health insurance deduction .... 30 Penalty on early withdrawal of savings. . . . . . 31a Alimony paid b Recipient's SSN 32 IRA deduction . . . . . . . . . . . . . . 33 Student loan interest deduction, 34 Reserved . . . . . . . . . . . . . 35 Reserved . . . . . . 35 36 Add lines 23 through 35 .. . . . For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F 30 31a 32 34 36 Schedule 1 (Form 1040) 2018 OMB No. 1545-0074 SCHEDULE 4 (Form 1040) Other Taxes 2018 Attach to Form 1040. Go to www.irs.gov/Form 1040 for instructions and the latest information. Department of the Treasury Intemal Revenue Service Name(s) shown on Form 1040 Attachment Sequence No. 04 Your social security number . . . 57 58 59 60a 60b Other 57 Self-employment tax. Attach Schedule SE .... Taxes 58 Unreported social security and Medicare tax from: Form a 4137 b 8919 Additional tax on IRAs, other qualified retirement plans, and other tax-favored accounts. Attach Form 5329 if required . . 60a Household employment taxes. Attach Schedule H .......... b Repayment of first-time homebuyer credit from Form 5405. Attach Form 5405 if required. . . . . . . . . . . . . . . . . . . . . . . . 61 Health care: individual responsibility (see instructions) . . . . . . . . . 62 Taxes from: a Form 8959 b Form 8960 c Instructions; enter code(s) 63 Section 965 net tax liability installment from Form 965-A . . . . . . . . . . . . . 63 64 Add the amounts in the far right column. These are your total other taxes. Enter here and on Form 1040, line 14 For Paperwork Reduction Act Notice, see your tax return Instructions. Cat. No. 71481R 61 62 . - 64 Schedule 4 (Form 1040) 2018 SCHEDULE A Itemized Deductions OMB No. 1545-0074 (Form 1040) Go to www.irs.gov/ScheduleA for instructions and the latest information. Attach to Form 1040. Department of the Treasury Attachment a Internal Revenue Service (9) Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 16. Sequence No. 07 Name(s) shown on Form 1040 Your social security number 2018 ne 16. sequence No Medical and Dental Expenses Taxes You Paid Caution: Do not include expenses reimbursed or paid by others. 1 Medical and dental expenses (see instructions)... 2 Enter amount from Form 1040, line 7 2 3 Multiply line 2 by 7.5% (0.075) . . . 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter-O- 5 State and local taxes. a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box ... b State and local real estate taxes (see instructions) . . . c State and local personal property taxes ........ d Add lines 5a through 5c. . . . . . . . . . . . e Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) . . . . . . 6 Other taxes. List type and amount 7 Add lines 5e and 6 .. Interest You 8 Home mortgage interest and points. If you didn't use all of your Paid home mortgage loan(s) to buy, build, or improve your home, Caution: Your see instructions and check this box. . . . . . . U mortgage interest deduction may be a Home mortgage interest and points reported to you on Form limited (see instructions). 1098 . . . . . . . . . . . . . . . . . . . b Home mortgage interest not reported to you on Form 1098. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address . Bd . . . . . c Points not reported to you on Form 1098. See instructions for special rules. . . d Reserved. . . . . . . e Add lines Ba through 8c...... through 8c . . . . . . . 8e . . 9 Investment interest. Attach Form 4952 if required. See instructions. . . . . . . . . . . . 10 Add lines 8e and 9 .. Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, Charity see instructions . 12 Other than by cash or check. If any gift of $250 or more, see you made a gift and got a instructions. You must attach Form 8283 if over $500 ... 12 benefit for it. 13 Carryover from prior year . . . . . . . . . . . . 13 see instructions. 14 Add lines 11 through 13. Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions . . . . . . . . . . . . . . . . . . . . Other 16 Other-from list in instructions. List type and amount Itemized Deductions 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Form 1040, line 8 . . . . . . . . . . . . . . . . . . . . . . . Deductions 18 If you elect to itemize deductions even though they are less than your standard deduction, check here .. For Paperwork Reduction Act Notice, see the Instructions for Form 1040. Cat. No. 171450 15 Total 17 Schedule A (Form 1040) 2018 SCHEDULE C (Form 1040) 2018 Department of the Treasury Internal Revenue Service (99) Name of proprietor Profit or Loss From Business OMB No. 1545-0074 (Sole Proprietorship) Go to www.irs.gov/Schedule for instructions and the latest information. Attachment Attach to Form 1040, 1040NR, or 1041; partnerships generally must file Form 1065. Sequence No. 09 Social security number (SSN) Principal business or profession, including product or service (see instructions) B Enter code from instructions Business name. If no separate business name, leave blank. D Employer ID number (EIN) (see instr.) 