Question

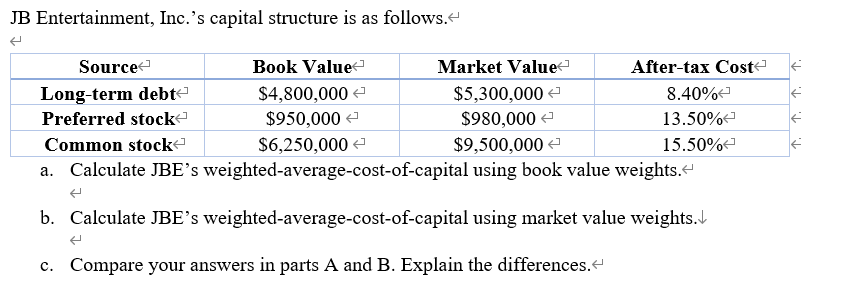

JB Entertainment, Inc.'s capital structure is as follows. < Source Long-term debt < Preferred stock < Book Value $4,800,000 $950,000 $6,250,000 Market Value <

JB Entertainment, Inc.'s capital structure is as follows. < Source Long-term debt < Preferred stock < Book Value $4,800,000 $950,000 $6,250,000 Market Value < $5,300,000 After-tax Cost 8.40% $980,000 13.50% Common stock < $9,500,000 15.50% a. Calculate JBE's weighted-average-cost-of-capital using book value weights. < < b. Calculate JBE's weighted-average-cost-of-capital using market value weights. c. Compare your answers in parts A and B. Explain the differences. < T. .

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate JB Entertainment Incs weightedaverage cost of capital WACC we need to determine the weights of each component in the capital structure and multiply them by their respective afterta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: James D. Stice, Earl K. Stice, Fred Skousen

17th Edition

032459237X, 978-0324592375

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App