Answered step by step

Verified Expert Solution

Question

1 Approved Answer

JD Partners was formed on 1 October 2011. Jodie invested $150,000 and David invested $100,000. The partnership agreement contained the following provisions: Salaries are

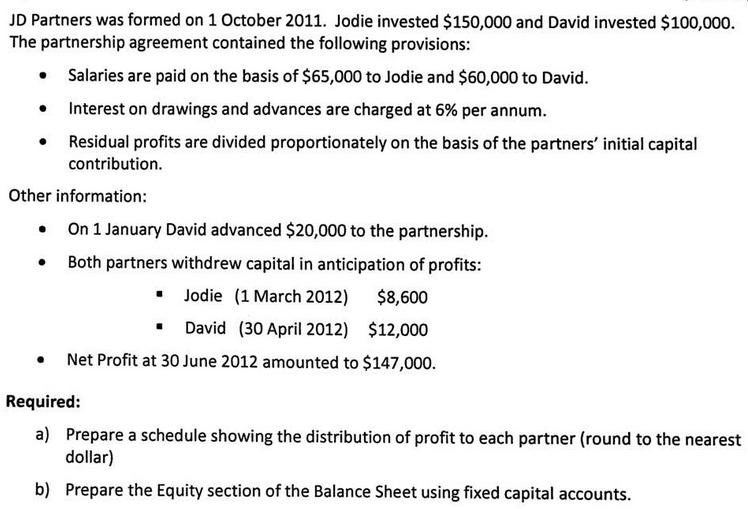

JD Partners was formed on 1 October 2011. Jodie invested $150,000 and David invested $100,000. The partnership agreement contained the following provisions: Salaries are paid on the basis of $65,000 to Jodie and $60,000 to David. Interest on drawings and advances are charged at 6% per annum. Residual profits are divided proportionately on the basis of the partners' initial capital contribution. Other information: On 1 January David advanced $20,000 to the partnership. Both partners withdrew capital in anticipation of profits: Jodie (1 March 2012) $8,600 $12,000 David (30 April 2012) Net Profit at 30 June 2012 amounted to $147,000. Required: a) Prepare a schedule showing the distribution of profit to each partner (round to the nearest dollar) b) Prepare the Equity section of the Balance Sheet using fixed capital accounts.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started