Question

Bamb-Bamb Incorporated acquired 80 percent of the outstanding common stock of Pebbles Corporation on January 1, 2013. Bamb-Bamb Incorporated paid a total of $910,000 in

Bamb-Bamb Incorporated acquired 80 percent of the outstanding common stock of Pebbles Corporation on January 1, 2013. Bamb-Bamb Incorporated paid a total of $910,000 in cash for these shares. The 20 percent noncontrolling interest shares had a total fair value of $215,000 both before and after Bamb-Bamb Incorporated's acquisition. The Book Value of Pebbles Corporation's Net Assets on January 1, 2013 was $550,000, which included the following:

Pebbles Corporations January 1, 2013 Owners Equity | |

Common Stock | ($150,000) |

Additional Paid In Capital | ($195,000) |

Retained Earnings, January 1, 2013 | ($205,000) |

Bamb-Bamb Incorporated uses the Partial Equity method for internal recordkeeping to monitor the activities of Pebbles Corporation. At the acquisition date, the carrying amounts of Pebbles Corporation's assets and liabilities were generally equivalent to the fair value except for the following:

Assets/Liabilities | Book Value | Fair Value | Reaming Useful Life |

Equipment (Net) | $80,000 | $100,000 | 10 Years |

Buildings (Net) | $315,000 | $510,000 | 20 Years |

Land | $120,000 | $165,000 | |

Loan Payable | ($230,000) | ($260,000) | 8 Years |

Fiscal Year 2014 Data:

On January 1, 2014 Bamb-Bamb Inc sold Pebbles Corp a Building for $150,000 cash. The Buildings net book value on January 1, 2014 was $90,000 and its originally purchased price was $115,000. The building is expected to be usable for another 15 years. Both Bamb-Bamb and Pebbles use the straight-line method for depreciating assets.

