Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jasmine Berhad is considering a project which requires an investment of RM500,000 in machinery with zero salvage value after 5 years. This machine will be

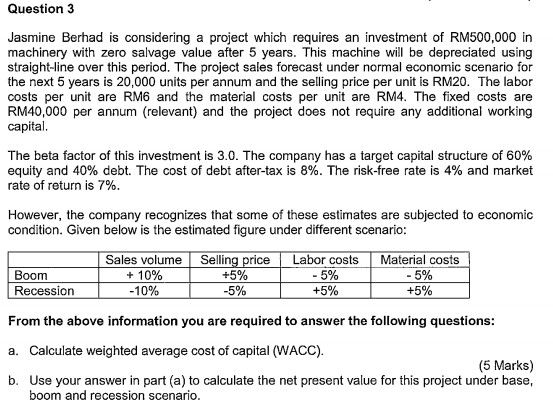

Jasmine Berhad is considering a project which requires an investment of RM500,000 in machinery with zero salvage value after 5 years. This machine will be depreciated using straight-line over this period. The project sales forecast under normal economic scenario for the next 5 years is 20,000 units per annum and the selling price per unit is RM20. The labor costs per unit are RM6 and the material costs per unit are RM4. The fixed costs are RM40,000 per annum (relevant) and the project does not require any additional working capital. The beta factor of this investment is 3.0. The company has a target capital structure of 60% equity and 40% debt. The cost of debt after-tax is 8%. The risk-free rate is 4% and market rate of return is 7%. However, the company recognizes that some of these estimates are subjected to economic condition. Given below is the estimated figure under different scenario: a. Calculate weighted average cost of capital (WACC). b. Use your answer in part (a) to calculate the net present value for this project under base boom and recession scenario

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started