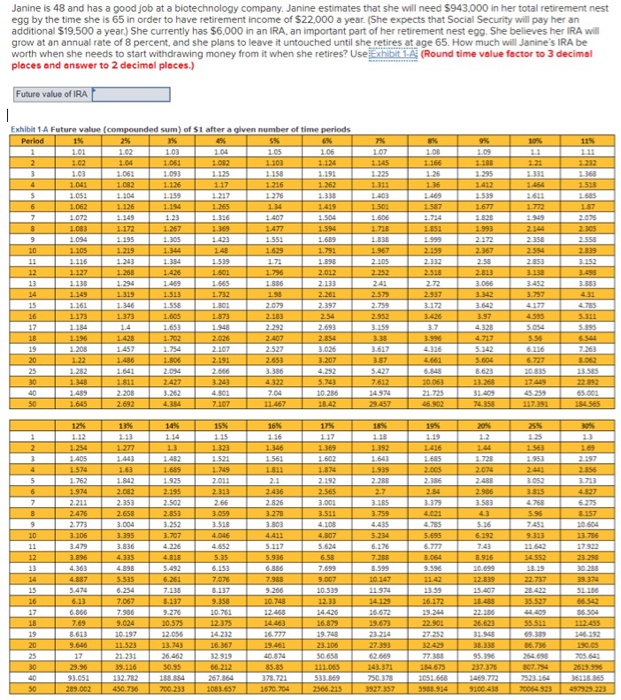

Janine is 48 and has a good job at a biotechnology company. Janine estimates that she will need 5943.000 in her total retirement nest egg by the time she is 65 in order to have retirement income of $22,000 a year. (She expects that Social Security will pay her an additional $19.500 a year.) She currently has $6.000 in an IRA an important part of her retirement nest egg. She believes her IRA will grow at an annual rate of 8 percent, and she plans to leave it untouched until she retires at age 65. How much will Janine's IRA be worth when she needs to start withdrawing money from it when she retires? Use Exhibit 1-A (Round time value factor to 3 decimal places and answer to 2 decimal places.) Future value of RA - 9% 107 1166 1.26 1.36 1.360 1518 1.587 1.403 1.501 1.606 1.710 1.295 1412 1.539 1.677 1.82 1.993 2.172 2.367 1851 2.305 Exhibit 1A Future value (compounded sum) of $1 after a given number of time periods Period 2% 1 1.01 1.02 1.00 104 1.05 106 1.061 1.100 1.124 3 1.03 1.06. 1.093 1.125 1.158 1.191 1.041 1.082 1.126 1.216 1.262 5 1.051 1.104 1159 2.276 1.333 6 1.062 1.126 1.194 1.265 1.419 7 1.072 1.407 1.504 8 1.083 1.267 1.394 9 1.094 1.305 1.55 1.689 10 1.105 1.219 1.344 1629 1.79 11 1.116 1.243 1.539 1.898 12 1.127 1.268 1.426 1.500 1.796 2012 13 1.294 1.886 2.133 1.149 1.319 1.513 1.732 1.50 2.261 15 1.161 1.346 1.558 1 301 2.079 2.397 16 1.173 1.373 1.605 1.373 2.183 2.54 17 1.154 1.4 1.653 1.948 2.292 2.693 18 1.196 1.428 1.702 2.020 2.407 2.554 19 1.208 1.457 1.754 2.107 2.527 3.026 20 1.22 1.486 1.800 2.191 2653 3.207 25 1.252 1.641 2.094 3.386 30 1.348 1.811 3.243 5.743 40 1489 2.208 3.262 4.301 7.04 10.286 50 1.645 2.692 4.384 7.107 18.42 2.105 2.252 2.159 2332 2513 2.72 2009 3.152 3.45 2.813 3.066 3.172 4177 2.379 2.759 2.952 3.159 4.75 5.311 3.995 3.054 3.996 3.642 3.97 4.328 4.717 5.142 5.604 8.623 3.617 3.87 5.427 3.062 13.585 10835 30.063 21.725 46.902 29.457 74.358 184565 115 125 1 2 2 4 5 1953 1.521 1.749 2.011 12% 1.12 1.254 1.405 1.574 1.762 1.974 2.211 2.476 2.773 3.106 3.479 3.896 2.397 2.856 2.711 16% 136 1.346 1.561 1811 2.1 2.436 2826 3.278 3.803 1.277 1.443 1.63 1.842 2.082 2.353 2.658 3.004 3.395 3.836 4.335 4.898 5.535 1.689 1.925 2.195 2.502 2.853 1.641 1.939 2.280 2.7 3.185 3.759 2.005 2.186 2.54 3.379 1.728 2.074 2488 2.986 3.583 4.3 3.052 3.815 4.768 5.96 4.785 5.695 1.369 1.602 1.874 2.192 2.565 3.001 3.511 4.100 4.307 5.624 6.58 7.699 9.007 10.339 12.33 2.66 3.059 3.518 4.046 4.652 5.35 6.153 7,076 8.137 9313 6.192 7.43 8.916 13.756 17.922 23 20 5.234 6.176 7.258 8.599 10.147 11.974 3.064 9.590 5.117 5.936 6.886 7.955 9.266 10.748 14 552 18 19 22.737 7 8 9 10 11 12 13 14 15 16 17 18 19 20 25 30 40 50 29.374 4.887 5.474 16.172 35 527 66 542 4.226 4.818 5.492 6.261 7.138 8.137 9.276 10.575 12.056 13.743 26.462 50.55 6.066 10.761 12.375 19.673 22.186 26.623 31.940 55 511 112.455 7.067 2.996 9.024 10.197 11.523 21.231 39.116 132.782 450.736 8.613 9.640 17 16.367 15.461 27.393 86.736 16.87 19.750 23.106 50.656 111065 533.869 2566.213 205.643 2519.996 143,372 66 212 257.864 1083.657 95.390 237.376 1469.772 9100 43 85.85 378.721 1670.704 93.051 289.002 1051 668 700-233 3927-357