0000 J & Business address (including suite or room no.) City, town or post office, state, and ZIP code Accounting method: (1) Cash (2) Accrual (3) Other (specify) Did you "materially participate in the operation of this business during 2018? If "No," see instructions for limit on losses Yes No H If you started or acquired this business during 2018, check here. Did you make any payments in 2018 that would require you to file Form(s) 1099? (see instructions). .. . Yes No I f "Yes," did you or will you file required Forms 1099? . . . . . . . . . . . . . . . . . D Yes U NO Partl Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked. . . ....SU Returns and allowances . . . . . . . Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . Cost of goods sold (from line 42) . . . . . . . . . . . . . . . . . . . . . Gross profit. Subtract line 4 from line 3 6 Other income, including federal and state gasoline or fuel tax credit or refund (see Instructions) . . 7 Gross income. Add lines 5 and 6. ... ... Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising. . . . 18 Office expense (see instructions) 18 Car and truck expenses (see 19 Pension and profit-sharing plans . 19 instructions). . . . . 20 Rent or lease (see instructions): Commissions and fees a Vehicles, machinery, and equipment 20a Contract labor (see instructions) b Other business property . . . 20b Depletion . . . . . 21 Repairs and maintenance. .. Depreciation and section 179 22 Supplies (not included in Part III). expense deduction (not 23 in Part III) (see Taxes and licenses. . . included . . instructions) . . . . . 24 Travel and meals: Employee benefit programs a Travel . . . . . . . . . (other than on line 19). . b Deductible meals (see 15 Insurance (other than health) 15 instructions) . . . . . . . 24b Interest (see instructions): 25 Utilities . . . 25 a Mortgage (paid to banks, etc.) 16a 26 Wages (less employment credits). 26 b Other . . . . 16b 27a Other expenses (from line 48). . 27a 17 Legal and professional services 17 b Reserved for future use. . . 28 Total expenses before expenses for business use of home. Add lines 8 through 27a 28 Tentative profit or loss). Subtract line 28 from line 7. . . . . . . . . . . . . . . . . 29 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method (see instructions). Simplified method filers only: enter the total square footage of: (a) your home: and (b) the part of your home used for business: _. Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30.. . . . . 30 31 Net profit or loss). Subtract line 30 from line 29. If a profit, enter on both Schedule 1 (Form 1040), line 12 (or Form 1040NR, line 13) and on Schedule SE, line 2. (if you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3 If a loss, you must go to line 32 If you have a loss, check the box that describes your investment in this activity (see instructions). If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 12 (or Form 1040NR, 32a All investment is at risk. line 13) and on Schedule SE, line 2. (If you checked the box on line 1, see the line 31 instructions). 32b Some investment is not Estates and trusts, enter on Form 1041, line 3. at risk. If you checked 32b, you must attach Form 6198. Your loss may be limited. For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11334P Schedule C (Form 1040) 2018 13 14 27b 29 O 0 4 0 Department of the Treasury-Internal Revenue Service (99) U.S. Individual Income Tax Return Filing status: Single Married fling jointly Married filing separately Your first name and initial Last name I OMB No 1545-0074 IRS Use Only-Do not write or staple in this space. Head of household Qualifying widower) Your social security number You were born before January 2, 1954 Your standard deduction: Someone can claim you as a dependent If joint return, spouse's first name and initial Last name You are blind Spouse's social security number Spouse standard deduction: Someone can claim your spouse as a dependent Spouse was born before January 2, 1954 Spouse is blind Spouse itemizes on a separate retum or you were dual-status alien Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Full-year health care coverage or exempt Ree Inst.) Presidential Election Campaign isce inst.) You Spouse City, town or post office, state, and ZIP code. If you have a foreign address, attach Schedule 6. If more than four dependents, see inst. and heren (4) If qualities for see inst. Child tax credit Credit for other dependents (2) Social security number (3) Relationship to you Dependents (see instructions): (1) First name Last name Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and baile, they are true correct, and complete. Declaration of preparer other than taxpayer is based on al information of which preparer has any knowledge Here Your signature Date Your occupation the IRS sent you an Identity Protection Joint return? PN, enter it See instructions. here see inst. Keep a copy for Spouse's signature. If a joint return, both must sign. Date Spouse's occupation I the IRS sent you an Identity Protection your records. PN, enter it here see install Preparer's name Preparer's signature PTIN Firm's EIN Paid Check if: 3rd Party Desigree Preparer Use Only Firm's name Phone no. Self-employed Firm's address For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 113208 Form 1040 2018 OMB No. 1545-0074 SCHEDULE 1 (Form 1040) Additional Income and Adjustments to Income 2018 Attach to Form 1040. Go to www.irs.gov/Form 1040 for instructions and the latest information. Department of the Treasury Internal Revenue Service Name(s) shown on Form 1040 Attachment Sequence No. 01 Your social security number 1-9b 10 11 12 15b 16b 17 19 20b Additional 1-9b Reserved . . . . . . . . . . . . . . . . . . . . . . . . 