Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jason is considering engaging in part-time work as an Uber driver, but he requires an initial investment in a vehicle. Following thorough market research,

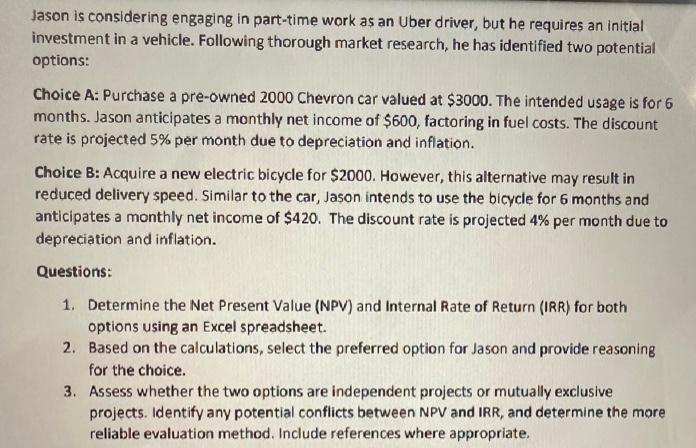

Jason is considering engaging in part-time work as an Uber driver, but he requires an initial investment in a vehicle. Following thorough market research, he has identified two potential options: Choice A: Purchase a pre-owned 2000 Chevron car valued at $3000. The intended usage is for 6 months. Jason anticipates a monthly net income of $600, factoring in fuel costs. The discount rate is projected 5% per month due to depreciation and inflation. Choice B: Acquire a new electric bicycle for $2000. However, this alternative may result in reduced delivery speed. Similar to the car, Jason intends to use the bicycle for 6 months and anticipates a monthly net income of $420. The discount rate is projected 4% per month due to depreciation and inflation. Questions: 1. Determine the Net Present Value (NPV) and Internal Rate of Return (IRR) for both options using an Excel spreadsheet. 2. Based on the calculations, select the preferred option for Jason and provide reasoning for the choice. 3. Assess whether the two options are independent projects or mutually exclusive projects. Identify any potential conflicts between NPV and IRR, and determine the more reliable evaluation method. Include references where appropriate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Net Present Value NPV and Internal Rate of Return IRR for both options well need to set up an Excel spreadsheet Lets calculate the NP...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started