Answered step by step

Verified Expert Solution

Question

1 Approved Answer

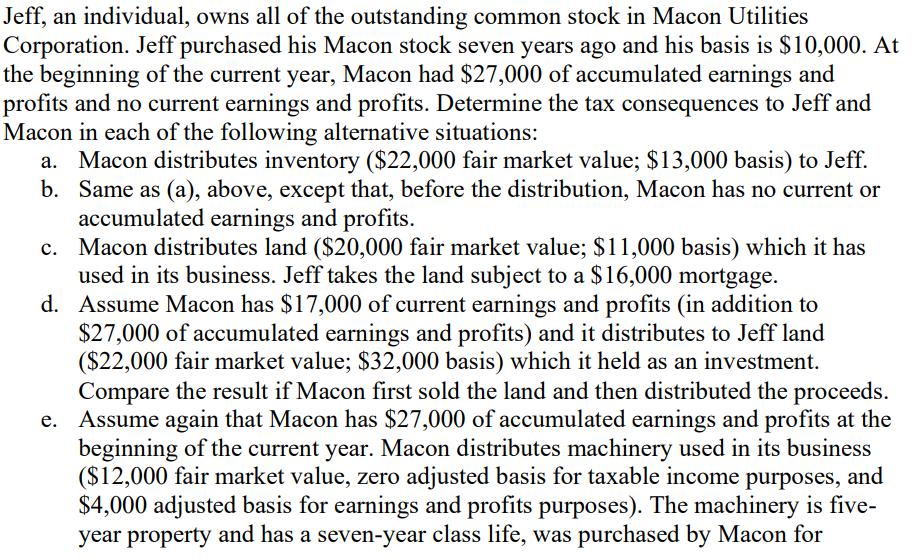

Jeff, an individual, owns all of the outstanding common stock in Macon Utilities Corporation. Jeff purchased his Macon stock seven years ago and his

Jeff, an individual, owns all of the outstanding common stock in Macon Utilities Corporation. Jeff purchased his Macon stock seven years ago and his basis is $10,000. At the beginning of the current year, Macon had $27,000 of accumulated earnings and profits and no current earnings and profits. Determine the tax consequences to Jeff and Macon in each of the following alternative situations: a. Macon distributes inventory ($22,000 fair market value; $13,000 basis) to Jeff. b. Same as (a), above, except that, before the distribution, Macon has no current or accumulated earnings and profits. c. Macon distributes land ($20,000 fair market value; $11,000 basis) which it has used in its business. Jeff takes the land subject to a $16,000 mortgage. d. Assume Macon has $17,000 of current earnings and profits (in addition to $27,000 of accumulated earnings and profits) and it distributes to Jeff land ($22,000 fair market value; $32,000 basis) which it held as an investment. Compare the result if Macon first sold the land and then distributed the proceeds. e. Assume again that Macon has $27,000 of accumulated earnings and profits at the beginning of the current year. Macon distributes machinery used in its business ($12,000 fair market value, zero adjusted basis for taxable income purposes, and $4,000 adjusted basis for earnings and profits purposes). The machinery is five- year property and has a seven-year class life, was purchased by Macon for $14,000 on July 1 of year one when it was fully expensed under 168(k), and the distribution is made on January 1 of year seven.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation Solution Requirement A Macon recognizes 9000 of gain which is ordinary income 311 b 2200013000 This gain will increase Macons current EP by 9000 312b1 f1 Therefore Macon has 9000 of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started