Answered step by step

Verified Expert Solution

Question

1 Approved Answer

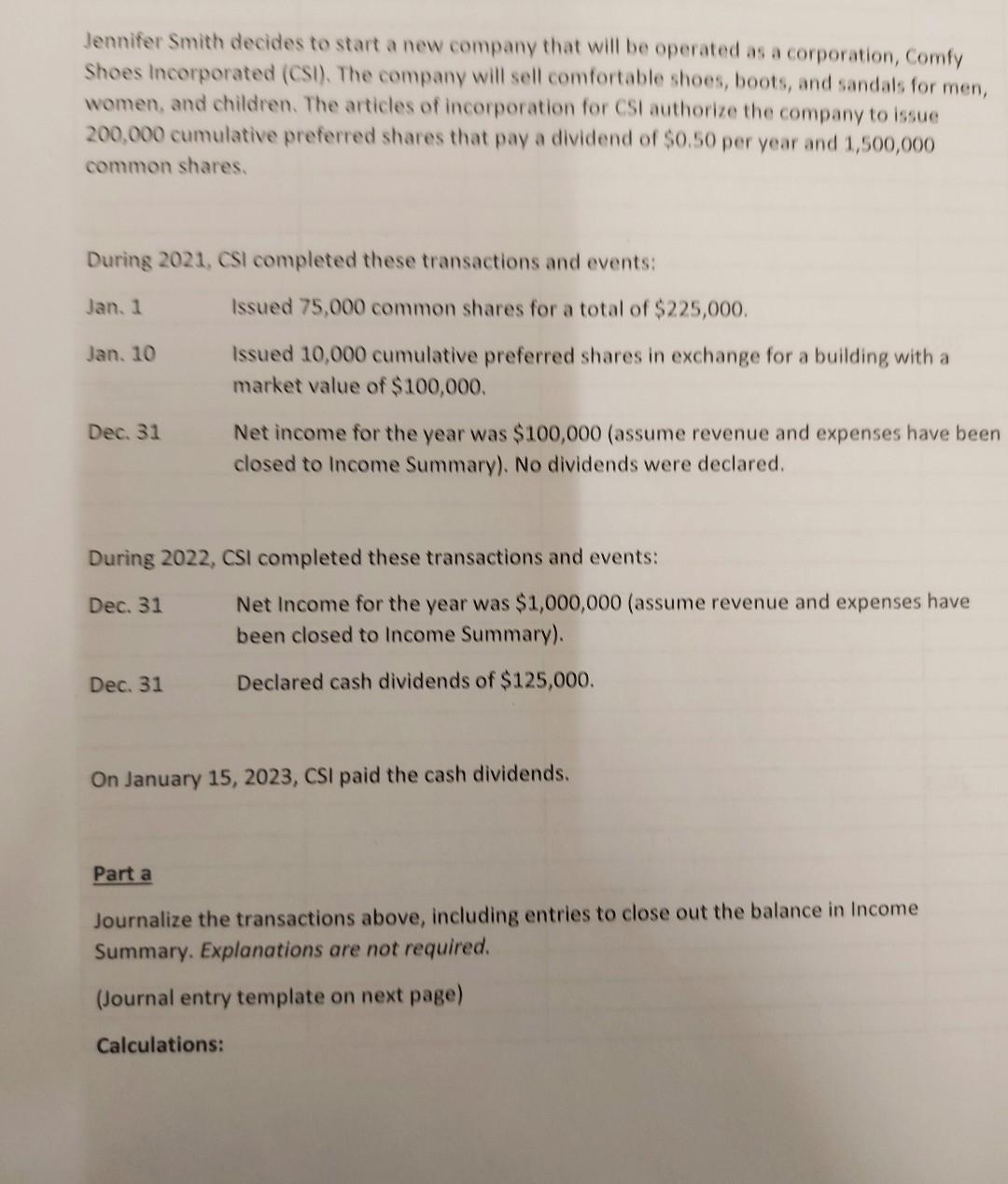

Jennifer Smith decides to start a new company that will be operated as a corporation, Comfy Shoes Incorporated (CSI). The company will sell comfortable shoes,

