Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jason Chen owns a business called Chen Home Building. He does his banking at Citizens National Bank in Seattle, Washington. The amounts in his general

Jason Chen owns a business called Chen Home Building. He does his banking at Citizens National Bank in Seattle, Washington. The amounts in his general ledger for payroll taxes and the employees' withholding of Social Security, Medicare, and federal income tax payable as of April 15 of the current year are as follows:

| Social Security tax payable (includes both employer and employee) | $11,250 |

| Medicare tax payable (includes both employer and employee) | 2,625 |

| FUTA tax payable | 500 |

| SUTA tax payable | 4,170 |

| Employee income tax payable | 6,825 |

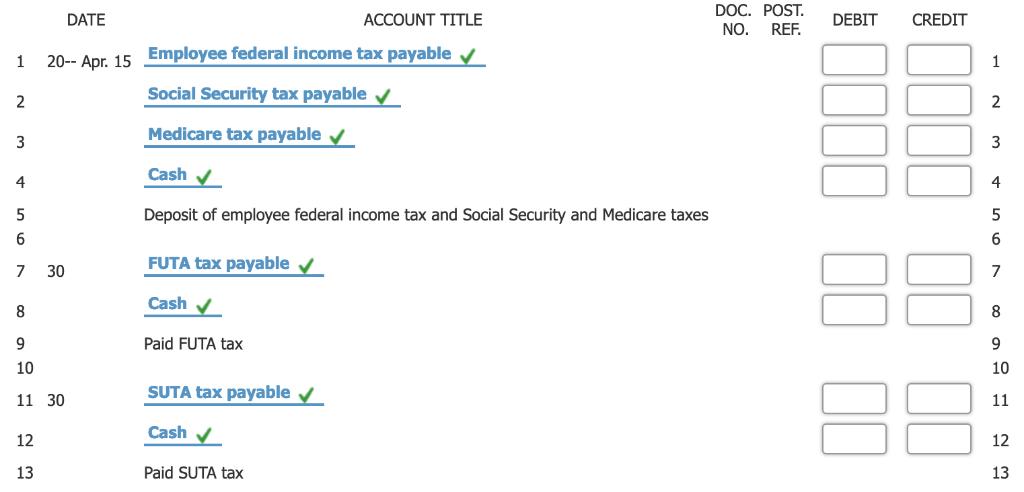

Journalize the quarterly payment of the employee federal income taxes and Social Security and Medicare taxes on April 15, 20--, and the payments of the FUTA and SUTA taxes on April 30, 20--.

DOC. POST. DATE ACCOUNT TITLE DEBIT CREDIT NO. REF. 1 20-- Apr. 15 Employee federal income tax payable v 1 Social Security tax payable 2 Medicare tax payable v 3 Cash v 4 4 Deposit of employee federal income tax and Social Security and Medicare taxes 6 FUTA tax payable v 7 30 7 Cash V 8 8 9. Paid FUTA tax 9. 10 10 SUTA tax payable v 11 30 11 Cash V 12 12 13 Paid SUTA tax 13

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Particulars Debit Credit Employee Fed...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started