Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. Jean just had a long conversation with his broker. His broker convinced him to do the following initial transactions: buy a share of

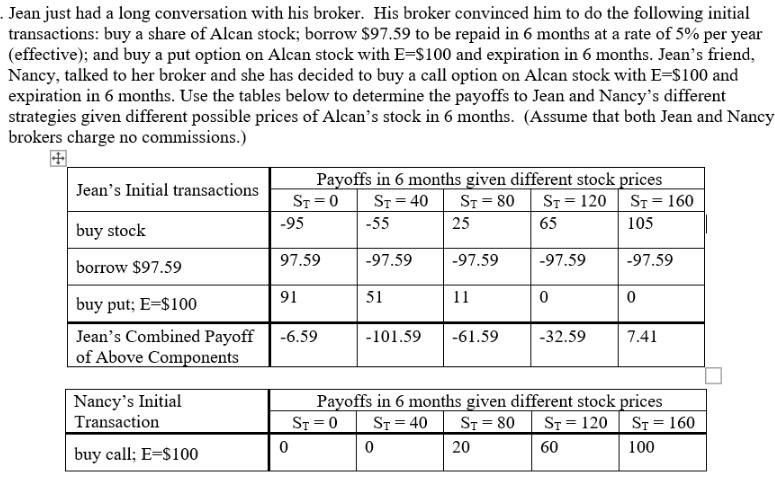

. Jean just had a long conversation with his broker. His broker convinced him to do the following initial transactions: buy a share of Alcan stock; borrow $97.59 to be repaid in 6 months at a rate of 5% per year (effective); and buy a put option on Alcan stock with E=$100 and expiration in 6 months. Jean's friend, Nancy, talked to her broker and she has decided to buy a call option on Alcan stock with E-$100 and expiration in 6 months. Use the tables below to determine the payoffs to Jean and Nancy's different strategies given different possible prices of Alcan's stock in 6 months. (Assume that both Jean and Nancy brokers charge no commissions.) Jean's Initial transactions buy stock borrow $97.59 buy put; E=$100 Jean's Combined Payoff of Above Components Nancy's Initial Transaction buy call; E-$100 Payoffs in 6 months given different stock prices ST = 40 ST = 80 ST=0 ST 120 ST 160 -55 25 65 105 -95 97.59 91 -6.59 0 -97.59 51 -97.59 11 -101.59 -61.59 0 -97.59 0 -32.59 - -97.59 0 7.41 Payoffs in 6 months given different stock prices ST=0 ST = 40 ST = 160 ST = 80 20 ST = 120 60 100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The table you provided shows the payoffs for Jeans and Nancys investment strategies involving options on Alcan stock with different stock prices at ex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started