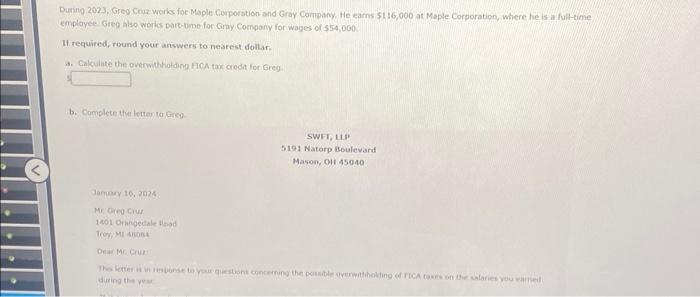

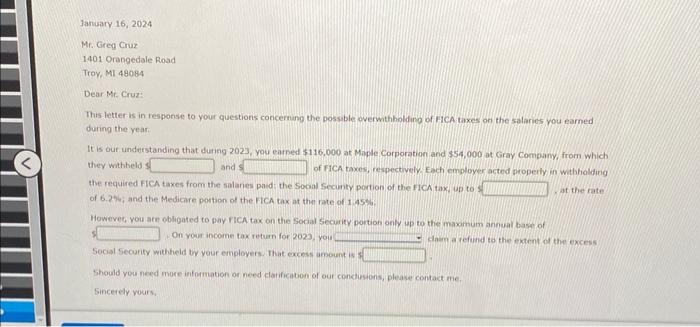

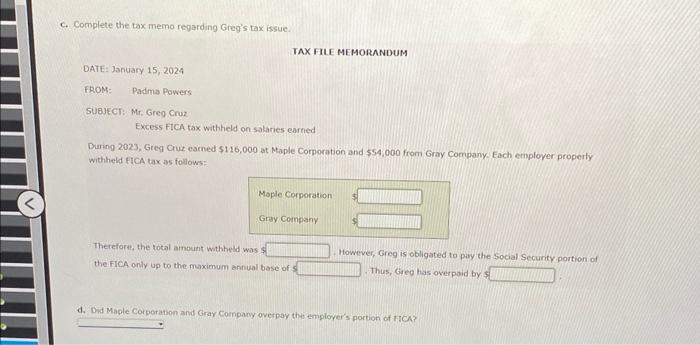

January 16,2024 Mr. Greg Cruz 1401 Orangedole Road Troy, MI 48084 Dear Mr. Cruz: This tetter is in response to your questions concerning the possable overwithholdino of HCA taxes or the salarios you earned during the year: It is our understanding that dunng 2023, you eaned $116,000 at Maple, Corporation and $54,000 at Gray Company, from which they witheld 1 and of FiCA taxes, respectively. Eich emploxer acted properly in withiolding the required ficA tuxes from the salaries paids the socal secunty portion of the FlCA tax ip to W the rate of 6.276 ; and the Medicare potion of the FicA tax at the rate of 1.45% : On your income tax return for 2023 , you cham a refund to the extent of the excess Social secarity wheld to your employers. That excess amount is 5 Sincerely wours, During 2023, Greg Cruz works foe Maple Corporstion and Gray Company, He earns $116,000 at Maple Corporation, where he is a full-time II required, round your answers to nearest dollar. A. Galculate the overwitholding HCA tak oredet for Greg. c. Complete the tax merno regarding Greg's tax issue. TAX FILE MEMORANDUM DATE: January 15,2024 FROM: Padma Powers SUBJECr: Mr. Greg Cruz Excess FICA tax withheld on salaries earned Durng 2023, Gteq Cur earned $116,000 at Maple Corporation and $54,000 from Gray Company. Each emplover property withicld ficA tax as follows: Thetefore, the total amount withheld was 3 However, Greg is obligated to pay the social Securty portion of the FicA only up to the maximum annual base of s Thus, Greo has overpoid by 3 January 16,2024 Mr. Greg Cruz 1401 Orangedole Road Troy, MI 48084 Dear Mr. Cruz: This tetter is in response to your questions concerning the possable overwithholdino of HCA taxes or the salarios you earned during the year: It is our understanding that dunng 2023, you eaned $116,000 at Maple, Corporation and $54,000 at Gray Company, from which they witheld 1 and of FiCA taxes, respectively. Eich emploxer acted properly in withiolding the required ficA tuxes from the salaries paids the socal secunty portion of the FlCA tax ip to W the rate of 6.276 ; and the Medicare potion of the FicA tax at the rate of 1.45% : On your income tax return for 2023 , you cham a refund to the extent of the excess Social secarity wheld to your employers. That excess amount is 5 Sincerely wours, During 2023, Greg Cruz works foe Maple Corporstion and Gray Company, He earns $116,000 at Maple Corporation, where he is a full-time II required, round your answers to nearest dollar. A. Galculate the overwitholding HCA tak oredet for Greg. c. Complete the tax merno regarding Greg's tax issue. TAX FILE MEMORANDUM DATE: January 15,2024 FROM: Padma Powers SUBJECr: Mr. Greg Cruz Excess FICA tax withheld on salaries earned Durng 2023, Gteq Cur earned $116,000 at Maple Corporation and $54,000 from Gray Company. Each emplover property withicld ficA tax as follows: Thetefore, the total amount withheld was 3 However, Greg is obligated to pay the social Securty portion of the FicA only up to the maximum annual base of s Thus, Greo has overpoid by 3