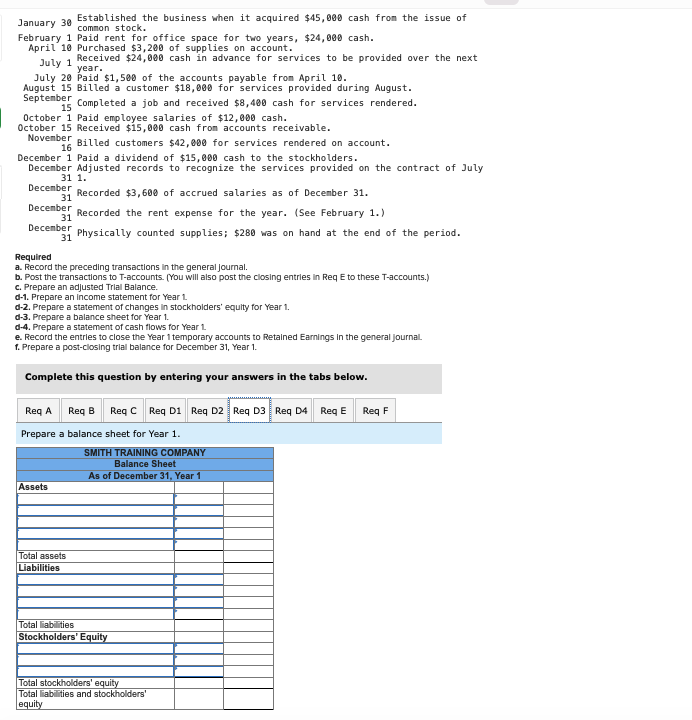

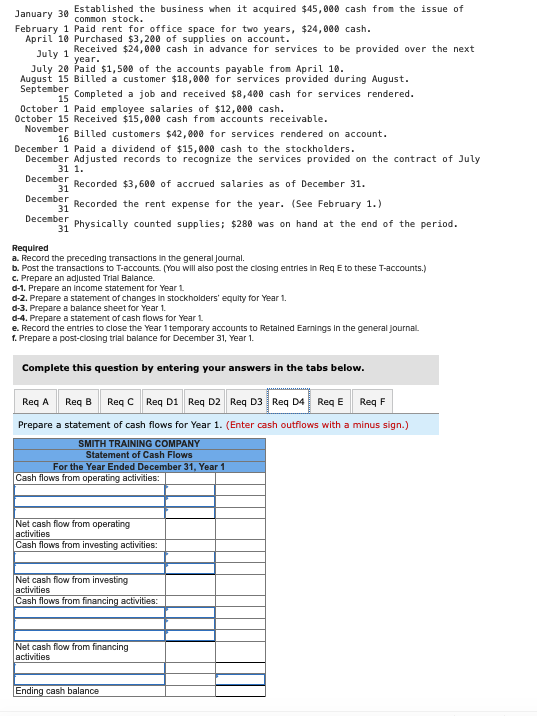

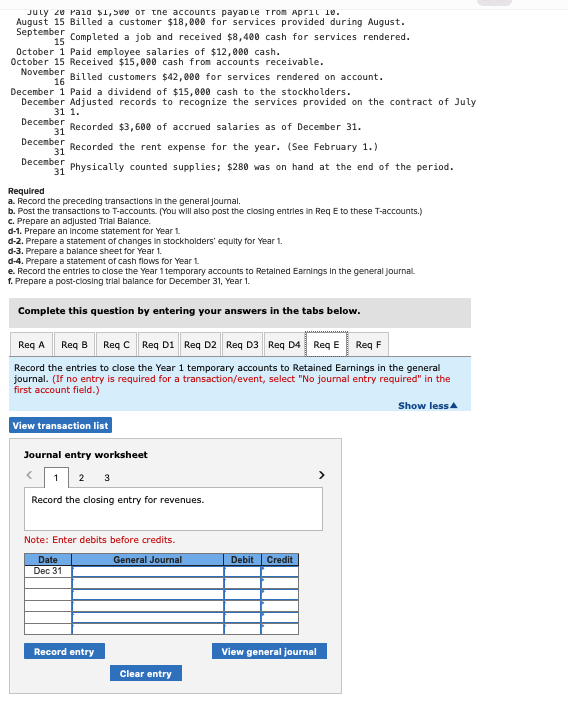

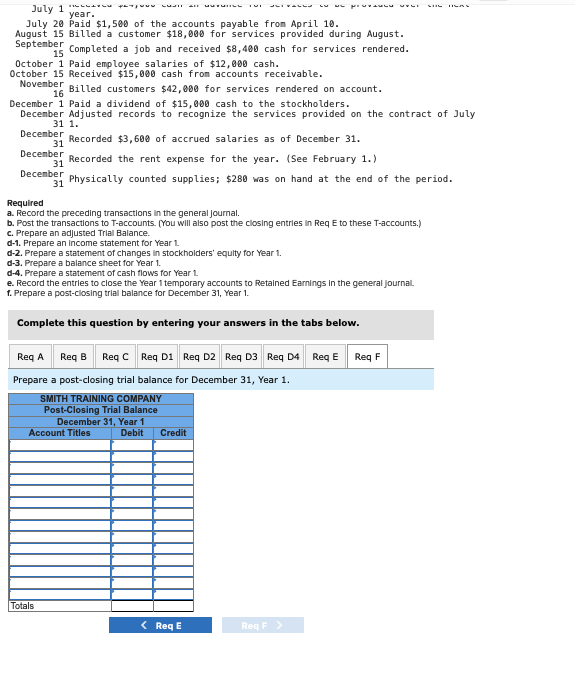

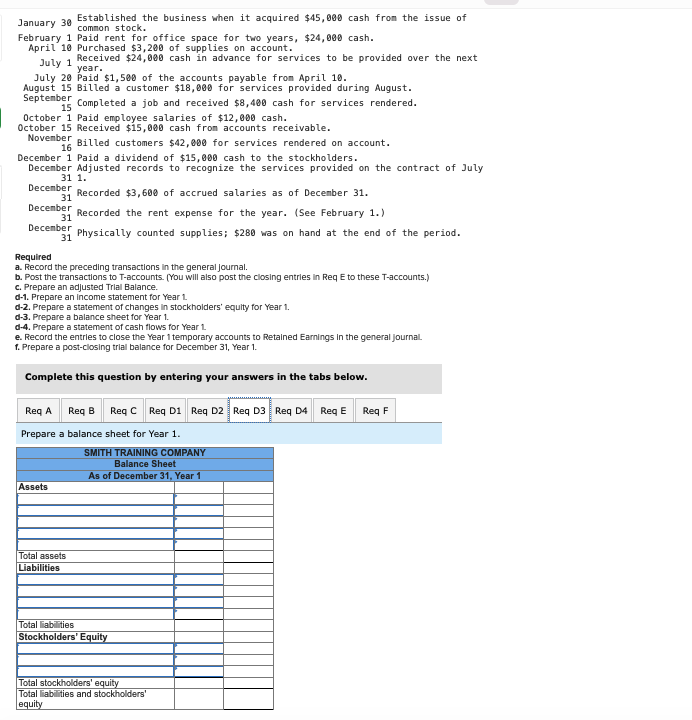

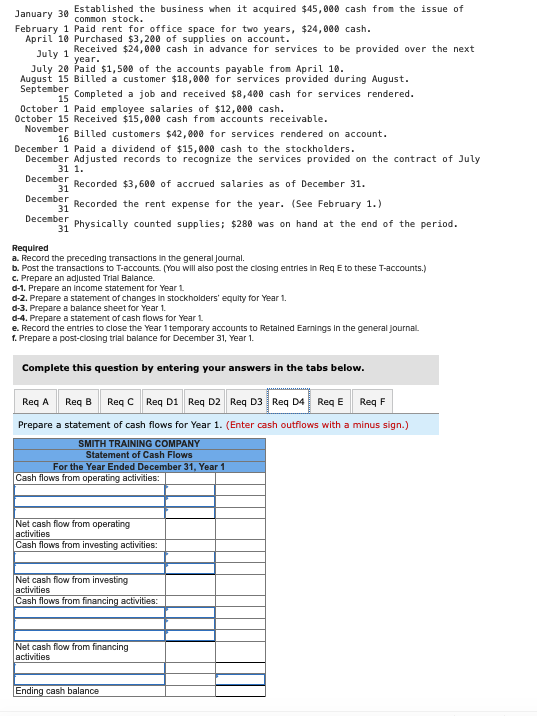

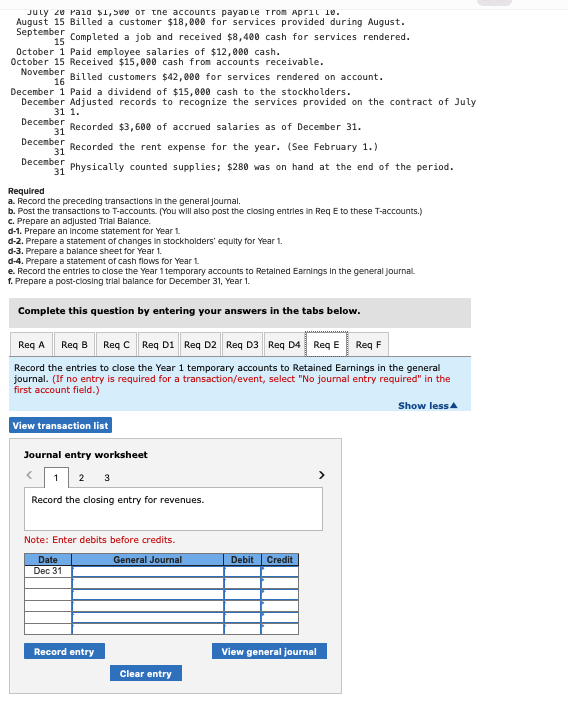

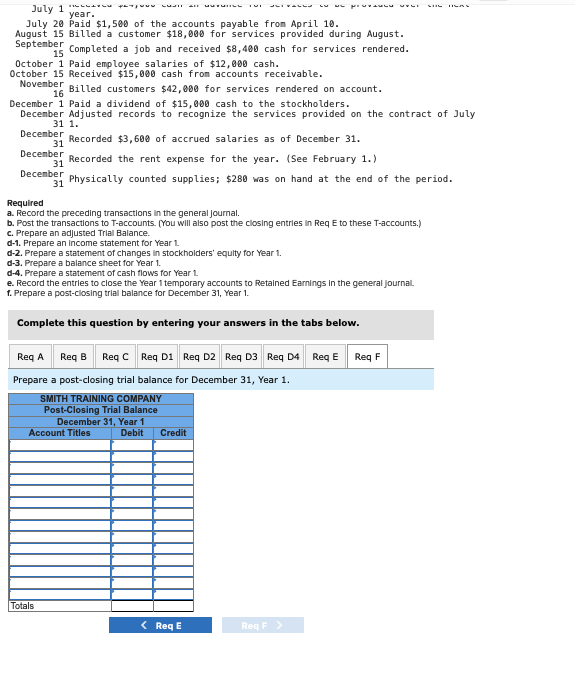

January 30 Established the business when it acquired $45, 000 cash from the issue of common stock. February 1 Paid rent for office space for two years, $24,000 cash. April 10 Purchased $3,200 of supplies on account. July 1 Received $24,000 cash in advance for services to be provided over the next July 20 Paid $1,500 of the accounts payable fron April 10. August 15 Billed a customer $18,000 for services provided during August. September Completed a job and received $8,400 cash for services rendered. 15 October 1 Paid employee salaries of $12,000 cash. October 15 Received $15,000 cash fron accounts receivable. November Billed customers $42,000 for services rendered on account. 16 December 1 Paid a dividend of $15,000 cash to the stockholders. December Adjusted records to recognize the services provided on the contract of July 31 1. December Recorded $3,600 of accrued salaries as of Decenber 31 . 