Answered step by step

Verified Expert Solution

Question

1 Approved Answer

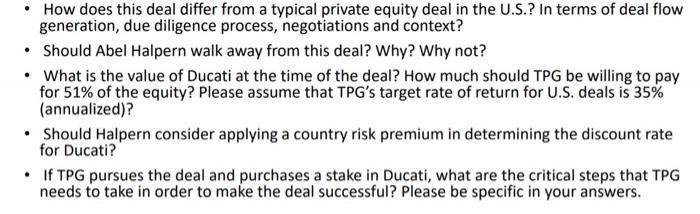

How does this deal differ from a typical private equity deal in the U.S.? In terms of deal flow generation, due diligence process, negotiations

How does this deal differ from a typical private equity deal in the U.S.? In terms of deal flow generation, due diligence process, negotiations and context? Should Abel Halpern walk away from this deal? Why? Why not? What is the value of Ducati at the time of the deal? How much should TPG be willing to pay for 51% of the equity? Please assume that TPG's target rate of return for U.S. deals is 35% (annualized)? Should Halpern consider applying a country risk premium in determining the discount rate for Ducati? If TPG pursues the deal and purchases a stake in Ducati, what are the critical steps that TPG needs to take in order to make the deal successful? Please be specific in your answers.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

This deal differs from a typical private equity deal in the US in terms of deal flow generation due ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started