Question

Jeff sold at $63 per share, PEP stocks who were purchased a year ago at $58.90. During the year the stock paid dividends of

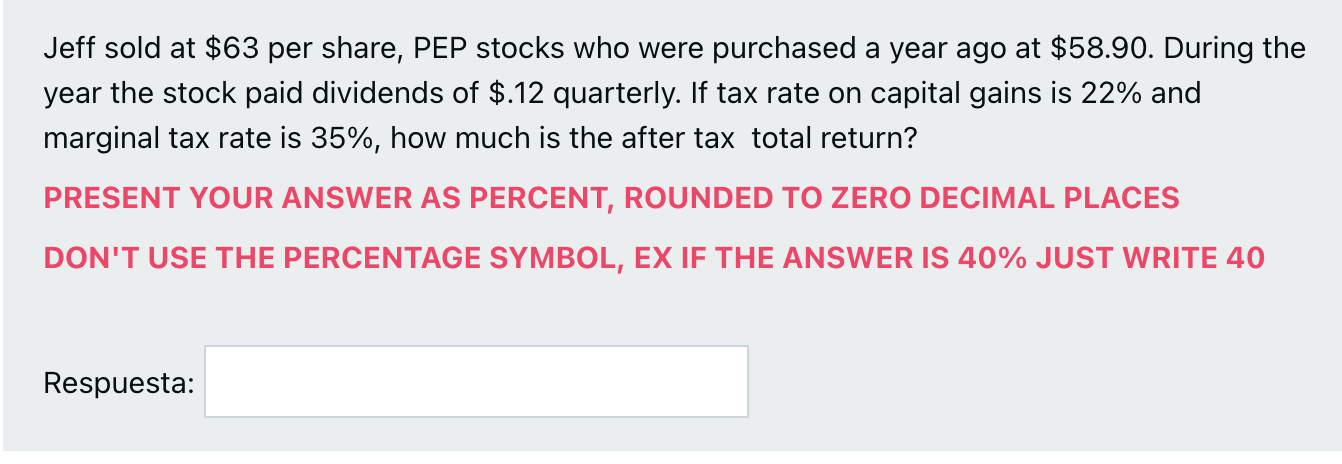

Jeff sold at $63 per share, PEP stocks who were purchased a year ago at $58.90. During the year the stock paid dividends of $.12 quarterly. If tax rate on capital gains is 22% and marginal tax rate is 35%, how much is the after tax total return? PRESENT YOUR ANSWER AS PERCENT, ROUNDED TO ZERO DECIMAL PLACES DON'T USE THE PERCENTAGE SYMBOL, EX IF THE ANSWER IS 40% JUST WRITE 40 Respuesta:

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Heres how to calculate the aftertax total return for Jeffs PEP stock sale Capital Gain per Sha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxes And Business Strategy A Planning Approach

Authors: Myron Scholes, Mark Wolfson, Merle Erickson, Michelle Hanlon

5th Edition

132752670, 978-0132752671

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App