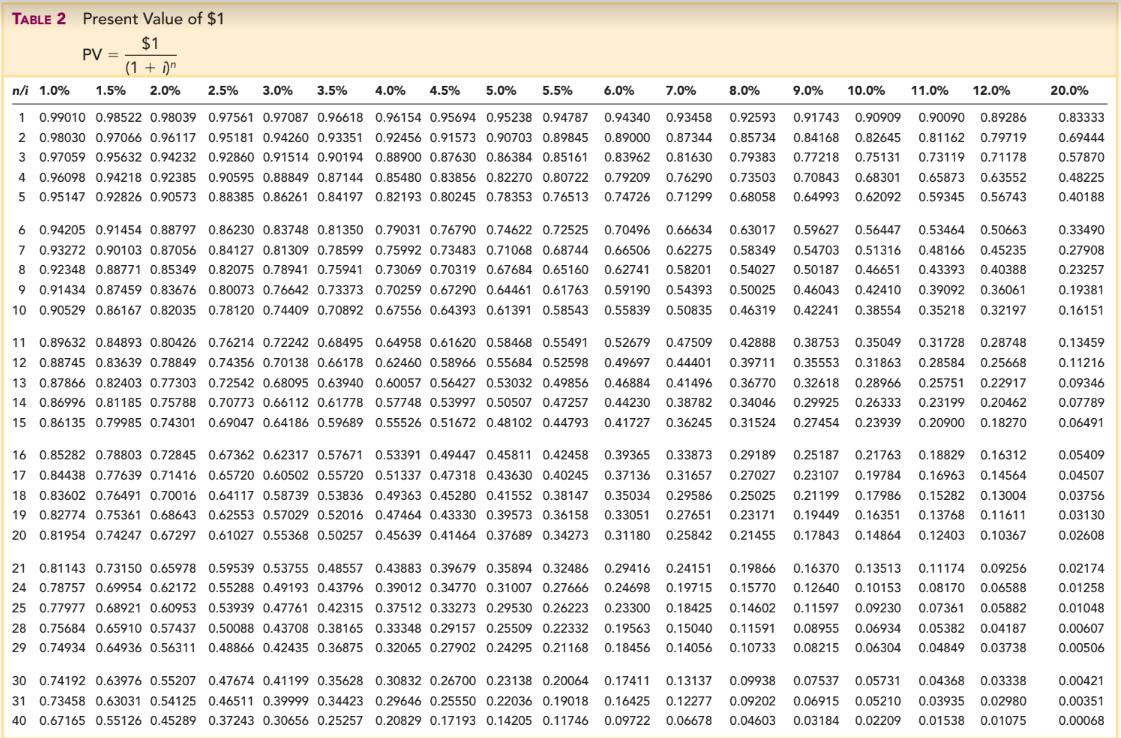

On January 1, 2014, Bamb-Bamb Incorporated acquired all of Pebbles' Corp outstanding bonds payable specifically to reduce the business combination's debt position. Pebbles Corporation makes cash interest payments of 4% each year; the market rate of return on the date the bonds were initially issued by Pebbles Corporation was 7%. Bond interest payments are made each December 31st. On January 1, 2014 the bonds had an outstanding book value of $231,391. Bamb-Bamb Incorporated paid $300,248 on January 1, 2014 for Pebbles Corp's outstanding bonds, at which time the market rate of return was 2%.

A.) Calculate the goodwill allocation over the controlling and noncontrolling interest owners on January 1, 2013.

B.) Prepare the consolidated journal entries on December 31, 2015 for the Intra-Entity Building Transfer.

C.) Prepare the consolidated journal entry on December 31, 2015 to eliminate the Intra-Entity Bond Holding.

D.) Calculate the noncontrolling interest in Pebbles Corporation as of December 31, 2015.

