Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Java Source, Incorporated, (JSI) roasts, blends, and packages coffee beans for resale. Some of JSI's coffees sell in large volumes, while some newer blends

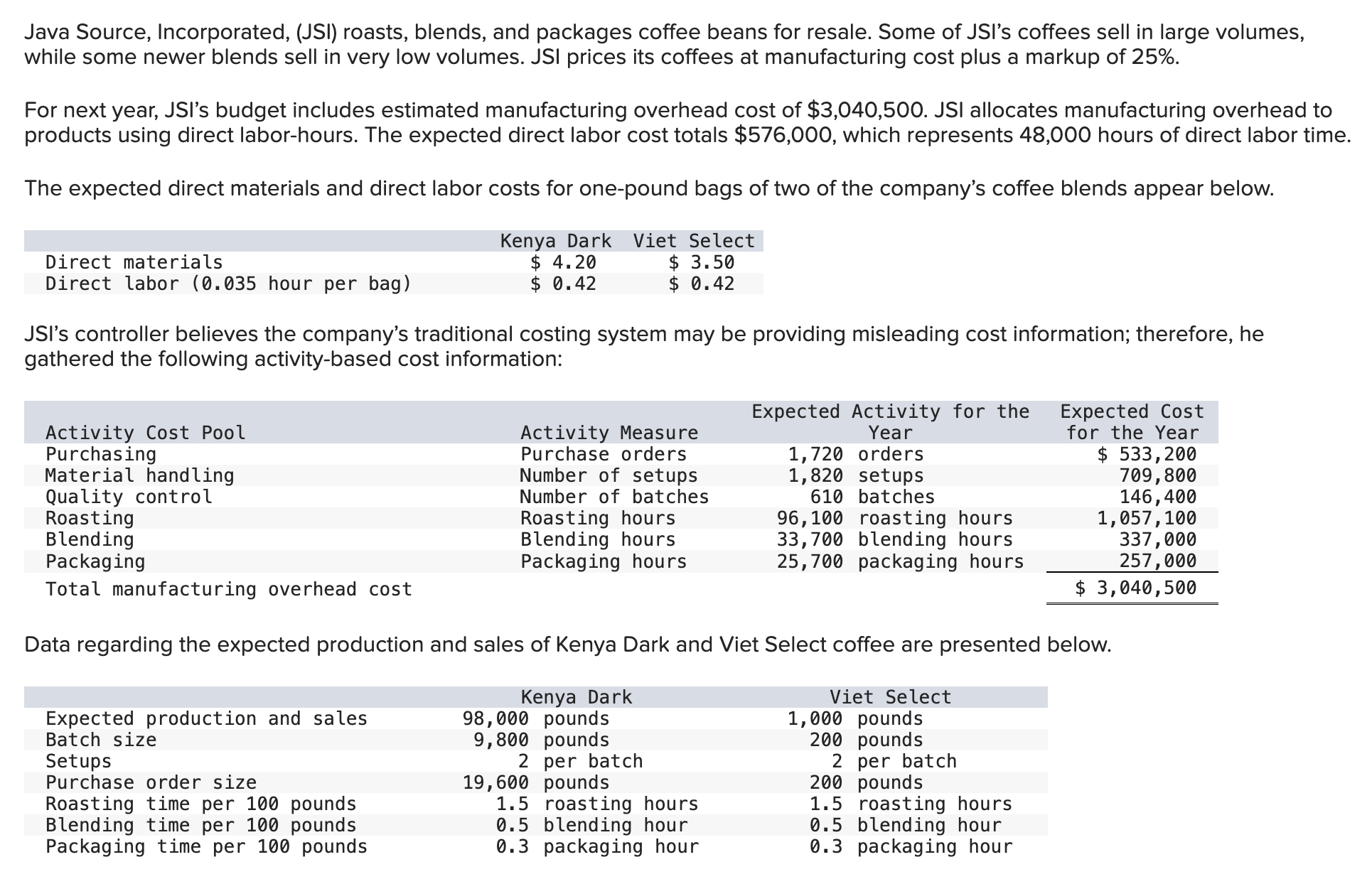

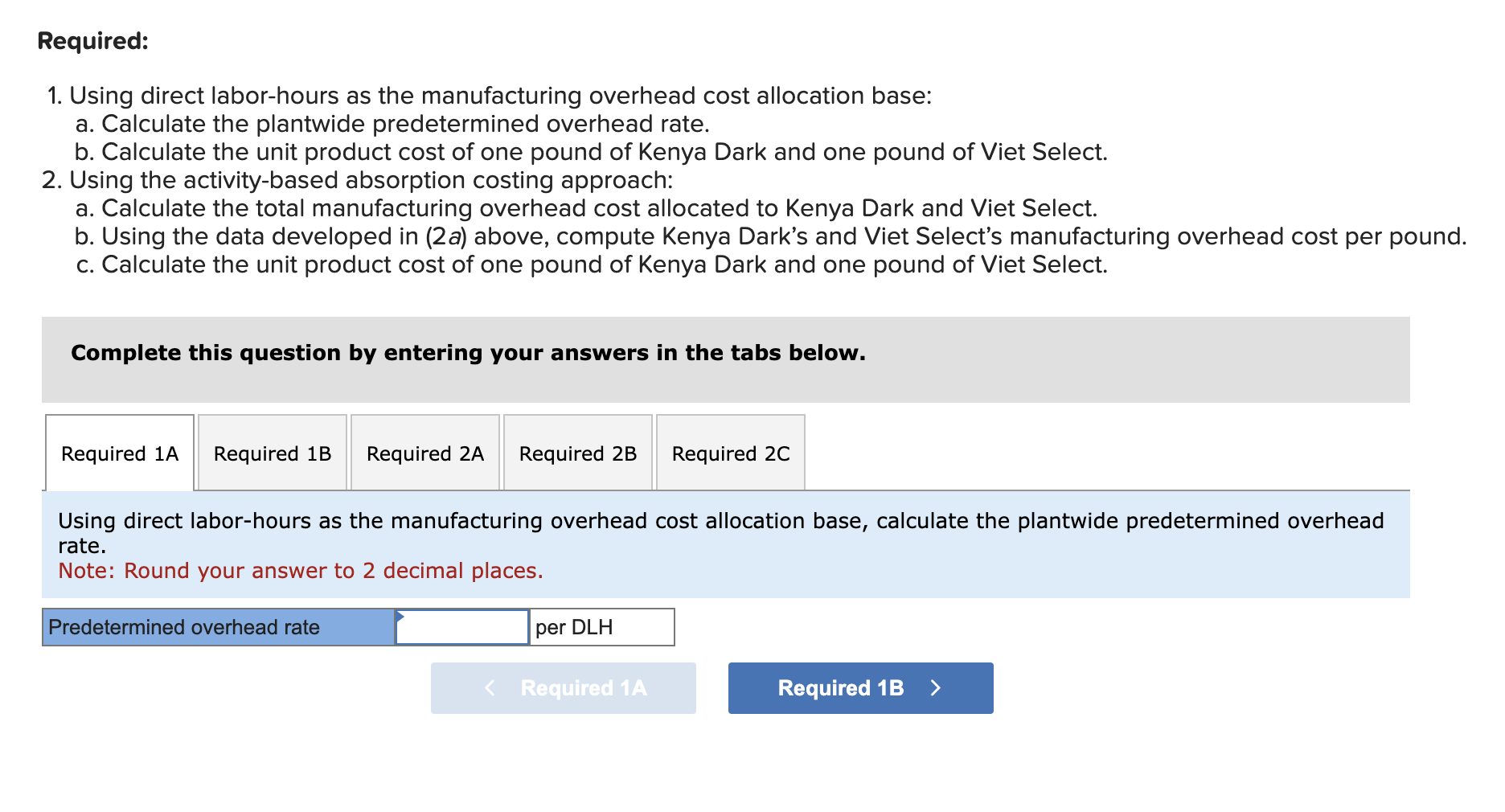

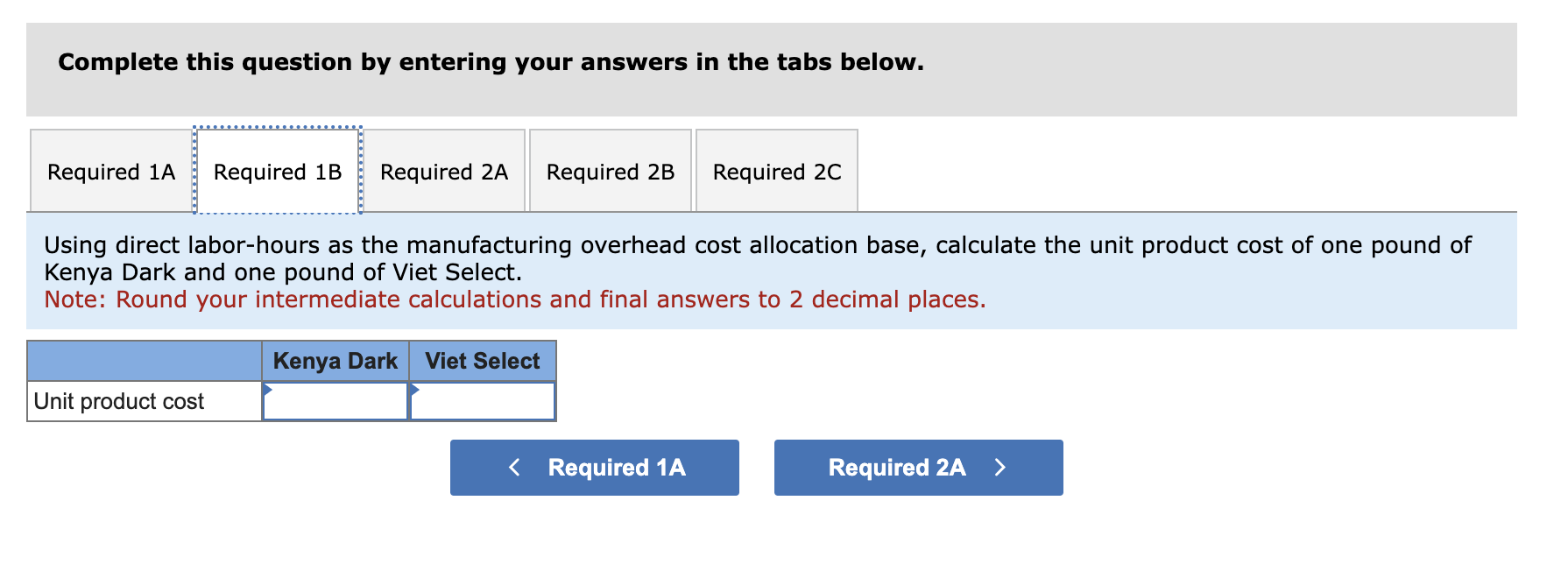

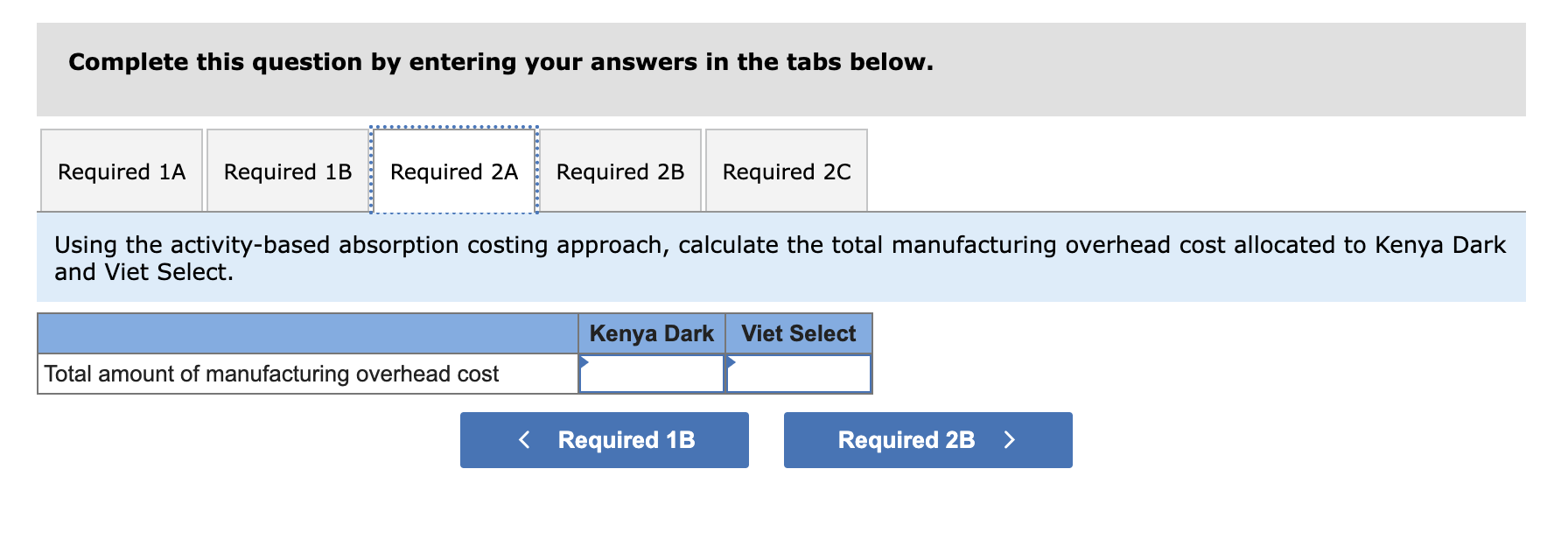

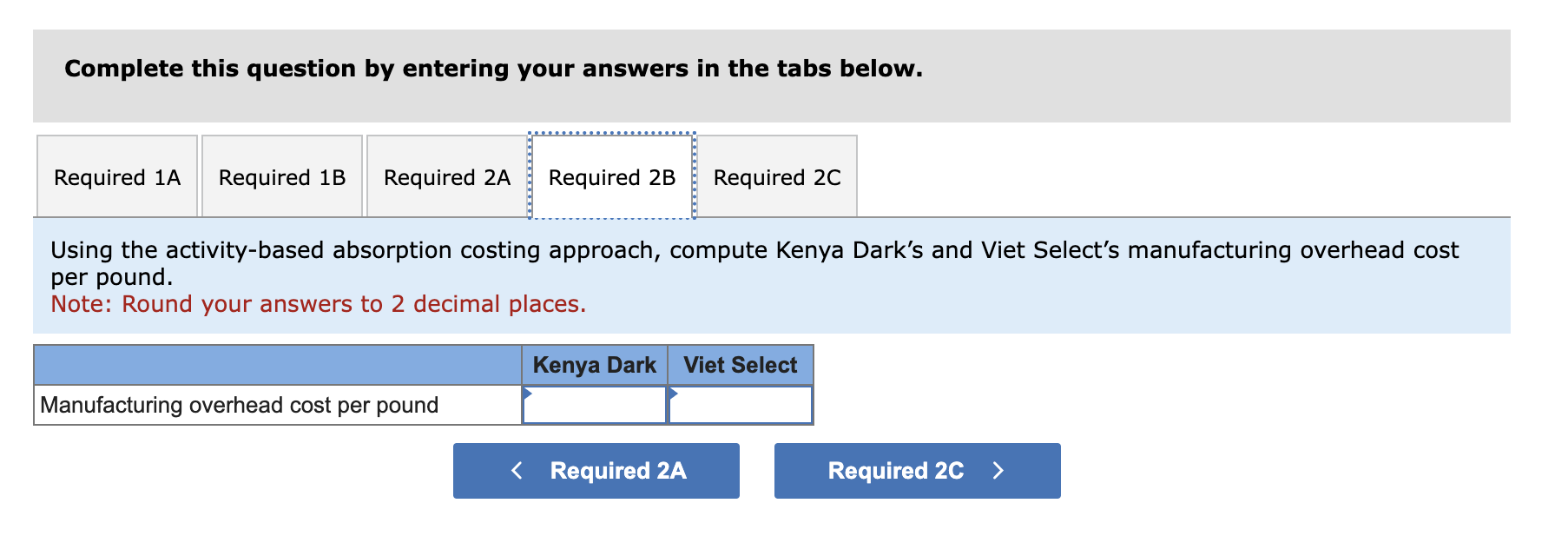

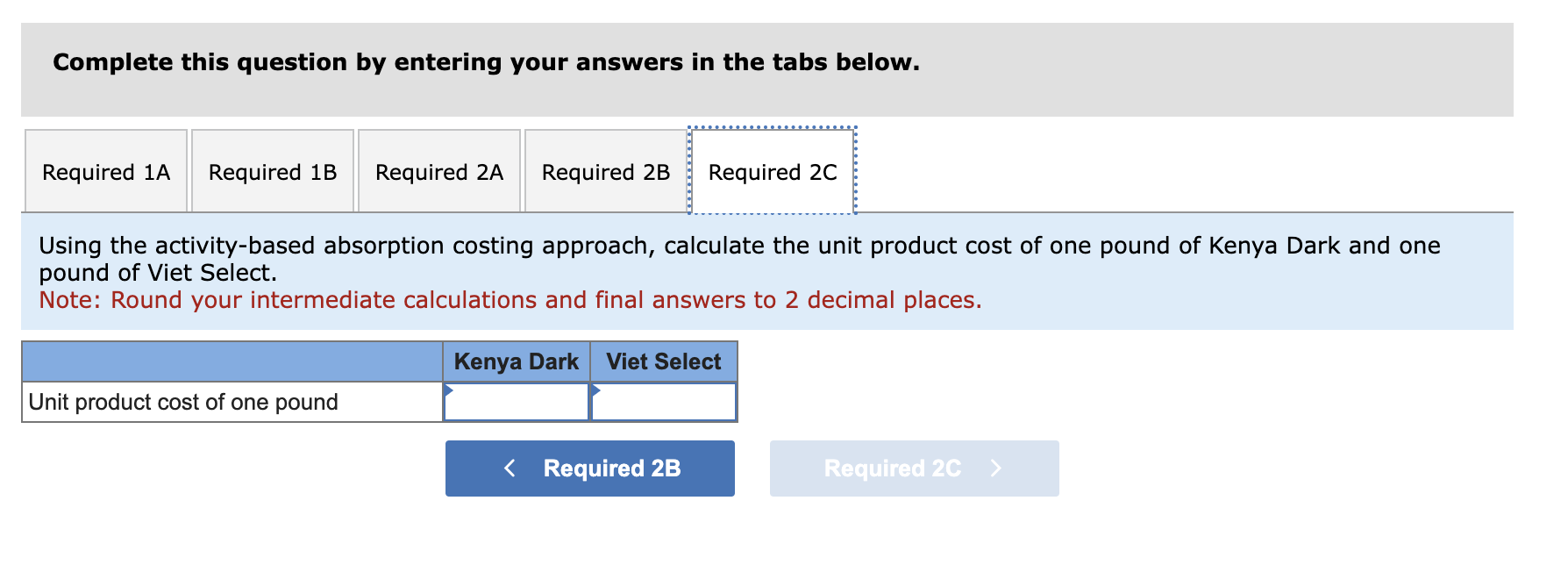

Java Source, Incorporated, (JSI) roasts, blends, and packages coffee beans for resale. Some of JSI's coffees sell in large volumes, while some newer blends sell in very low volumes. JSI prices its coffees at manufacturing cost plus a markup of 25%. For next year, JSI's budget includes estimated manufacturing overhead cost of $3,040,500. JSI allocates manufacturing overhead to products using direct labor-hours. The expected direct labor cost totals $576,000, which represents 48,000 hours of direct labor time. The expected direct materials and direct labor costs for one-pound bags of two of the company's coffee blends appear below. Direct materials Direct labor (0.035 hour per bag) Kenya Dark Viet Select $ 4.20 $ 0.42 $ 3.50 $ 0.42 JSI's controller believes the company's traditional costing system may be providing misleading cost information; therefore, he gathered the following activity-based cost information: Activity Cost Pool Purchasing Material handling Quality control Roasting Blending Packaging Total manufacturing overhead cost Activity Measure Purchase orders Number of setups Number of batches Roasting hours Blending hours Packaging hours Expected Activity for the Year 1,720 orders 1,820 setups 610 batches 96,100 roasting hours 33,700 blending hours 25,700 packaging hours Expected Cost for the Year $ 533,200 709,800 146,400 1,057,100 337,000 257,000 $ 3,040,500 Data regarding the expected production and sales of Kenya Dark and Viet Select coffee are presented below. Expected production and sales Batch size Setups Purchase order size Roasting time per 100 pounds Blending time per 100 pounds Packaging time per 100 pounds Kenya Dark 98,000 pounds 9,800 pounds 2 per batch 19,600 pounds 1.5 roasting hours 0.5 blending hour 0.3 packaging hour Viet Select 1,000 pounds 200 pounds 2 per batch 200 pounds 1.5 roasting hours 0.5 blending hour 0.3 packaging hour Required: 1. Using direct labor-hours