Question

J.D. Williams is an investment advisory firm that manages $120 million in funds for its clients. The company utilizes several financial approaches in advising their

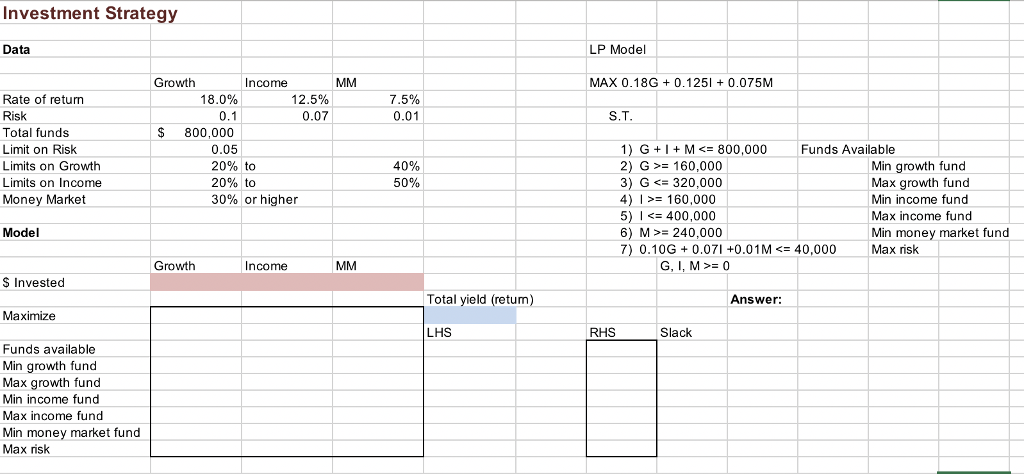

J.D. Williams is an investment advisory firm that manages $120 million in funds for its clients. The company utilizes several financial approaches in advising their clients how to achieve optimal portfolio returns. They are as follows: An Asset Allocation Model - An asset allocation model, which provides individual clients with an investment strategy in order to obtain optimal investment combinations. Percentage Limitations - The company strongly recommends investment diversity as a protection of the investors' assets. Each client is, therefore, encouraged with percentage limitations by a team of professional advisors. A Risk Tolerance Analysis - The company conducts an analysis of the individual investor's risk tolerance and adjusts their portfolios accordingly. J.D. Williams has recently contracted with a new client and would like to determine what is the best way to allocate the client's $800,000 in available funds for optimal growth. The subsequent sections of this report provide an outline of the investment recommendation provided to the client. II. Model Formulation 1. Decision Variables GF = $ amount of investment in growth stock fund IF = $ amount of investment in income fund MMF $ amount of investment in money market fund

Q1 Solve the LP model you already formulated. You should get total yield of $94133.33. In order to answer the remaining questions, make 4 copies of your Excel sheet from Q1, make appropriate changes and run solver again. Remember not to carry over the change in one question to the next question. For Q2 and Q3, you need to change some number in the Data section and run solver. In Q3, remember to try both rates 16% and 14% - on separate sheets. On Q4, you need to add a new constraint and run Solver.

Investment Strategy Data LP Model Growth Income MAX 0.18G 0.1251 0.075M 12.5% 0.07 18.0% 7.5% 0.01 Rate of return Risk Total funds Limit on Risk Limits on Growth Limits on Income Money Market S.T $800.000 0.05 20% to 20% to 30% or higher 1) G+1M800,000 Funds Available 2) G 160,000 3) G320,000 4) I>= 160,000 5) 400,000 6) M 240,000 7) 0.10G + 0.071 +0.01 M 40,000 40% 50% Min growth fund Max growth fund Min income fund Max income fund Min money market fund Max risk Model Growth Income G, I, M >= 0 $ Invested Total yield (retum) Answer: Maximize LHS RHS Slack Funds available Min growth fund Max growth fund Min income fund Max income fund Min money market fund Max risk Investment Strategy Data LP Model Growth Income MAX 0.18G 0.1251 0.075M 12.5% 0.07 18.0% 7.5% 0.01 Rate of return Risk Total funds Limit on Risk Limits on Growth Limits on Income Money Market S.T $800.000 0.05 20% to 20% to 30% or higher 1) G+1M800,000 Funds Available 2) G 160,000 3) G320,000 4) I>= 160,000 5) 400,000 6) M 240,000 7) 0.10G + 0.071 +0.01 M 40,000 40% 50% Min growth fund Max growth fund Min income fund Max income fund Min money market fund Max risk Model Growth Income G, I, M >= 0 $ Invested Total yield (retum) Answer: Maximize LHS RHS Slack Funds available Min growth fund Max growth fund Min income fund Max income fund Min money market fund Max riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started