Answered step by step

Verified Expert Solution

Question

1 Approved Answer

JC Moss & Son are experiencing disappointing financial conditions The company has been reporting loss for a couple of years The income statement for

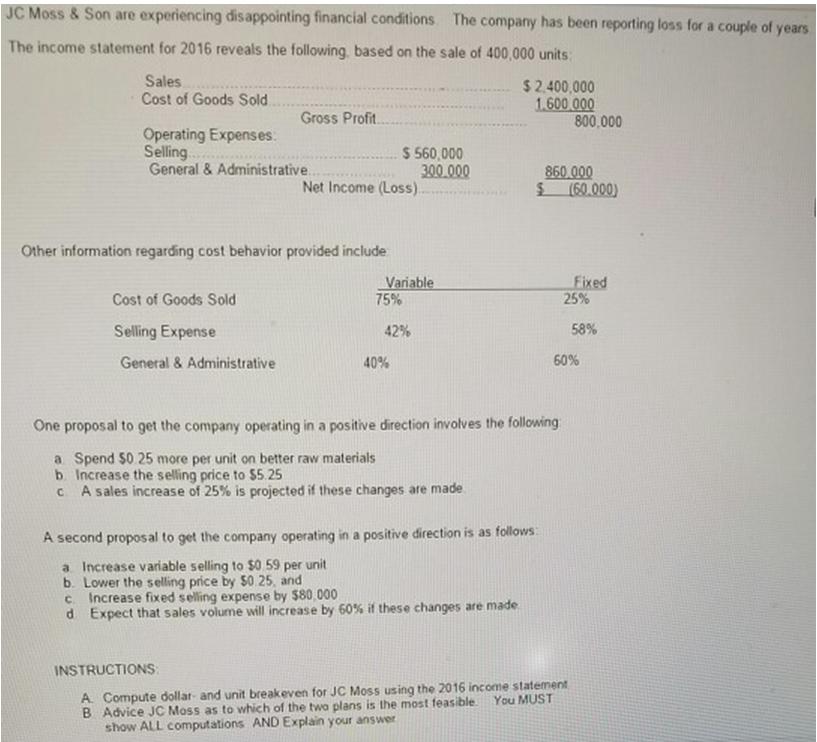

JC Moss & Son are experiencing disappointing financial conditions The company has been reporting loss for a couple of years The income statement for 2016 reveals the following. based on the sale of 400,000 units: Sales Cost of Goods Sold $2.400,000 1.600 000 800,000 Gross Profit. Operating Expenses: Selling General & Administrative. $ 560,000 300.000 860.000 (60.000) Net Income (Loss). Other information regarding cost behavior provided include Variable 75% Fixed 25% Cost of Goods Sold Selling Expense 42% 58% General & Administrative 40% 60% One proposal to get the company operating in a positive direction involves the following a Spend $0.25 more per unit on better raw materials b. Increase the selling price to $5.25 C A sales increase of 25% is projected if these changes are made A second proposal to get the company operating in a positive direction is as follows: a Increase variable selling to $0 59 per unit b. Lower the selling price by $0.25, and Increase fixed selling expense by $80,000 C. d Expect that sales volume will increase by 60% if these changes are made INSTRUCTIONS: A. Compute dollar- and unit breakeven for JC Moss using the 2016 income statement B Advice JC Moss as to which of the twa plans is the most feasible show ALL computations AND Explain your answer You MUST JC Moss & Son are experiencing disappointing financial conditions The company has been reporting loss for a couple of years The income statement for 2016 reveals the following. based on the sale of 400,000 units: Sales Cost of Goods Sold $2.400,000 1.600 000 800,000 Gross Profit. Operating Expenses: Selling General & Administrative. $ 560,000 300.000 860.000 (60.000) Net Income (Loss). Other information regarding cost behavior provided include Variable 75% Fixed 25% Cost of Goods Sold Selling Expense 42% 58% General & Administrative 40% 60% One proposal to get the company operating in a positive direction involves the following a Spend $0.25 more per unit on better raw materials b. Increase the selling price to $5.25 C A sales increase of 25% is projected if these changes are made A second proposal to get the company operating in a positive direction is as follows: a Increase variable selling to $0 59 per unit b. Lower the selling price by $0.25, and Increase fixed selling expense by $80,000 C. d Expect that sales volume will increase by 60% if these changes are made INSTRUCTIONS: A. Compute dollar- and unit breakeven for JC Moss using the 2016 income statement B Advice JC Moss as to which of the twa plans is the most feasible show ALL computations AND Explain your answer You MUST JC Moss & Son are experiencing disappointing financial conditions The company has been reporting loss for a couple of years The income statement for 2016 reveals the following. based on the sale of 400,000 units: Sales Cost of Goods Sold $2.400,000 1.600 000 800,000 Gross Profit. Operating Expenses: Selling General & Administrative. $ 560,000 300.000 860.000 (60.000) Net Income (Loss). Other information regarding cost behavior provided include Variable 75% Fixed 25% Cost of Goods Sold Selling Expense 42% 58% General & Administrative 40% 60% One proposal to get the company operating in a positive direction involves the following a Spend $0.25 more per unit on better raw materials b. Increase the selling price to $5.25 C A sales increase of 25% is projected if these changes are made A second proposal to get the company operating in a positive direction is as follows: a Increase variable selling to $0 59 per unit b. Lower the selling price by $0.25, and Increase fixed selling expense by $80,000 C. d Expect that sales volume will increase by 60% if these changes are made INSTRUCTIONS: A. Compute dollar- and unit breakeven for JC Moss using the 2016 income statement B Advice JC Moss as to which of the twa plans is the most feasible show ALL computations AND Explain your answer You MUST JC Moss & Son are experiencing disappointing financial conditions The company has been reporting loss for a couple of years The income statement for 2016 reveals the following. based on the sale of 400,000 units: Sales Cost of Goods Sold $2.400,000 1.600 000 800,000 Gross Profit. Operating Expenses: Selling General & Administrative. $ 560,000 300.000 860.000 (60.000) Net Income (Loss). Other information regarding cost behavior provided include Variable 75% Fixed 25% Cost of Goods Sold Selling Expense 42% 58% General & Administrative 40% 60% One proposal to get the company operating in a positive direction involves the following a Spend $0.25 more per unit on better raw materials b. Increase the selling price to $5.25 C A sales increase of 25% is projected if these changes are made A second proposal to get the company operating in a positive direction is as follows: a Increase variable selling to $0 59 per unit b. Lower the selling price by $0.25, and Increase fixed selling expense by $80,000 C. d Expect that sales volume will increase by 60% if these changes are made INSTRUCTIONS: A. Compute dollar- and unit breakeven for JC Moss using the 2016 income statement B Advice JC Moss as to which of the twa plans is the most feasible show ALL computations AND Explain your answer You MUST

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started