as the manufacturing overhead cost allocation base: a. Calculate the plantwide predetermined overhead rate. b. Calculate the unit product cost of one pound of Kenya Dark and one pound of Viet Select. 2. Using the activity-based absorption costing approach: a. Calculate the total manufacturing overhead cost allocated to Kenya Dark and Viet Select. b. Using the data developed in (2a) above, compute Kenya Dark's and Viet Select's manufacturing overhead cost per pound. c. Calculate the unit product cost of one pound of Kenya Dark and one pound of Viet Select. Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2A Required 2B Required 2C Using direct labor-hours as the manufacturing overhead cost allocation base, calculate the plantwide predetermined overhead rate. Note: Round your answer to 2 decimal places. Predetermined overhead rate per DLH < Required 1A Required 1B > Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2A Required 2B Required 2C Using direct labor-hours as the manufacturing overhead cost allocation base, calculate the unit product cost of one pound of Kenya Dark and one pound of Viet Select. Note: Round your intermediate calculations and final answers to 2 decimal places. Kenya Dark Viet Select Unit product cost < Required 1A Required 2A > Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2A Required 2B Required 2C Using the activity-based absorption costing approach, calculate the total manufacturing overhead cost allocated to Kenya Dark and Viet Select. Kenya Dark Viet Select Total amount of manufacturing overhead cost < Required 1B Required 2B > Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2A Required 2B Required 2C Using the activity-based absorption costing approach, compute Kenya Dark's and Viet Select's manufacturing overhead cost per pound. Note: Round your answers to 2 decimal places. Kenya Dark Viet Select Manufacturing overhead cost per pound < Required 2A Required 2C > Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2A Required 2B Required 2C Using the activity-based absorption costing approach, calculate the unit product cost of one pound of Kenya Dark and one pound of Viet Select. Note: Round your intermediate calculations and final answers to 2 decimal places. Kenya Dark Viet Select Unit product cost of one pound < Required 2B Required 2C >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started