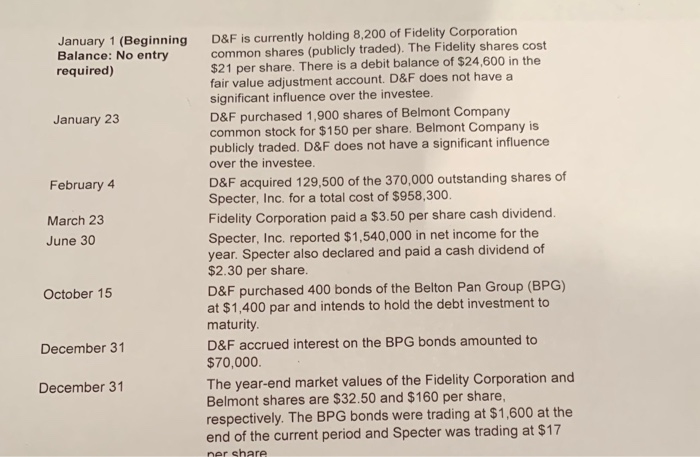

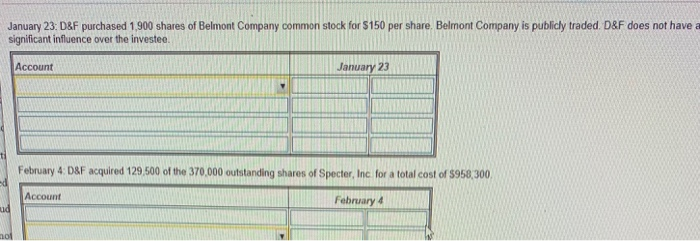

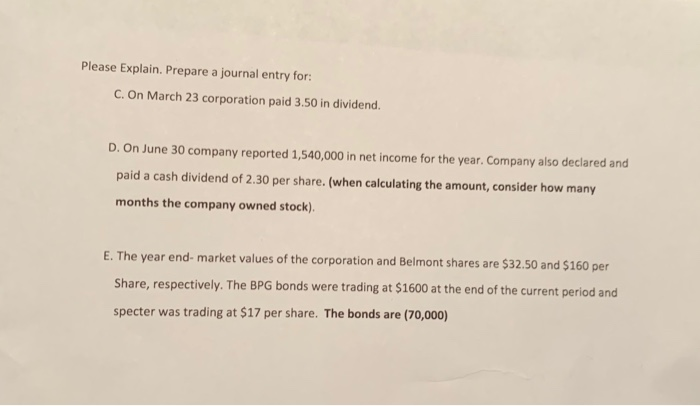

January 1 (Beginning Balance: No entry required) January 23 February 4 March 23 June 30 D&F is currently holding 8,200 of Fidelity Corporation common shares (publicly traded). The Fidelity shares cost $21 per share. There is a debit balance of $24,600 in the fair value adjustment account. D&F does not have a significant influence over the investee. D&F purchased 1,900 shares of Belmont Company common stock for $150 per share. Belmont Company is publicly traded. D&F does not have a significant influence over the investee. D&F acquired 129,500 of the 370,000 outstanding shares of Specter, Inc. for a total cost of $958,300. Fidelity Corporation paid a $3.50 per share cash dividend. Specter, Inc. reported $1,540,000 in net income for the year. Specter also declared and paid a cash dividend of $2.30 per share. D&F purchased 400 bonds of the Belton Pan Group (BPG) at $1,400 par and intends to hold the debt investment to maturity D&F accrued interest on the BPG bonds amounted to $70,000. The year-end market values of the Fidelity Corporation and Belmont shares are $32.50 and $160 per share, respectively. The BPG bonds were trading at $1,600 at the end of the current period and Specter was trading at $17 ner share October 15 December 31 December 31 January 23: D&F purchased 1,900 shares of Belmont Company common stock for $150 per share. Belmont Company is publicly traded. D&F does not have a significant influence over the investee. Account January 23 February 4 D&F acquired 129.500 of the 370,000 outstanding shares of Specter, Inc for a total cost of $958,300 Account February 4 Please Explain. Prepare a journal entry for: C. On March 23 corporation paid 3.50 in dividend. D. On June 30 company reported 1,540,000 in net income for the year. Company also declared and paid a cash dividend of 2.30 per share. (when calculating the amount, consider how many months the company owned stock). E. The year end market values of the corporation and Belmont shares are $32.50 and 5160 per Share, respectively. The BPG bonds were trading at $1600 at the end of the current period and specter was trading at $17 per share. The bonds are (70,000) January 1 (Beginning Balance: No entry required) January 23 February 4 March 23 June 30 D&F is currently holding 8,200 of Fidelity Corporation common shares (publicly traded). The Fidelity shares cost $21 per share. There is a debit balance of $24,600 in the fair value adjustment account. D&F does not have a significant influence over the investee. D&F purchased 1,900 shares of Belmont Company common stock for $150 per share. Belmont Company is publicly traded. D&F does not have a significant influence over the investee. D&F acquired 129,500 of the 370,000 outstanding shares of Specter, Inc. for a total cost of $958,300. Fidelity Corporation paid a $3.50 per share cash dividend. Specter, Inc. reported $1,540,000 in net income for the year. Specter also declared and paid a cash dividend of $2.30 per share. D&F purchased 400 bonds of the Belton Pan Group (BPG) at $1,400 par and intends to hold the debt investment to maturity D&F accrued interest on the BPG bonds amounted to $70,000. The year-end market values of the Fidelity Corporation and Belmont shares are $32.50 and $160 per share, respectively. The BPG bonds were trading at $1,600 at the end of the current period and Specter was trading at $17 ner share October 15 December 31 December 31 January 23: D&F purchased 1,900 shares of Belmont Company common stock for $150 per share. Belmont Company is publicly traded. D&F does not have a significant influence over the investee. Account January 23 February 4 D&F acquired 129.500 of the 370,000 outstanding shares of Specter, Inc for a total cost of $958,300 Account February 4 Please Explain. Prepare a journal entry for: C. On March 23 corporation paid 3.50 in dividend. D. On June 30 company reported 1,540,000 in net income for the year. Company also declared and paid a cash dividend of 2.30 per share. (when calculating the amount, consider how many months the company owned stock). E. The year end market values of the corporation and Belmont shares are $32.50 and 5160 per Share, respectively. The BPG bonds were trading at $1600 at the end of the current period and specter was trading at $17 per share. The bonds are (70,000)