Answered step by step

Verified Expert Solution

Question

1 Approved Answer

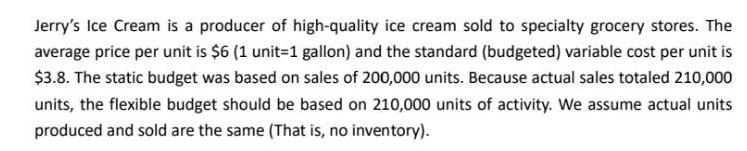

Jerry's Ice Cream is a producer of high-quality ice cream sold to specialty grocery stores. The average price per unit is $6 (1 unit-1

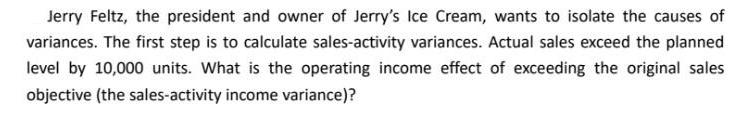

Jerry's Ice Cream is a producer of high-quality ice cream sold to specialty grocery stores. The average price per unit is $6 (1 unit-1 gallon) and the standard (budgeted) variable cost per unit is $3.8. The static budget was based on sales of 200,000 units. Because actual sales totaled 210,000 units, the flexible budget should be based on 210,000 units of activity. We assume actual units produced and sold are the same (That is, no inventory). Jerry Feltz, the president and owner of Jerry's Ice Cream, wants to isolate the causes of variances. The first step is to calculate sales-activity variances. Actual sales exceed the planned level by 10,000 units. What is the operating income effect of exceeding the original sales objective (the sales-activity income variance)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution The salesactivity income variance is calculated by subtracting the a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started