Answered step by step

Verified Expert Solution

Question

1 Approved Answer

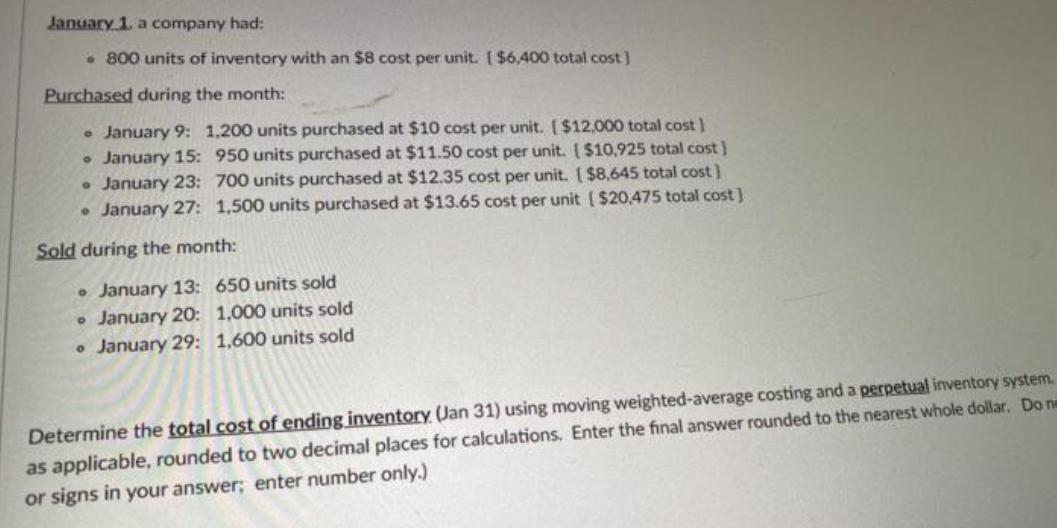

January 1, a company had: 800 units of inventory with an $8 cost per unit. [$6,400 total cost] Purchased during the month: January 9:

January 1, a company had: 800 units of inventory with an $8 cost per unit. [$6,400 total cost] Purchased during the month: January 9: January 15: 1,200 units purchased at $10 cost per unit. [$12,000 total cost] 950 units purchased at $11.50 cost per unit. [$10,925 total cost] 700 units purchased at $12.35 cost per unit. [$8,645 total cost) O January 23: 9 January 27: 1,500 units purchased at $13.65 cost per unit ($20,475 total cost] Sold during the month: January 13: 650 units sold January 20: 1,000 units sold January 29: 1.600 units sold Determine the total cost of ending inventory (Jan 31) using moving weighted-average costing and a perpetual inventory system. as applicable, rounded to two decimal places for calculations. Enter the final answer rounded to the nearest whole dollar. Do ne or signs in your answer; enter number only.)

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution Total cost of ending inventory 22971 Calculations Wei...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started