Answered step by step

Verified Expert Solution

Question

1 Approved Answer

January 1, 2021 kept on a double Civic Company began business operations on During the year, the accounting records are decided to use the

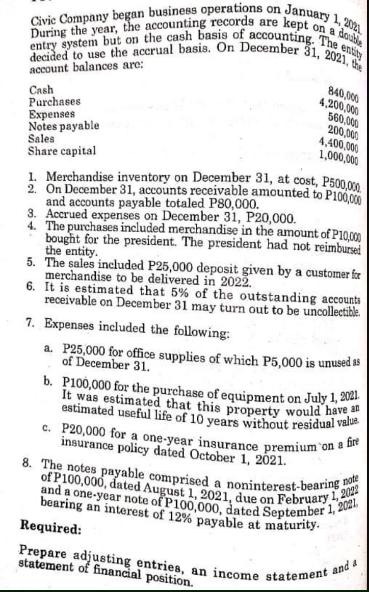

January 1, 2021 kept on a double Civic Company began business operations on During the year, the accounting records are decided to use the accrual basis. On December 31, 2021, the entry system but on the cash basis of accounting. The entity account balances are: Cash Purchases Expenses Notes payable Sales Share capital 840,000 4,200,000 560,000 200,000 4,400,000 1,000,000 1. Merchandise inventory on December 31, at cost, P500,00 2. On December 31, accounts receivable amounted to P100,000 and accounts 3. Accrued expenses on December 31, P20,000. 4. The purchases included merchandise in the amount of P10,000 bought for the president. The president had not reimbursed the entity. 5. The sales included P25,000 deposit given by a customer for merchandise to be delivered in 2022. 6. It is estimated that 5% of the outstanding accounts receivable on December 31 may turn out to be uncollectible 7. Expenses included the following: a. P25,000 for office supplies of which P5,000 is unused as of December 31. b. P100,000 for the purchase of equipment on July 1, 2021 It was estimated that this property would have an estimated useful life of 10 years without residual value c. P20,000 for a one-year insurance premium on a fire insurance policy dated October 1, 2021. 8. The notes payable comprised a noninterest-bearing note and a one-year note of P100,000, dated September 1, 2021 of P100,000, dated August 1, 2021, due on February 1, 2022 bearing an interest of 12% payable at maturity. Required: Prepare adjusting entries, an income statement and a statement of financial position.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started