Question: The factory manager is considering the following two quotes from two vendors for purchace and maintanance of an equipment. Vendor X's estimates are all

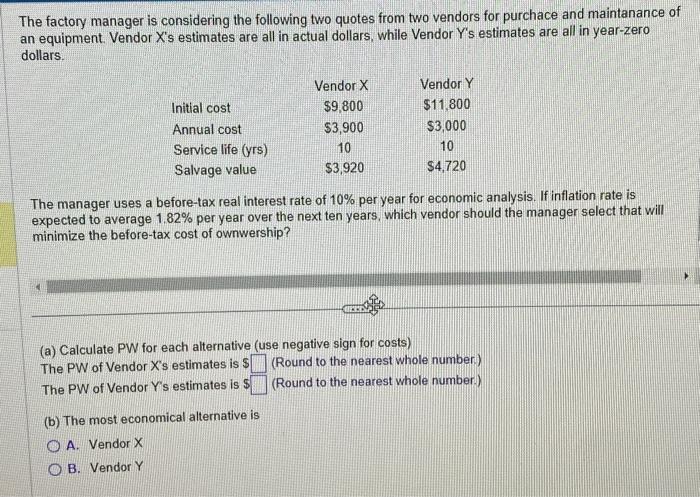

The factory manager is considering the following two quotes from two vendors for purchace and maintanance of an equipment. Vendor X's estimates are all in actual dollars, while Vendor Y's estimates are all in year-zero dollars. Initial cost Annual cost Service life (yrs) Salvage value 4 Vendor X $9,800 $3,900 10 $3,920 The manager uses a before-tax real interest rate of 10% per year for economic analysis. If inflation rate is expected to average 1.82% per year over the next ten years, which vendor should the manager select that will minimize the before-tax cost of ownwership? (b) The most economical alternative is OA. Vendor X OB. Vendor Y CRED (a) Calculate PW for each alternative (use negative sign for costs) The PW of Vendor X's estimates is $ The PW of Vendor Y's estimates is $ Vendor Y $11,800 $3,000 10 $4,720 (Round to the nearest whole number.) (Round to the nearest whole number.)

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

a Calcul ate PW for each alternative use negative sign for costs The PW of Vendor X s estimate... View full answer

Get step-by-step solutions from verified subject matter experts