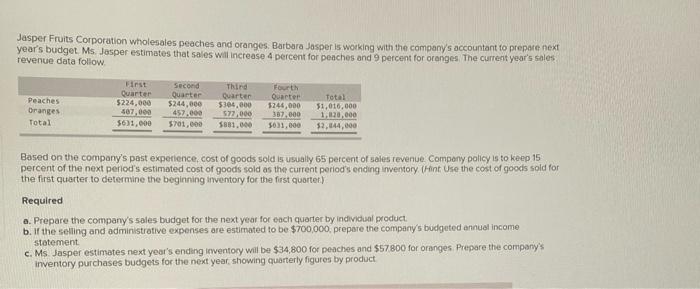

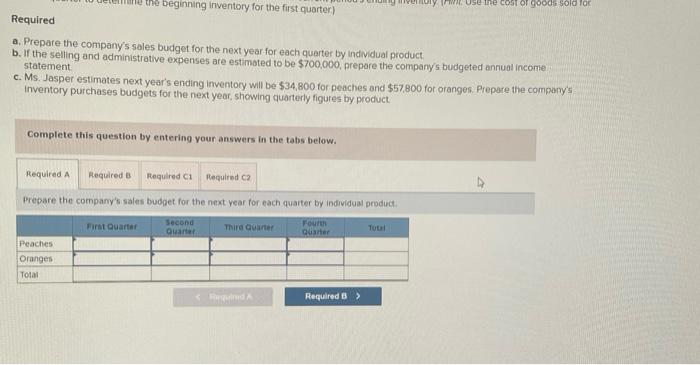

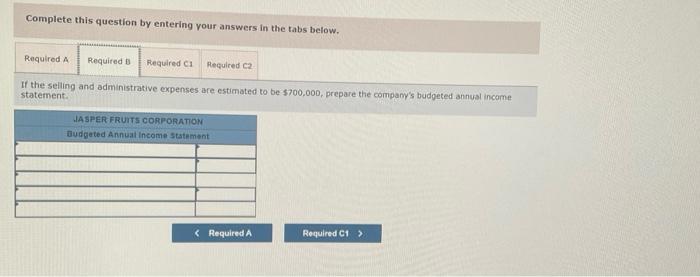

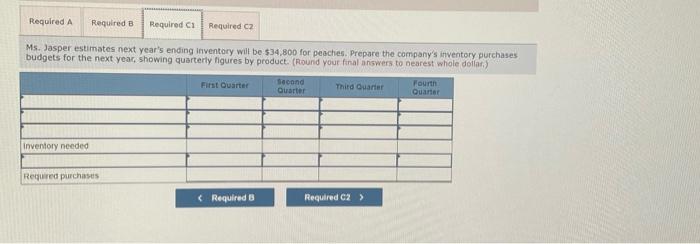

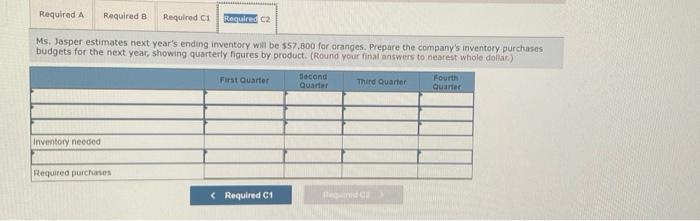

Jasper Fruits Corporation wholesales peaches and oranges. Barbara Jasper is working with the company's accountant to prepare next year's budget. Ms. Jasper estimates that sales will increase 4 percent for peaches and 9 percent for oranges. The current year's sales revenue data follow Peaches Oranges Total First Quarter 5224,000 467,000 $631,000 Second Quarter $244,000 457.000 5701,000 Third Quarter $300,000 572.000 5881.000 Fourth Quarter 1246,000 387.000 5033,000 Total 51,010,000 1,120,000 $2,144,000 Based on the company's past experience cost of goods sold is usually 65 percent of sales revenue Company policy is to keep 15 percent of the next period's estimated cost of goods sold as the current period's ending inventory (Hint Use the cost of goods sold for the first quarter to determine the beginning inventory for the first quartet) Required a. Prepare the company's sales budget for the next year for each quarter by individual product b. If the selling and administrative expenses are estimated to be $700,000, prepare the company's budgeted annual income statement c. Ms Jasper estimates next year's ending inventory will be $34,800 for peaches and $57800 for oranges. Prepare the company's Inventory purchases budgets for the next year showing quarterly figures by product vyose the cost of goods sold to the beginning inventory for the first quarter) Required a. Prepare the company's sales budget for the next year for each quarter by individual product b. If the selling and administrative expenses are estimated to be $700,000, prepare the company's budgeted annual income statement c. Ms. Jasper estimates next year's ending inventory will be $34,800 for peaches and $57,800 for oranges. Prepare the company's Inventory purchases budgets for the next year, showing quarterly figures by product Complete this question by entering your answers in the tabs below. Required A Required Required ca equired ca Prepare the company's sales budget for the next year for each quarter by individual product First Quarter Second Quarter Third Quarter Fourt Quarter Total Peaches Oranges Total F Required B > Complete this question by entering your answers in the tabs below. Required A Required Required CI Required C2 If the selling and administrative expenses are estimated to be $700,000, prepare the company's budgeted annual income statement JASPER FRUITS CORPORATION Budgeted Annual Income Statement Required A Required B Required C1 Required CZ Ms. Jasper estimates next year's ending inventory will be $34,800 for peaches. Prepare the company's inventory purchases budgets for the next year, showing quarterly figures by product. (Round your final answers to nearest whole dollar) First Quarter Second Quarter Third Quarter Fourth Quarter Inventory needed Required purchases Required A Required B Required i Required 2 Ms. Jasper estimates next year's ending inventory will be $57,000 for oranges. Prepare the company's inventory purchases budgets for the next year, showing quarterly figures by product. (Round your final answers to nearest whole dolar) First Quarter Second Quarter Third Quarter Fourth Quarter Inventory needed Required purchases