Question

January 22: Issued $75,000 of 6% term bonds due on January 1, 2025 (10 periods) with interest payable each June 30 and December 31. Investors

January 22: Issued $75,000 of 6% term bonds due on January 1, 2025 (10 periods) with interest payable each June 30 and December 31. Investors require an effective interest rate of 8%. Record the entries for issuance of the bond.

February 28: A new long-term lease is entered into for extra storage space for the new product line of ink cartridges. The net present value of the future lease payments is $120,400. The lease is for two years at $5,000 per month beginning March 1.

March 6: A long-term note for $60,000 was taken out from the bank. The loan is for two years with an interest rate of 6% repayable at maturity.

April 22: New equipment was purchased to make printers for $55,000. Use straight line depreciation assuming a 4-year life, with no residual value. Use full years depreciation for the first year.

April 17: 200 shares of common stock with a $1 par value were sold for $20 per share.

May 5: Paid cash dividends to stockholders of $22,500.

June 22: Purchased 50 shares of the companys stock at $25 per share.

June 30: Book the depreciation for the first half of the year on the printer equipment purchased April 22.

June 30: Book the interest for the first half of the year on the loan you took out on March 6.

June 30: Book the interest payment and amortization on discount for bond.

June 30: Paid the rent expense for the first half of the year in cash.

June 30: Book the service revenue of $100,000 for the first half of the year paid in cash.

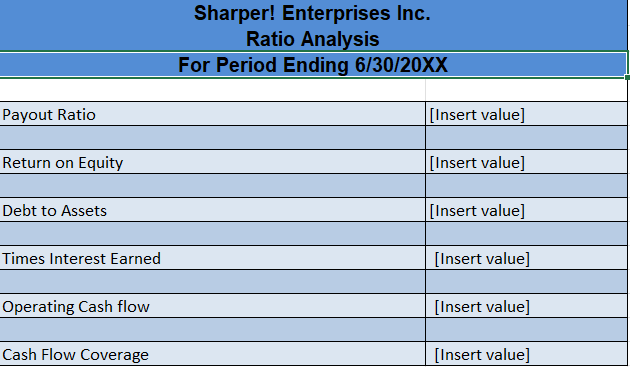

Sharper! Enterprises Inc. Ratio Analysis For Period Ending 6/30/20XX \begin{tabular}{|l|l|} \hline Payout Ratio & {[ Insert value] } \\ \hline Return on Equity & \\ \hline & {[ Insert value ]} \\ \hline Debt to Assets & {[ Insert value ]} \\ \hline & \\ \hline Times Interest Earned & {[ Insert value] } \\ \hline & \\ \hline Operating Cash flow & {[ Insert value ]} \\ \hline & {[ Insert value ]} \\ \hline Cash Flow Coverage & \\ \hline \end{tabular} Sharper! Enterprises Inc. Ratio Analysis For Period Ending 6/30/20XX \begin{tabular}{|l|l|} \hline Payout Ratio & {[ Insert value] } \\ \hline Return on Equity & \\ \hline & {[ Insert value ]} \\ \hline Debt to Assets & {[ Insert value ]} \\ \hline & \\ \hline Times Interest Earned & {[ Insert value] } \\ \hline & \\ \hline Operating Cash flow & {[ Insert value ]} \\ \hline & {[ Insert value ]} \\ \hline Cash Flow Coverage & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started