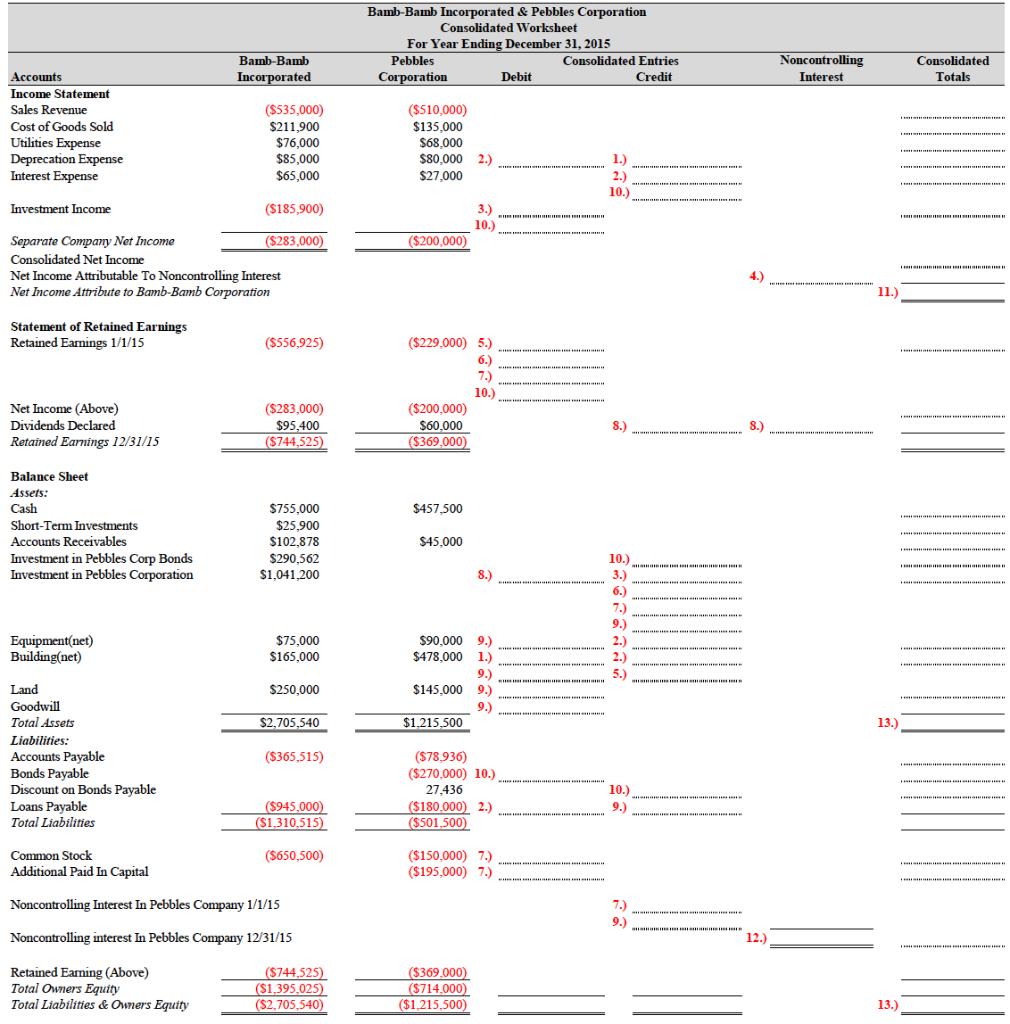

E.) The following consolidated worksheet for Bamb-Bamb Incorporated and Pebbles Corporation is to be used along with the information provided above to determine the consolidated balances "1)" through "13)" below [Note: Calculations are involved]:

Accounts Income Statement Sales Revenue Cost of Goods Sold Utilities Expense Deprecation Expense Interest Expense Investment Income Statement of Retained Earnings Retained Earnings 1/1/15 Net Income (Above) Dividends Declared Retained Earnings 12/31/15 Balance Sheet Assets: Cash Separate Company Net Income Consolidated Net Income Net Income Attributable To Noncontrolling Interest Net Income Attribute to Bamb-Bamb Corporation Short-Term Investments Accounts Receivables Investment in Pebbles Corp Bonds Investment in Pebbles Corporation Equipment(net) Building(net) Land Goodwill Total Assets Liabilities: Accounts Payable Bonds Payable Discount on Bonds Payable Loans Payable Total Liabilities Bamb-Bamb Incorporated ($535,000) $211,900 Retained Earning (Above) Total Owners Equity Total Liabilities & Owners Equity $76,000 $85,000 $65,000 ($185,900) ($283,000) ($556,925) ($283,000) $95,400 ($744,525) $755,000 $25,900 $102,878 $290,562 $1,041,200 $75,000 $165,000 $250,000 $2,705,540 ($365,515) ($945,000) ($1,310,515) ($650,500) Common Stock Additional Paid In Capital Noncontrolling Interest In Pebbles Company 1/1/15 Noncontrolling interest In Pebbles Company 12/31/15 ($744.525) ($1,395,025) ($2,705,540) Bamb-Bamb Incorporated & Pebbles Corporation Consolidated Worksheet For Year Ending December 31, 2015 Pebbles Corporation ($510,000) $135,000 $68,000 $80,000 2.) $27,000 ($200,000) ($229,000) 5.) 6.) 7.) 10.) ($200,000) $60,000 ($369,000) $457,500 $45,000 3.) 10.) $90,000 9.) $478,000 1.) $1,215,500 8.) 9.) $145,000 9.) 9.) ($78,936) ($270,000) 10.) 27,436 ($180,000) 2.) ($501,500) ($369,000) ($714,000) ($1,215,500) ($150,000) 7.) ($195,000) 7.) Debit Consolidated Entries Credit mam 1.) 2.) 10.) 8.) 10.) 3.) 6.) 7.) 9.) 2.) 2.) 5.) 10.) 9.) 7.) 9.) w SE e e 8.) 12.) Noncontrolling Interest 11.) 13.) 13.) T T T Consolidated Totals

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

A Calculate the goodwill allocation over the controlling and noncontrolling interest owners on January 1 2013 The total fair value of the noncontrolling interest on January 1 2013 was 215000 which rep...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started