Question

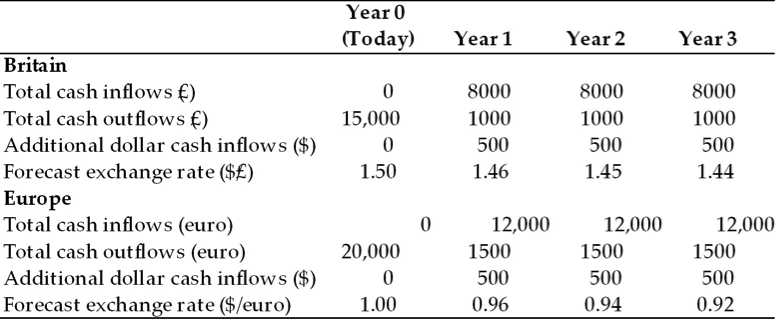

Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows

Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows for each project, assume a 12% wacc, and consider these to be average risk projects for the firm. Answer the questions that follow.

Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows for each project, assume a 12% wacc, and consider these to be average risk projects for the firm. Answer the questions that follow.

1) Refer to Table 19.1. The NPV for the British investment is estimated at ________.

A) $3,092

B) $6,420

C) ?3,092

D) $0

Answer: A

2) Refer to Table 19.1. The NPV for the European investment is estimated at ________.

A) euro 4,945

B) $4,945

C) $6,420

D) euro 6,420

Answer: B

3) Refer to Table 19.1. Which of the following best summarizes the preliminary results of the investment analysis for the two prospective investments.

A) The British investment should be accepted, the European investment rejected.

B) The British investment is superior to the European investment.

C) Both investments are acceptable.

D) None of the above is true.

Answer: C

Show steps please

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started