31 December Recorded the rent expense for the year. (See February 1. ) 31 December Physically counted supplies; $280 was on hand at the end of the period. Required a. Record the preceding transactions in the general joumal. b. Post the transactions to T-accounts. (You will also post the closing entries In Req E to these T-accounts.) c. Prepare an adjusted Trlal Balance. d-1. Prepare an income statement for Year 1. d-2. Prepare a statement of changes in stockholders' equlty for Year 1. d-3. Prepare a balance sheet for Year 1. d-4. Prepare a statement of cash flows for Year 1. e. Record the entries to close the Year 1 temporary accounts to Retained Earnings in the general journal. f. Prepare a post-closing trlal balance for December 31 , Year 1. Complete this question by entering your answers in the tabs below. Prepare a balance sheet for Year 1. Required a. Record the preceding transactions in the general joumal. b. Post the transactions to T-accounts. (You will also post the closing entries in Req E to these T-accounts.) c. Prepare an adjusted Trlal Balance. d-1. Prepare an income statement for Year 1. d-2. Prepare a statement of changes In stockholders' equity for Year 1. d-3. Prepare a balance sheet for Year 1 . d-4. Prepare a statement of cash flows for Year 1 . e. Record the entries to close the Year 1 temporary accounts to Retained Earnings in the general journal. f. Prepare a post-closing trlal balance for December 31, Year 1. Complete this question by entering your answers in the tabs below. Prepare a statement of cash flows for Year 1. (Enter cash outflows with a minus sign.) July 20 Pala $1, s0 ot the accounts