Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jealea designed a video game! Below are the costs which Jaelea incurred in the first 5 years of production. Computer for development (with a

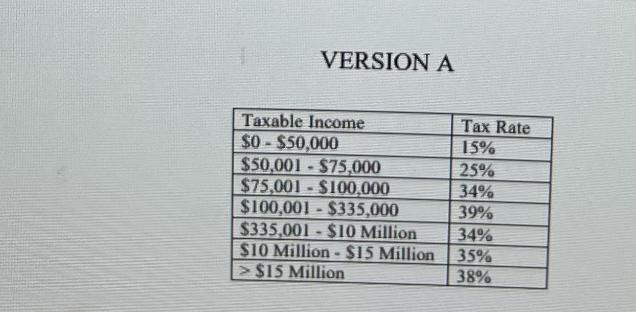

Jealea designed a video game! Below are the costs which Jaelea incurred in the first 5 years of production. Computer for development (with a super fancy graphics card) - $10,300 o . . This device can be depreciated using MACRS depreciation. The computer is a 3- yr property class. The first year was for development only, meaning no games are sold. The game was available for $15 in the Steam store in the first year it is sold (aka year 2), while the bugs are worked out. It was then sold for $50 every year after. Marketing did not occur in the first year of development or second year of beta testing. However, starting in year 3 marketing costs were $8,000 per year. The first year the game was available for purchase it sold 350 copies. In year 3 it sold 500 copies, in year 4 it sold 4,000 copies and in year 5 it sold 7,500 copies. a. Create the ATCF table for the first 5 years of the business. This includes the first year when there are no sales. Since the game was considered a start-up Jealea qualified for a special program that actually allows them to only pay taxes on profit. They do not receive tax credit for the years in which they have a loss. Meaning the taxes paid are 0$ for that year. There is no state tax to consider. You will pay taxes based on the federal tax bracket below. VERSION A Taxable Income $0-$50,000 $50,001-$75,000 $75,001-$100,000 $100,001-$335,000 $335,001-$10 Million $10 Million $15 Million $15 Million Tax Rate 15% 25% 34% 39% 34% 35% 38%

Step by Step Solution

★★★★★

3.56 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To create the ATCF AfterTax Cash Flow table for the first 5 years of the business we need t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started