Jefferson Company is a merchandiser located in western North Carolina. You serve on the companys capital budgeting review committee whose purpose is to evaluate all

Jefferson Company is a merchandiser located in western North Carolina. You serve on the company’s capital budgeting review committee whose purpose is to evaluate all capital investment proposals and then provide an “accept or reject” recommendation to the CEO. Recently, your committee provided a “reject” recommendation on a specific proposal based on the following net present value analysis (NPV):

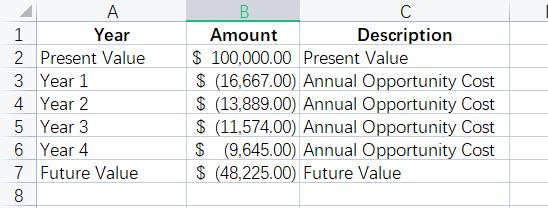

The group of employees that submitted this request is disappointed that you provided a “reject” recommendation for its proposal. The group does not understand why working capital is treated as a $100,000 cash outflow now and a $100,000 cash inflow at the end of the project. To explain your accounting for working capital in the NPV analysis shown above, you decide to proceed in two steps. First, you will explain how to calculate the annual opportunity costs that arise from tying up $100,000 of working capital for four years. Second, you will create a data visualization that summarizes these calculations.

Download the Excel file, which you will use to create the Tableau visualization that aid your explanation.

Upload the Excel file into Tableau by doing the following:

- Open the Tableau Desktop application.

- On the left-hand side, under the “Connect” header and the “To a file” sub-header, click on “Microsoft Excel.”

- Choose the Excel file and click “Open.”

- Since the only worksheet in the Excel File is “Calloway Company” it will default as a selection with no further import steps needed

Upload your visualizations to PowerPoint

- Go to File -> Export as PowerPoint. Save your new PowerPoint file

- Upload your PowerPoint file where shown below.

A C 1 Year Description $ 100,000.00 Present Value $ (16,667.00) Annual Opportunity Cost $ (13,889.00) Annual Opportunity Cost $ (11,574.00) Annual Opportunity Cost $ (9,645.00) Annual Opportunity Cost $ (48,225.00) Future Value Amount 2 Present Value 3 Year 1 4 Year 2 5 Year 3 6 Year 4 7 Future Value

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

the opportunity cost is benefit derived from the option which is not chosen here we can calculate op...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started