10 Taxable refunds, credits, or offsets of state and local income taxes . . . . . Income 11 Alimony received. . . . . . . . . . . . . . . . . . . 12 Business income or (loss). Attach Schedule C or C-EZ . . . . . . . 13 Capital gain or loss). Attach Schedule D if required. If not required, check here 14 Other gains or losses). Attach Form 4797. . . 15a Reserved . . . . . . . . . . . . . . . . . . . 16a Reserved . . . . . . . . . . . . . . . . . . . 17 Rental real estate, royalties, partnerships. S corporations, trusts, etc. Attach Schedule E 18 Farm income or loss). Attach Schedule F . . . . . . . . . . . . . . 19 Unemployment compensation . . . . . . . . . . . . . . . . . 20a Reserved . . . . . . . . . . . . . . . . . . . . . 21 Other income. List type and amount 22 Combine the amounts in the far right column. If you don't have any adjustments to income, enter here and include on Form 1040, line 6. Otherwise, go to line 23. . Adjustments 23 Educator expenses ............ 23 to Income 24 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 . . 24 25 Health savings account deduction. Attach Form 8889 . 25 26 Moving expenses for members of the Armed Forces. Attach Form 3903 . . . . . . . . . . . . 26 27 Deductible part of self-employment tax. Attach Schedule SE 27 28 28 Self-employed SEP, SIMPLE, and qualified plans.. 29 Self-employed health insurance deduction .... 30 Penalty on early withdrawal of savings. . . . . . 31a Alimony paid b Recipient's SSN 32 IRA deduction . . . . . . . . . . . . . . 33 Student loan interest deduction, 34 Reserved . . . . . . . . . . . . . 35 Reserved . . . . . . 35 36 Add lines 23 through 35 .. . . . For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F 30 31a 32 34 36 Schedule 1 (Form 1040) 2018 OMB No. 1545-0074 SCHEDULE 4 (Form 1040) Other Taxes 2018 Attach to Form 1040. Go to www.irs.gov/Form 1040 for instructions and the latest information. Department of the Treasury Intemal Revenue Service Name(s) shown on Form 1040 Attachment Sequence No. 04 Your social security number . . . 57 58 59 60a 60b Other 57 Self-employment tax. Attach Schedule SE .... Taxes 58 Unreported social security and Medicare tax from: Form a 4137 b 8919 Additional tax on IRAs, other qualified retirement plans, and other tax-favored accounts. Attach Form 5329 if required . . 60a Household employment taxes. Attach Schedule H .......... b Repayment of first-time homebuyer credit from Form 5405. Attach Form 5405 if required. . . . . . . . . . . . . . . . . . . . . . . . 61 Health care: individual responsibility (see instructions) . . . . . . . . . 62 Taxes from: a Form 8959 b Form 8960 c Instructions; enter code(s) 63 Section 965 net tax liability installment from Form 965-A . . . . . . . . . . . . . 63 64 Add the amounts in the far right column. These are your total other taxes. Enter here and on Form 1040, line 14 For Paperwork Reduction Act Notice, see your tax return Instructions. Cat. No. 71481R 61 62 . - 64 Schedule 4 (Form 1040) 2018 SCHEDULE A Itemized Deductions OMB No. 1545-0074 (Form 1040) Go to www.irs.gov/ScheduleA for instructions and the latest information. Attach to Form 1040. Department of the Treasury Attachment a Internal Revenue Service (9) Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 16. Sequence No. 07 Name(s) shown on Form 1040 Your social security number 2018 ne 16. sequence No Medical and Dental Expenses Taxes You Paid Caution: Do not include expenses reimbursed or paid by others. 1 Medical and dental expenses (see instructions)... 2 Enter amount from Form 1040, line 7 2 3 Multiply line 2 by 7.5% (0.075) . . . 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter-O- 5 State and local taxes. a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box ... b State and local real estate taxes (see instructions) . . . c State and local personal property taxes ........ d Add lines 5a through 5c. . . . . . . . . . . . e Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) . . . . . . 6 Other taxes. List type and amount 7 Add lines 5e and 6 .. Interest You 8 Home mortgage interest and points. If you didn't use all of your Paid home mortgage loan(s) to buy, build, or improve your home, Caution: Your see instructions and check this box. . . . . . . U mortgage interest deduction may be a Home mortgage interest and points reported to you on Form limited (see instructions). 1098 . . . . . . . . . . . . . . . . . . . b Home mortgage interest not reported to you on Form 1098. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address . Bd . . . . . c Points not reported to you on Form 1098. See instructions for special rules. . . d Reserved. . . . . . . e Add lines Ba through 8c...... through 8c . . . . . . . 