Answered step by step

Verified Expert Solution

Question

1 Approved Answer

JBL Aircraft manufactures and distributes aircraft parts and supplies. Employees are offered a variety of share-based compensation plans. Under its nonqualified stock option plan, JBL

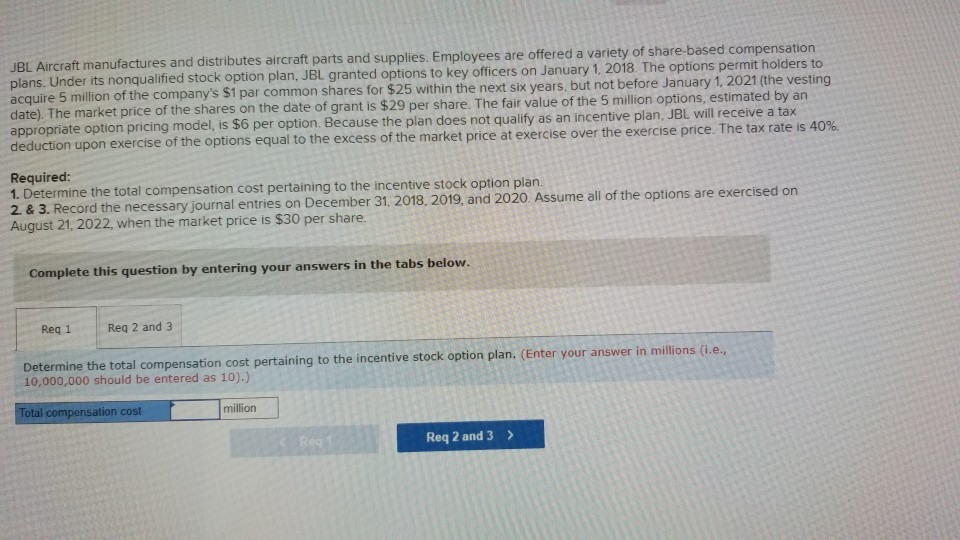

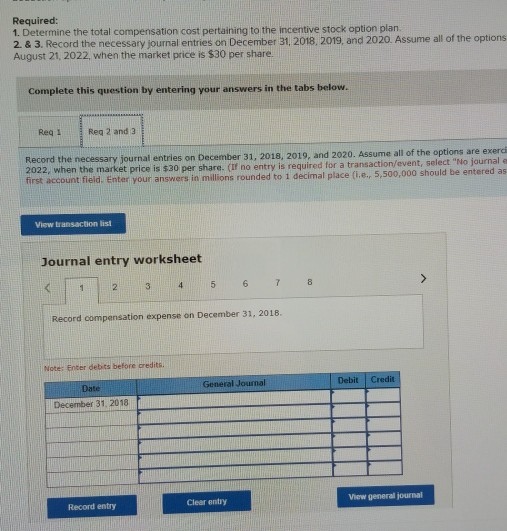

JBL Aircraft manufactures and distributes aircraft parts and supplies. Employees are offered a variety of share-based compensation plans. Under its nonqualified stock option plan, JBL granted options to key officers on January 1, 2018. The options permit holders to acquire 5 million of the company's $1 par common shares for $25 within the next six years, but not before January 1, 2021 (the vesting date). The market price of the shares on the date of grant is $29 per share. The fair value of the 5 million options, estimated by an appropriate option pricing model, is $6 per option. Because the plan does not qualify as an incentive plan, JBL will receive a tax deduction upon exercise of the options equal to the excess of the market price at exercise over the exercise price. The tax rate is 40%. Required: 1. Determine the total compensation cost pertaining to the incentive stock option plan. 2. & 3. Record the necessary journal entries on December 31, 2018, 2019, and 2020. Assume all of the options are exercised on August 21, 2022, when the market price is $30 per share. Complete this question by entering your answers in the tabs below. Reg 1 Req 2 and 3 Determine the total compensation cost pertaining to the incentive stock option plan. (Enter your answer in millions (i.e., 10,000,000 should be entered as 10).) Total compensation cost million Steg Req 2 and 3 > Required: 1. Determine the total compensation cost pertaining to the incentive stock option plan 2. & 3. Record the necessary journal entries on December 31, 2018, 2019, and 2020. Assume all of the options August 21, 2022, when the market price is $30 per share Complete this question by entering your answers in the tabs below. Req1 Reg 2 and 3 Record the necessary journal entries on December 31, 2018, 2019, and 2020. Assume all of the options are exerci 2022, when the market price is $30 per share. (If no entry is required for a transaction/event, select "No journal first account field. Enter your answers in millions rounded to 1 decimal place (le, 5,500,000 should be entered as View transaction list Journal entry worksheet 1 4 2 3 7 8 5 6 Record compensation expense on December 31, 2018 Note: Enter debits before credits Debit Credit General Journal Date December 31, 2018 View general journal Clear entry Record entry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started