Question

January 30 Established the business when it acquired $51,000 cash from the issue of common stock. February 1 Paid rent for office space for two

| January 30 | Established the business when it acquired $51,000 cash from the issue of common stock. |

|---|---|

| February 1 | Paid rent for office space for two years, $16,700 cash. |

| April 10 | Purchased $760 of supplies on account. |

| July 1 | Received $24,500 cash in advance for services to be provided over the next year. |

| July 20 | Paid $570 of the accounts payable from April 10. |

| August 15 | Billed a customer $9,200 for services provided during August. |

| September 15 | Completed a job and received $3,200 cash for services rendered. |

| October 1 | Paid employee salaries of $38,000 cash. |

| October 15 | Received $7,500 cash from accounts receivable. |

| November 16 | Billed customers $34,000 for services rendered on account. |

| December 1 | Paid a dividend of $1,300 cash to the stockholders. |

| December 31 | Adjusted records to recognize the services provided on the contract of July 1. |

| December 31 | Recorded $2,300 of accrued salaries as of December 31. |

| December 31 | Recorded the rent expense for the year. (See February 1.) |

| December 31 | Physically counted supplies; $80 was on hand at the end of the period. |

Required

a. Record the preceding transactions in the general journal.

b. Post the transactions to T-accounts. (You will also post the closing entries in Req E to these T-accounts.)

c. Prepare an adjusted Trial Balance.

d-1. Prepare an income statement for Year 1.

d-2. Prepare a statement of changes in stockholders’ equity for Year 1.

d-3. Prepare a balance sheet for Year 1.

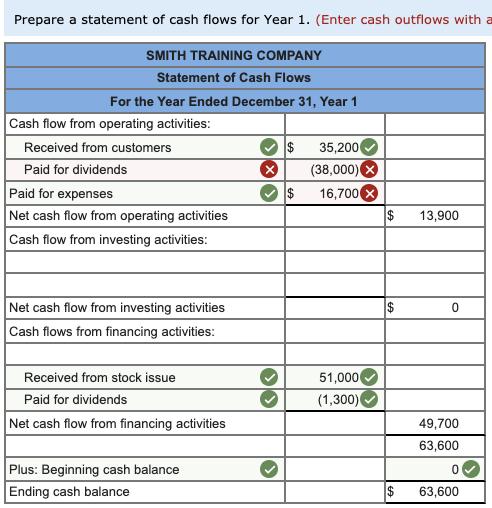

d-4. Prepare a statement of cash flows for Year 1.

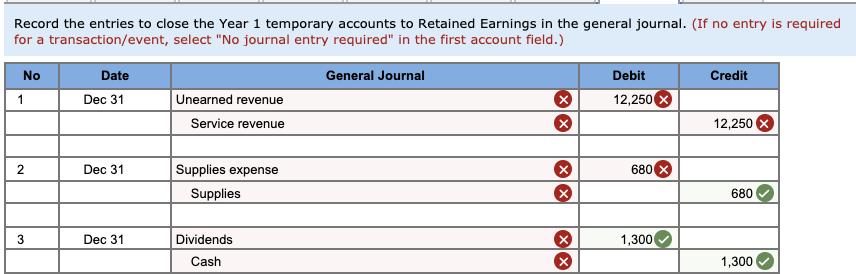

e. Record the entries to close the Year 1 temporary accounts to Retained Earnings in the general journal and post to the T-accounts.

f. Prepare a post-closing trial balance for December 31, Year 1.

1 No Date Jan 30 Cash Common stock 2 Feb 01 Prepaid rent Cash General Journal Debit Credit 51,000 51,000 16,700 16,700 3 Apr 10 Supplies 760 Accounts payable 760 4 Jul 01 Cash 24,5000 Unearned revenue 24,500 5 Jul 20 Accounts payable Cash 570 570 6 Aug 15 Accounts receivable 9,2000 Service revenue 9,200 7 Sep 15 Cash 3,200 Service revenue 3,200 8 Oct 01 Salaries expense Cash 38,000( 38,000 9 Oct 15 Cash 7,500 Accounts receivable 7,500 10 Nov 16 Accounts receivable Service revenue 11 Dec 01 Dividends Cash 34,000 34,000 1,3000 1,300 12 Dec 31 Unearned revenue 12,250 Service revenue 12,250 13 Dec 31 Salaries expense 2,300 Salaries payable 2,300 14 Dec 31 Rent expense Prepaid rent 7,654 7,654 15 Dec 31 Supplies expense 680 Supplies 680

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Part a Journal Entries January 30Cash 51000 Common Stock 51000 February 1Prepaid Rent 16700 Cash 16700 April 10Supplies 760 Accounts Payable 760 July 1Cash 24500 Unearned Revenue 24500 July 20 Account...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started