Question

Jen & Berry, (J&B) supplies its ice cream parlors with 3 flavors of ice cream: chocolate, vanilla and banana, which generate, respectively, $1.00, $0.90 and

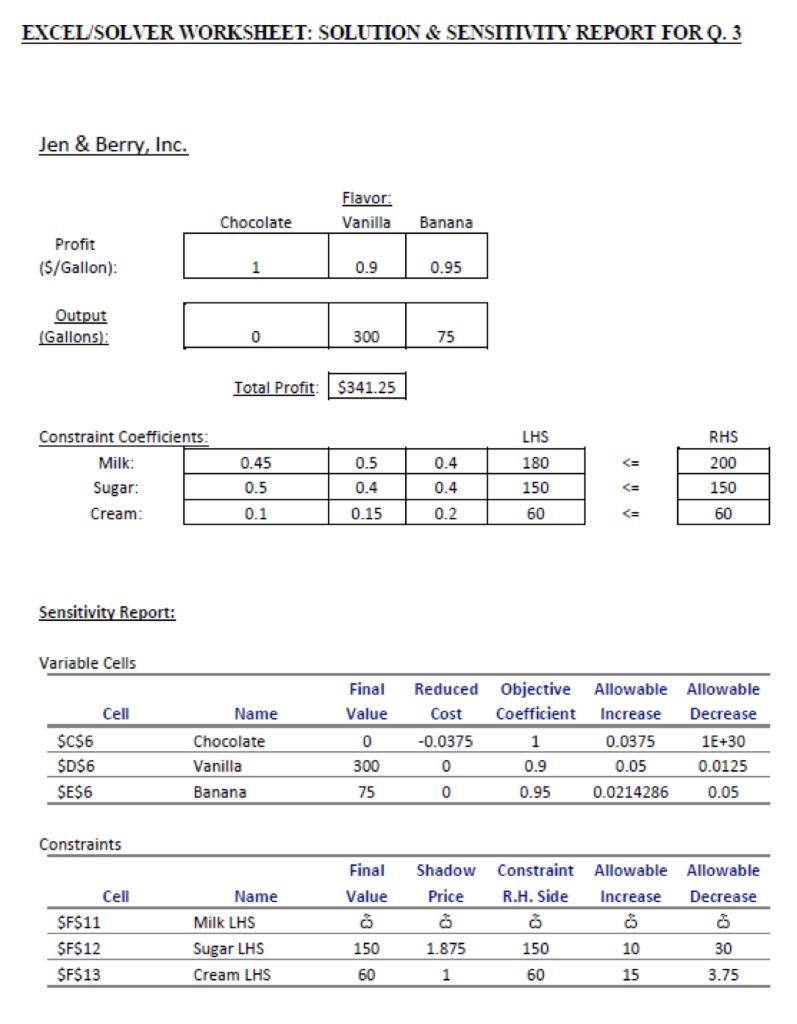

Jen & Berry, (J&B) supplies its ice cream parlors with 3 flavors of ice cream: chocolate, vanilla and banana, which generate, respectively, $1.00, $0.90 and $0.95 of profit per gallon sold. Due to severe global warming effects and exploding demand for its products, the company has run short of its supplies of basic ingredients: milk, sugar and cream. Due to these circumstances, J&B has decided to determine a product mix for the next day, which will maximize its total profit, given the existing constraints on the ingredients’ availabilities, i.e. 200 gallons of milk, 150 pounds of sugar and 60 gallons of cream. For this purpose, the following LP model has been formulated and solved:

Maximize Total Profit: Z = 1.00C + 0.90V + 0.95B ($)

Subject to: (1) 0.45C + 0.50V + 0.40B ≤ 200 (gallons of milk) (2) 0.50C + 0.40V + 0.40B ≤ 150 (pounds of sugar) (3) 0.10C + 0.15V + 0.20B ≤ 60 (gallons of cream) (4) C, V, B ≥ 0 (non-negativity),

where C ≜ gallons of chocolate ice cream to be produced next day, V ≜ gallons of vanilla ice cream to be produced next day,

B ≜ gallons of banana ice cream to be produced next day.

Refer to the attached Excel/Solver worksheet, showing the solution to the LP above, along with the associated sensitivity report and answer the question(s) asked in each of the following parts, as specifically and completely as possible, without solving the problem again. Note that each part is separate and independent (i.e. any change made to the model in one part does not apply to any other part, where the model parameters not in question are reset to their original values. Also, note that due to a “printer malfunction”, the sensitivity data pertaining to the milk constraint are missing! (Use of Excel/Solver is not permitted for answering the questions below.)

How much of each product should be produced the next day and what is the resulting total profit? Is there any aspect of the solution that appears to be surprising, or contrary to conventional wisdom? Explain briefly.

How would J&B’s profitability be affected if it produces a gallon of chocolate ice cream, needed for an influential local official’s birthday party? Briefly explain.

If the profit for banana ice cream can be increased to $0.97 per gallon, how would the currently optimal product mix and the total profit be affected? Explain.

Suppose that due to an increase in the price of vanilla extract, the profit for vanilla ice cream declines to $0.88 per gallon. Will the solution in part (a) change and what can be said about the effect on total profit? Explain briefly.

If three gallons of cream turn sour and have to be thrown out, what would be the effect on total profit? Briefly explain.

Suppose that J&B has the opportunity of buying 8 more pounds of sugar at an additional (above the usual) cost of $0.75 per pound. Should this purchase be made? If yes, what would be the impact on total profit? Explain briefly.

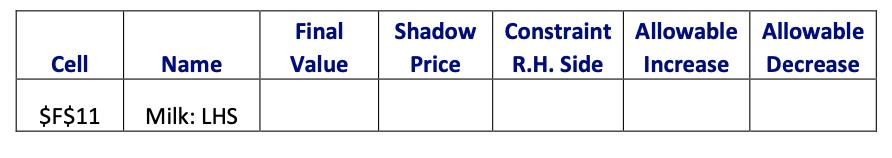

Determine and fill in the missing sensitivity data pertaining to the milk constraint below, briefly explaining the rationale involved.

If 30 more gallons of milk became available at no additional cost, should this extra milk be purchased? If yes, how would the total profit be affected? Explain briefly.

If an additional quantity of only one of the 3 ingredients can be obtained at no additional cost, which one and how much of it should be purchased? Explain.

Name $F$11 Milk: LHS Cell Final Value Shadow Constraint Allowable Allowable Increase Decrease Price R.H. Side

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Chocolate 0 Vanilla 300 Banana 75 Total Profit 34125 Only surprise is taking a decisi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started