Question

Jason went through the papers analysing receivable expected credit loss estimate (Exhibit 4) when he noticed something that did not seem quite right. There have

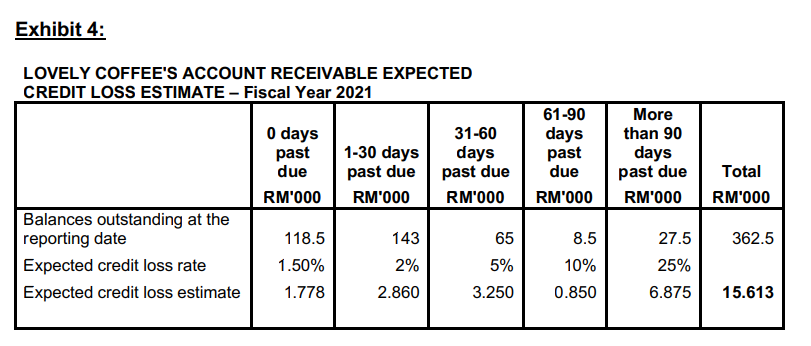

Jason went through the papers analysing receivable expected credit loss estimate (Exhibit 4) when he noticed something that did not seem quite right. There have not been any changes applied to the historical rates to the receivable within 12-month period. In fact, there had not been any changes to the historical rates to any stages of receivable at all since the previous three years. This is odd, said Jason. Surely there must be some changes in the trends of receivable payments over the years, thought Jason. He contacted Ganesh from the Accounts Receivable Department and clarified what he discovered. Ganesh responded, Yes, thats true. We confirmed that with Kenneth. There are no significant changes in debtors payment pattern hence we maintained the same rate.

What is the financial accounting issue and what should do to solve the issue?/

Exhibit 4: LOVELY COFFEE'S ACCOUNT RECEIVABLE EXPECTED CREDIT LOSS ESTIMATE - Fiscal Year 2021 0 days 31-60 past 1-30 days days due past due past due RM'000 RM'000 RM'000 Balances outstanding at the reporting date 118.5 Expected credit loss rate 1.50% Expected credit loss estimate 1.778 143 2% 2.860 65 5% 3.250 61-90 days past due RM'000 8.5 10% 0.850 More than 90 days past due RM'000 27.5 25% 6.875 Total RM'000 362.5 15.613Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started