Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jenkins Electronics has purchased a large quantity of electronic components from a Japanese firm for use in its new DVD players. The Japanese supplier has

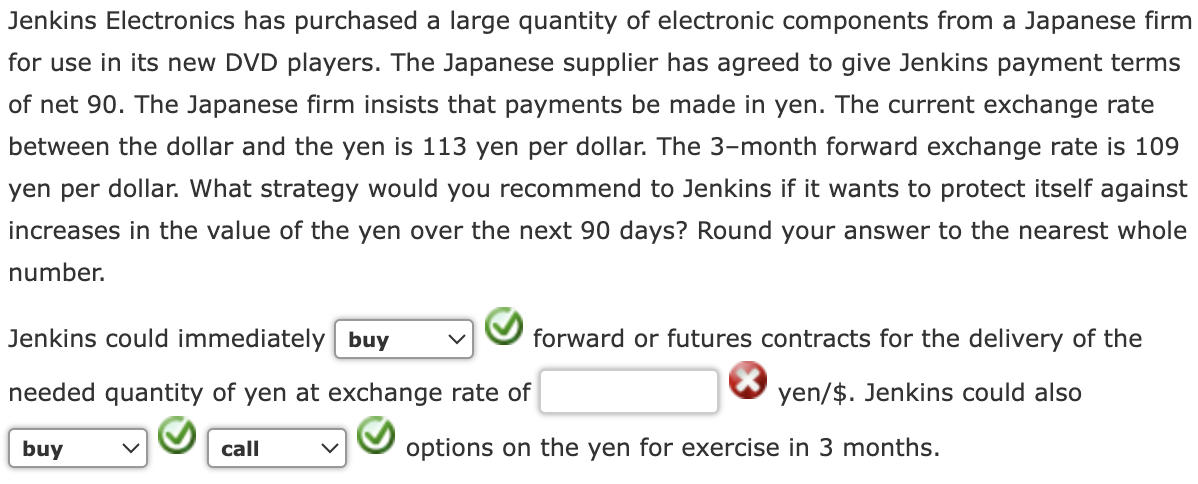

Jenkins Electronics has purchased a large quantity of electronic components from a Japanese firm for use in its new DVD players. The Japanese supplier has agreed to give Jenkins payment terms of net 90. The Japanese firm insists that payments be made in yen. The current exchange rate between the dollar and the yen is 113 yen per dollar. The 3-month forward exchange rate is 109 yen per dollar. What strategy would you recommend to Jenkins if it wants to protect itself against increases in the value of the yen over the next 90 days? Round your answer to the nearest whole number. Jenkins could immediately forward or futures contracts for the delivery of the needed quantity of yen at exchange rate of yen/\$. Jenkins could also options on the yen for exercise in 3 months. Jenkins Electronics has purchased a large quantity of electronic components from a Japanese firm for use in its new DVD players. The Japanese supplier has agreed to give Jenkins payment terms of net 90. The Japanese firm insists that payments be made in yen. The current exchange rate between the dollar and the yen is 113 yen per dollar. The 3-month forward exchange rate is 109 yen per dollar. What strategy would you recommend to Jenkins if it wants to protect itself against increases in the value of the yen over the next 90 days? Round your answer to the nearest whole number. Jenkins could immediately forward or futures contracts for the delivery of the needed quantity of yen at exchange rate of yen/\$. Jenkins could also options on the yen for exercise in 3 months

Jenkins Electronics has purchased a large quantity of electronic components from a Japanese firm for use in its new DVD players. The Japanese supplier has agreed to give Jenkins payment terms of net 90. The Japanese firm insists that payments be made in yen. The current exchange rate between the dollar and the yen is 113 yen per dollar. The 3-month forward exchange rate is 109 yen per dollar. What strategy would you recommend to Jenkins if it wants to protect itself against increases in the value of the yen over the next 90 days? Round your answer to the nearest whole number. Jenkins could immediately forward or futures contracts for the delivery of the needed quantity of yen at exchange rate of yen/\$. Jenkins could also options on the yen for exercise in 3 months. Jenkins Electronics has purchased a large quantity of electronic components from a Japanese firm for use in its new DVD players. The Japanese supplier has agreed to give Jenkins payment terms of net 90. The Japanese firm insists that payments be made in yen. The current exchange rate between the dollar and the yen is 113 yen per dollar. The 3-month forward exchange rate is 109 yen per dollar. What strategy would you recommend to Jenkins if it wants to protect itself against increases in the value of the yen over the next 90 days? Round your answer to the nearest whole number. Jenkins could immediately forward or futures contracts for the delivery of the needed quantity of yen at exchange rate of yen/\$. Jenkins could also options on the yen for exercise in 3 months Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started