8e . . 9 Investment interest. Attach Form 4952 if required. See instructions. . . . . . . . . . . . 10 Add lines 8e and 9 .. Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, Charity see instructions . 12 Other than by cash or check. If any gift of $250 or more, see you made a gift and got a instructions. You must attach Form 8283 if over $500 ... 12 benefit for it. 13 Carryover from prior year . . . . . . . . . . . . 13 see instructions. 14 Add lines 11 through 13. Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions . . . . . . . . . . . . . . . . . . . . Other 16 Other-from list in instructions. List type and amount Itemized Deductions 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Form 1040, line 8 . . . . . . . . . . . . . . . . . . . . . . . Deductions 18 If you elect to itemize deductions even though they are less than your standard deduction, check here .. For Paperwork Reduction Act Notice, see the Instructions for Form 1040. Cat. No. 171450 15 Total 17 Schedule A (Form 1040) 2018 SCHEDULE C (Form 1040) 2018 Department of the Treasury Internal Revenue Service (99) Name of proprietor Profit or Loss From Business OMB No. 1545-0074 (Sole Proprietorship) Go to www.irs.gov/Schedule for instructions and the latest information. Attachment Attach to Form 1040, 1040NR, or 1041; partnerships generally must file Form 1065. Sequence No. 09 Social security number (SSN) Principal business or profession, including product or service (see instructions) B Enter code from instructions Business name. If no separate business name, leave blank. D Employer ID number (EIN) (see instr.) 0000 J & Business address (including suite or room no.) City, town or post office, state, and ZIP code Accounting method: (1) Cash (2) Accrual (3) Other (specify) Did you "materially participate in the operation of this business during 2018? If "No," see instructions for limit on losses Yes No H If you started or acquired this business during 2018, check here. Did you make any payments in 2018 that would require you to file Form(s) 1099? (see instructions). .. . Yes No I f "Yes," did you or will you file required Forms 1099? . . . . . . . . . . . . . . . . . D Yes U NO Partl Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked. . . ....SU Returns and allowances . . . . . . . Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . Cost of goods sold (from line 42) . . . . . . . . . . . . . . . . . . . . . Gross profit. Subtract line 4 from line 3 6 Other income, including federal and state gasoline or fuel tax credit or refund (see Instructions) . . 7 Gross income. Add lines 5 and 6. ... ... Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising. . . . 18 Office expense (see instructions) 18 Car and truck expenses (see 19 Pension and profit-sharing plans . 19 instructions). . . . . 20 Rent or lease (see instructions): Commissions and fees a Vehicles, machinery, and equipment 20a Contract labor (see instructions) b Other business property . . . 20b Depletion . . . . . 21 Repairs and maintenance. .. Depreciation and section 179 22 Supplies (not included in Part III). expense deduction (not 23 in Part III) (see Taxes and licenses. . . included . . instructions) . . . . . 24 Travel and meals: Employee benefit programs a Travel . . . . . . . . . (other than on line 19). . b Deductible meals (see 15 Insurance (other than health) 15 instructions) . . . . . . . 24b Interest (see instructions): 25 Utilities . . . 25 a Mortgage (paid to banks, etc.) 16a 26 Wages (less employment credits). 26 b Other . . . . 16b 27a Other expenses (from line 48). . 27a 17 Legal and professional services 17 b Reserved for future use. . . 28 Total expenses before expenses for business use of home. Add lines 8 through 27a 28 Tentative profit or loss). Subtract line 28 from line 7. . . . . . . . . . . . . . . . . 29 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method (see instructions). Simplified method filers only: enter the total square footage of: (a) your home: and (b) the part of your home used for business: _. Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30.. . . . . 30 31 Net profit or loss). Subtract line 30 from line 29. If a profit, enter on both Schedule 1 (Form 1040), line 12 (or Form 1040NR, line 13) and on Schedule SE, line 2. (if you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3 If a loss, you must go to line 32 If you have a loss, check the box that describes your investment in this activity (see instructions). If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 12 (or Form 1040NR, 32a All investment is at risk. line 13) and on Schedule SE, line 2. (If you checked the box on line 1, see the line 31 instructions). 32b Some investment is not Estates and trusts, enter on Form 1041, line 3. at risk. If you checked 32b, you must attach Form 6198. Your loss may be limited. For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11334P Schedule C (Form 1040) 2018 13 14 27b 29

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started