Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jason Jackson is attempting to evaluate two possible portfolios consisting of the same five assets but held in different proportions. He is particularly interested in

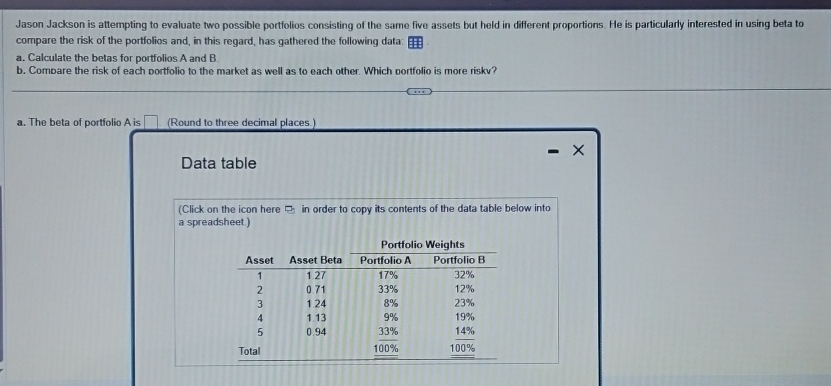

Jason Jackson is attempting to evaluate two possible portfolios consisting of the same five assets but held in different proportions. He is particularly interested in using beta to compare the risk of the portfolios and, in this regard, has gathered the following data:

a Calculate the betas for portfolios A and

b Combare the risk of each portfolio to the market as well as to each other. Which oortfolio is more riskv?

a The beta of portfolio is

Round to three decimal places.

Data table

Click on the icon here in order to copy its contents of the data table below into a spreadsheet.

tablePortfolio WeightsAssetAsset Beta,Portfolio APortfolio B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started