Answered step by step

Verified Expert Solution

Question

1 Approved Answer

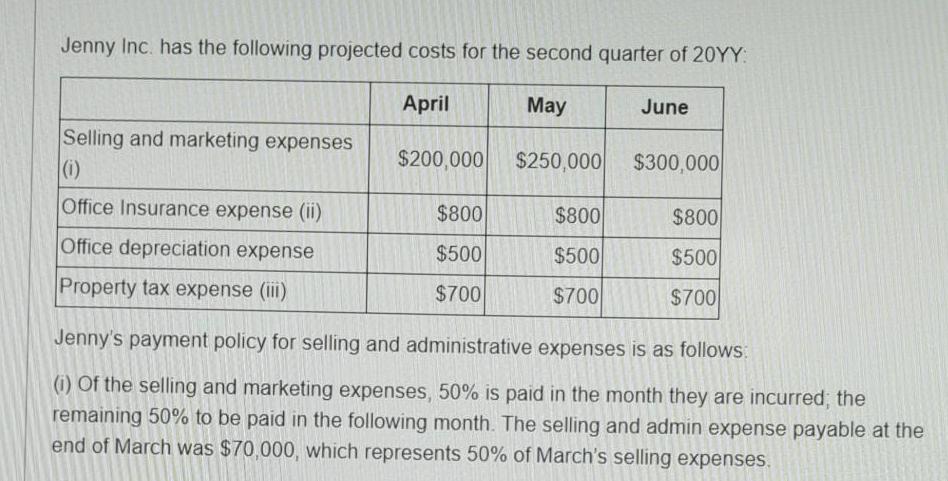

Jenny Inc. has the following projected costs for the second quarter of 20YY: April $200,000 $250,000 Selling and marketing expenses (1) Office Insurance expense

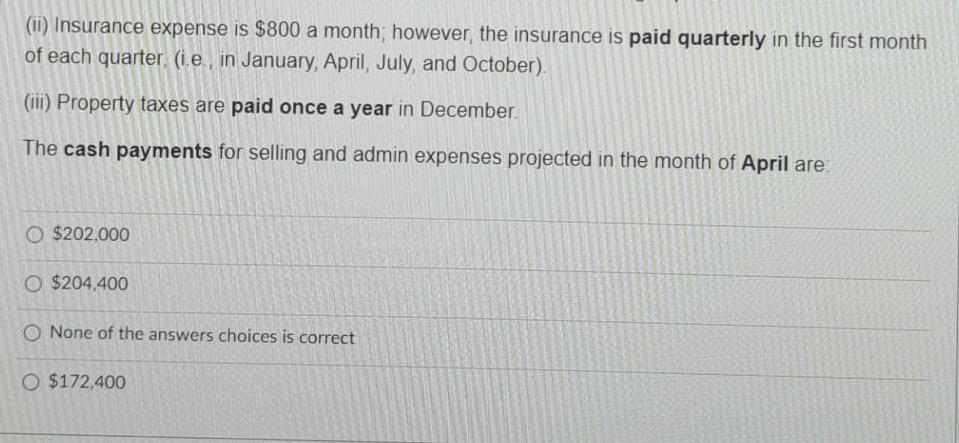

Jenny Inc. has the following projected costs for the second quarter of 20YY: April $200,000 $250,000 Selling and marketing expenses (1) Office Insurance expense (ii) Office depreciation expense Property tax expense (iii) $800 $500 $700 May $800 $500 $700 June $300,000 $800 $500 $700 Jenny's payment policy for selling and administrative expenses is as follows: (i) Of the selling and marketing expenses, 50% is paid in the month they are incurred; the remaining 50% to be paid in the following month. The selling and admin expense payable at the end of March was $70,000, which represents 50% of March's selling expenses. (ii) Insurance expense is $800 a month; however, the insurance is paid quarterly in the first month of each quarter, (ie, in January, April, July, and October). (iii) Property taxes are paid once a year in December. The cash payments for selling and admin expenses projected in the month of April are: O $202,000 O $204,400 O None of the answers choices is correct O $172,400

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To determine the cash payments for sell...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started