payad Le Tron April 10. August 15 Billed a customer $18,000 for services provided during August. September Completed a job and received $8,400 cash for services rendered. October 1 Paid employee salaries of $12,000 cash. October 15 Received $15,000 cash fron accounts receivable. Novenber Billed customers $42,000 for services rendered on account. December 1 Paid a dividend of $15,000 cash to the stockholders. December Adjusted records to recognize the services provided on the contract of July 311. December Recorded the rent expense for the year. (See February 1.) Required a. Record the preceding transactions in the general joumal. b. Post the transactions to T-accounts. (You will also post the closing entries in Req E to these T-accounts.) c. Prepare an adjusted Trlal Balance. d-1. Prepare an income statement for Year 1 . d-2. Prepare a statement of changes in stockholders' equity for Year 1. d-3. Prepare a balance sheet for Year 1 . d-4. Prepare a statement of cash flows for Year 1 . e. Record the entries to close the Year 1 temporary accounts to Retained Earnings in the general Journal. f. Prepare a post-closing trlal balance for December 31, Year 1. Complete this question by entering your answers in the tabs below. Record the entries to close the Year 1 temporary accounts to Retained Earnings in the general journal. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 3 Record the closing entry for revenues. Note: Enter debits before credits. July 1 year. July 20 Paid $1,500 of the accounts payable fron April 10. August 15 Billed a customer $18,000 for services provided during August. Septenber 15 Completed a job and received $8,400 cash for services rendered. 0ctober 1 Paid employee salaries of $12,000 cash. October 15 Received $15,000 cash fron accounts receivable. November Billed customers $42,000 for services rendered on account. December 1 Paid a dividend of $15,000 cash to the stockholders. December Adjusted records to recognize the services provided on the contract of July 31 . December Recorded $3,600 of accrued salaries as of December 31 . Decenber Recorded the rent expense for the year. (See February 1.) Required a. Record the preceding transactions in the general joumal. b. Post the transactions to T-accounts. (You will also post the closing entries In Req E to these T-accounts.) c. Prepare an adjusted Trlal Balance. d-1. Prepare an income statement for Year 1 . d-2. Prepare a statement of changes in stockholders' equlty for Year 1. d-3. Prepare a balance sheet for Year 1 . d-4. Prepare a statement of cash flows for Year 1 . e. Record the entrles to close the Year 1 temporary accounts to Retained Earnings in the general Journal. f. Prepare a post-closing trial balance for December 31, Year 1. Complete this question by entering your answers in the tabs below. Prepare a post-closing trial balance for December 31 , Year 1