Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jerry's Ice Cream is a producer of high-quality ice cream sold to specialty grocery stores. The average price per unit is $6 ( 1 unit=1

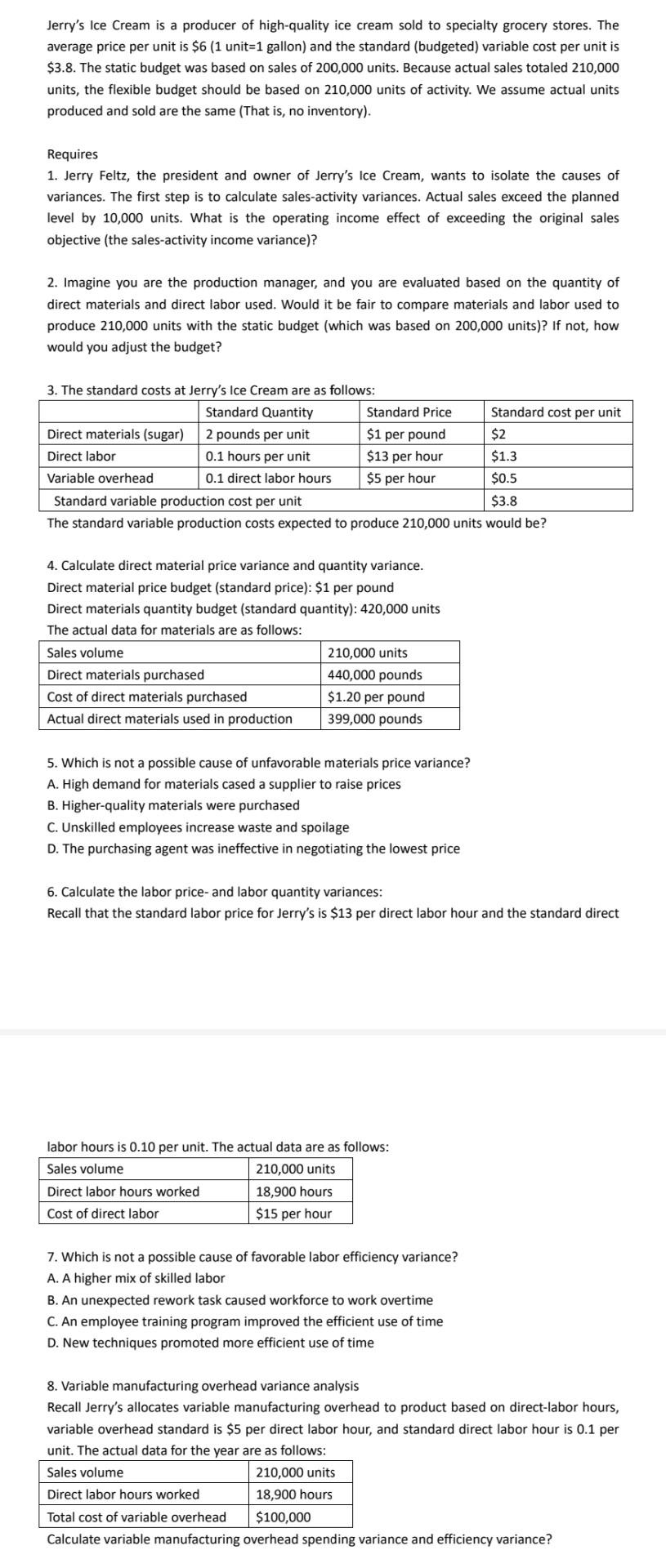

Jerry's Ice Cream is a producer of high-quality ice cream sold to specialty grocery stores. The average price per unit is $6 ( 1 unit=1 gallon) and the standard (budgeted) variable cost per unit is $3.8. The static budget was based on sales of 200,000 units. Because actual sales totaled 210,000 units, the flexible budget should be based on 210,000 units of activity. We assume actual units produced and sold are the same (That is, no inventory). Requires 1. Jerry Feltz, the president and owner of Jerry's Ice Cream, wants to isolate the causes of variances. The first step is to calculate sales-activity variances. Actual sales exceed the planned level by 10,000 units. What is the operating income effect of exceeding the original sales objective (the sales-activity income variance)? 2. Imagine you are the production manager, and you are evaluated based on the quantity of direct materials and direct labor used. Would it be fair to compare materials and labor used to produce 210,000 units with the static budget (which was based on 200,000 units)? If not, how would you adjust the budget? 2 The ctandard rectc at lerris'c Ire Cream are ac followic. The standard variable production costs expected to produce 210,000 units would be? 4. Calculate direct material price variance and quantity variance. Direct material price budget (standard price): \$1 per pound Direct materials quantity budget (standard quantity): 420,000 units Tha artual data for matariale ara ac fallnuse. 5. Which is not a possible cause of unfavorable materials price variance? A. High demand for materials cased a supplier to raise prices B. Higher-quality materials were purchased C. Unskilled employees increase waste and spoilage D. The purchasing agent was ineffective in negotiating the lowest price 6. Calculate the labor price- and labor quantity variances: Recall that the standard labor price for Jerry's is $13 per direct labor hour and the standard direct labor hours is 0.10 per unit. The actual data are as follows: 7. Which is not a possible cause of favorable labor efficiency variance? A. A higher mix of skilled labor B. An unexpected rework task caused workforce to work overtime C. An employee training program improved the efficient use of time D. New techniques promoted more efficient use of time 8. Variable manufacturing overhead variance analysis Recall Jerry's allocates variable manufacturing overhead to product based on direct-labor hours, variable overhead standard is $5 per direct labor hour, and standard direct labor hour is 0.1 per unit. The actual data for the year are as follows: Calculate variable manufacturing overhead spending variance and efficiency variance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started