Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jaypee has the following income in 2017: 10,000 interest income from a non-resident Japanese friend 40,000 interest income from Philippine residents 500,000 rent income

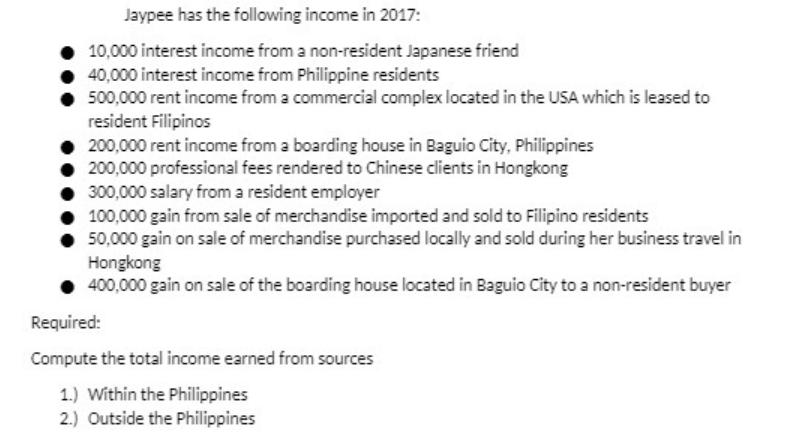

Jaypee has the following income in 2017: 10,000 interest income from a non-resident Japanese friend 40,000 interest income from Philippine residents 500,000 rent income from a commercial complex located in the USA which is leased to resident Filipinos 200,000 rent income from a boarding house in Baguio City, Philippines 200,000 professional fees rendered to Chinese clients in Hongkong 300,000 salary from a resident employer 100,000 gain from sale of merchandise imported and sold to Filipino residents 50,000 gain on sale of merchandise purchased locally and sold during her business travel in Hongkong 400,000 gain on sale of the boarding house located in Baguio City to a non-resident buyer Required: Compute the total income earned from sources 1.) Within the Philippines 2.) Outside the Philippines

Step by Step Solution

★★★★★

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Income Earned within the Philippines Interest income 40000 PHP from Philippine residents Rent income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started