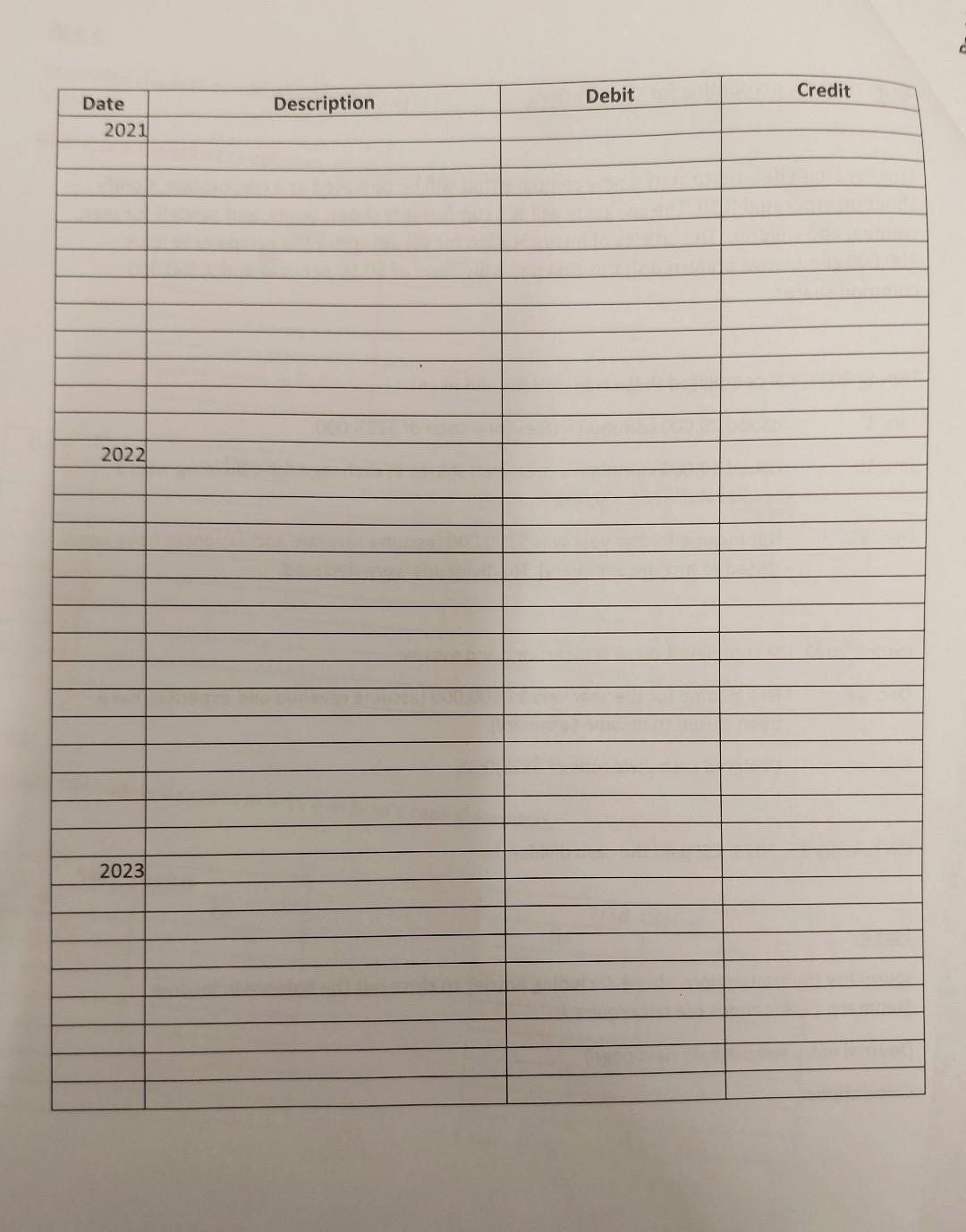

Jennifer Smith decides to start a new company that will be operated as a corporation, Comfy Shoes Incorporated (CSI). The company will sell comfortable shoes, boots, and sandals for men, women and children. The articles of incorporation for CSI authorize the company to issue 200,000 cumulative preferred shares that pay a dividend of $0.50 per year and 1,500,000 common shares During 2021, CSI completed these transactions and events: Jan. 1 Issued 75,000 common shares for a total of $225,000. Jan. 10 Issued 10,000 cumulative preferred shares in exchange for a building with a market value of $100,000 Net income for the year was $100,000 (assume revenue nd expenses have been closed to Income Summary). No dividends were declared. Dec. 31 During 2022, CSI completed these transactions and events: Dec. 31 Net Income for the year was $1,000,000 (assume revenue and expenses have been closed to Income Summary). Declared cash dividends of $125,000. Dec. 31 On January 15, 2023, CSI paid the cash dividends. Part a Journalize the transactions above, including entries to close out the balance in Income Summary. Explanations are not required. (Journal entry template on next page) Calculations: Debit Credit Description Date 2021 2022 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started