Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jekyll and Hyde formed a corporation (Halloween Inc.) on October 31 to develop a drug to address split personalities. Jekyll will contribute a patented

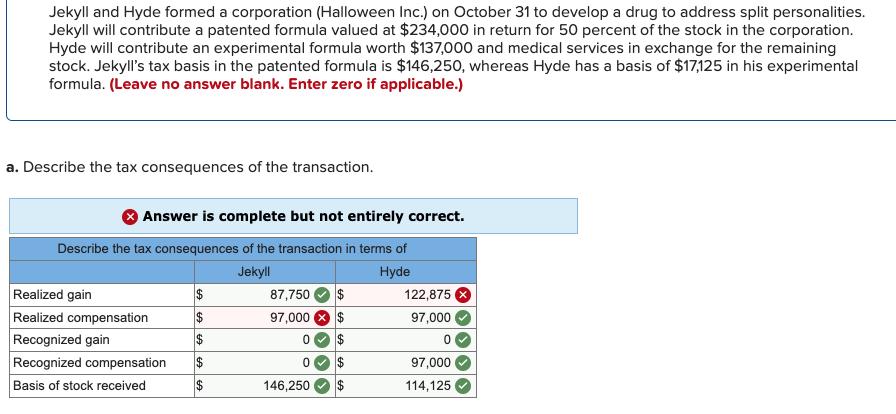

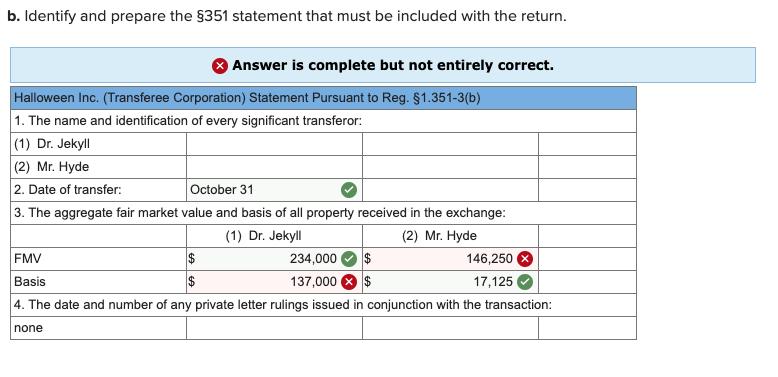

Jekyll and Hyde formed a corporation (Halloween Inc.) on October 31 to develop a drug to address split personalities. Jekyll will contribute a patented formula valued at $234,000 in return for 50 percent of the stock in the corporation. Hyde will contribute an experimental formula worth $137,000 and medical services in exchange for the remaining stock. Jekyll's tax basis in the patented formula is $146,250, whereas Hyde has a basis of $17,125 in his experimental formula. (Leave no answer blank. Enter zero if applicable.) a. Describe the tax consequences of the transaction. Answer is complete but not entirely correct. Describe the tax consequences of the transaction in terms of Jekyll Hyde Realized gain Realized compensation Recognized gain Recognized compensation 87,750 Os $ $ 122,875 2$ 97,000 97,000 2$ 97,000 Basis of stock received 2$ 146,250 114,125 %24 b. Identify and prepare the $351 statement that must be included with the return. Answer is complete but not entirely correct. Halloween Inc. (Transferee Corporation) Statement Pursuant to Reg. $1.351-3(b) 1. The name and identification of every significant transferor: (1) Dr. Jekyll (2) Mr. Hyde 2. Date of transfer: 3. The aggregate fair market value and basis of all property received in the exchange: October 31 (1) Dr. Jekyll (2) Mr. Hyde $ $ FMV 234,000 146,250 Basis 137,000 8 $ 17,125 4. The date and number of any private letter rulings issued in conjunction with the transaction: none

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started