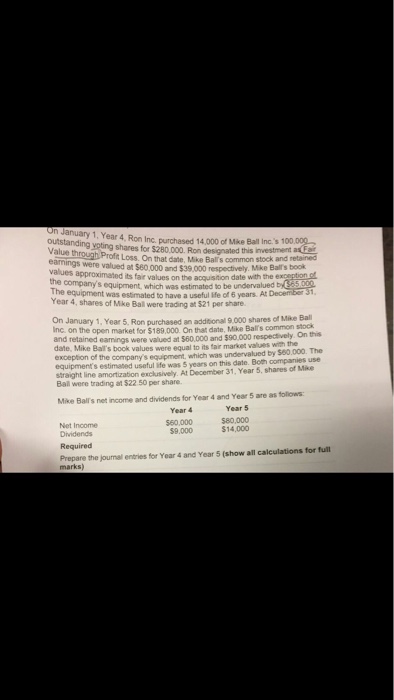

January 1, Year 4, Ron Inc. purchased 14,000 of Mike Ball Inc.'s 100,000 outstanding voting shares for $280,000. Ron designated this investment as Fair value trough Profit Loss. On that date, Mike Ball's common stock and retained earnings were valued at $60,000 and $39,000 respectively. Mike Ball's book values approximated its fair values on the acquisition date with the exception of the company's equipment, which was estimated to be undervalued by $65,000. The equipment was estimated to have a useful life of 6 years. At December 31, Year 4, shares of Mike Ball were trading at $21 per share. On January 1, Year 5, Ron purchased an additional 9,000 shares of Mike Ball Inc. On the open market for $189,000. On that date, Mike Ball's common stock and retained earnings were valued at $60,000 and $90,000 respectively. On this date, Mike Ball's book values were equal to its fair market values with the exception of the company's equipment, which was undervalued $60,000. The equipment's estimated useful life was 5 years on this date. Both companies use straight line amortization exclusively. At December 31, Year 5, shares of Mike Ball were trading at $22.50 per share. Mike Balls net income and dividends for Year 4 and Year 5 are as follows: Prepare the journal entries for Year 4 and Year 5 January 1, Year 4, Ron Inc. purchased 14,000 of Mike Ball Inc.'s 100,000 outstanding voting shares for $280,000. Ron designated this investment as Fair value trough Profit Loss. On that date, Mike Ball's common stock and retained earnings were valued at $60,000 and $39,000 respectively. Mike Ball's book values approximated its fair values on the acquisition date with the exception of the company's equipment, which was estimated to be undervalued by $65,000. The equipment was estimated to have a useful life of 6 years. At December 31, Year 4, shares of Mike Ball were trading at $21 per share. On January 1, Year 5, Ron purchased an additional 9,000 shares of Mike Ball Inc. On the open market for $189,000. On that date, Mike Ball's common stock and retained earnings were valued at $60,000 and $90,000 respectively. On this date, Mike Ball's book values were equal to its fair market values with the exception of the company's equipment, which was undervalued $60,000. The equipment's estimated useful life was 5 years on this date. Both companies use straight line amortization exclusively. At December 31, Year 5, shares of Mike Ball were trading at $22.50 per share. Mike Balls net income and dividends for Year 4 and Year 5 are as follows: Prepare the journal entries for Year 4 and Year 5