Answered step by step

Verified Expert Solution

Question

1 Approved Answer

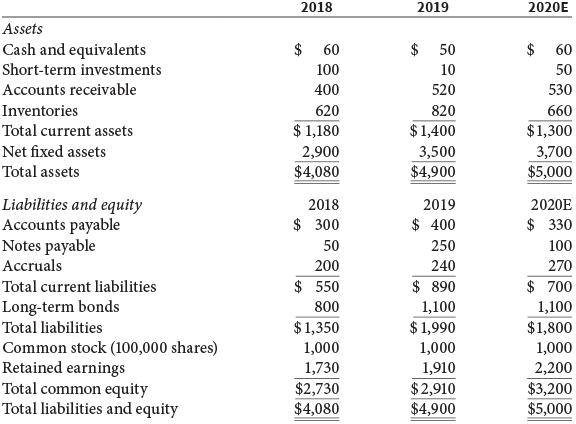

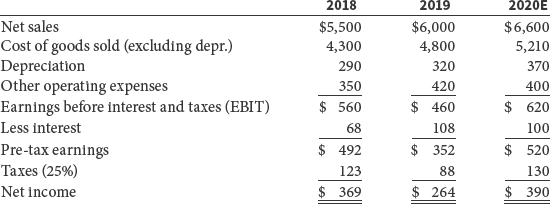

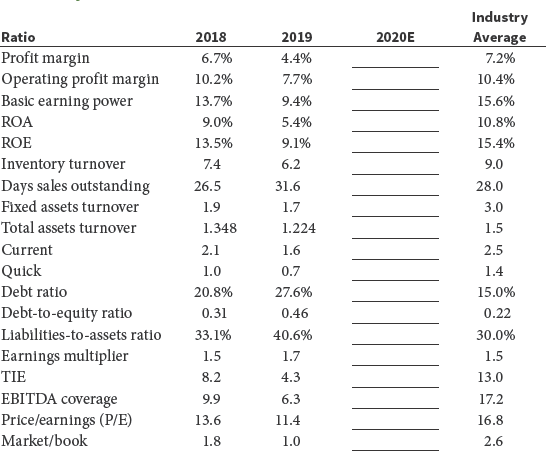

Jenny Cochran was brought in as assistant to Computron's chairman, who had the task of getting the company back into a sound financial position. Cochran

Jenny Cochran was brought in as assistant to Computron's chairman, who had the task of getting the company back into a sound financial position. Cochran must prepare an analysis of where the company is now, what it must do to regain its financial health, and what actions to take. Your assignment is to help her answer the following questions. Provide clear explanations, not yes or no answers. Use the recent and projected financial information shown next.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started