Question

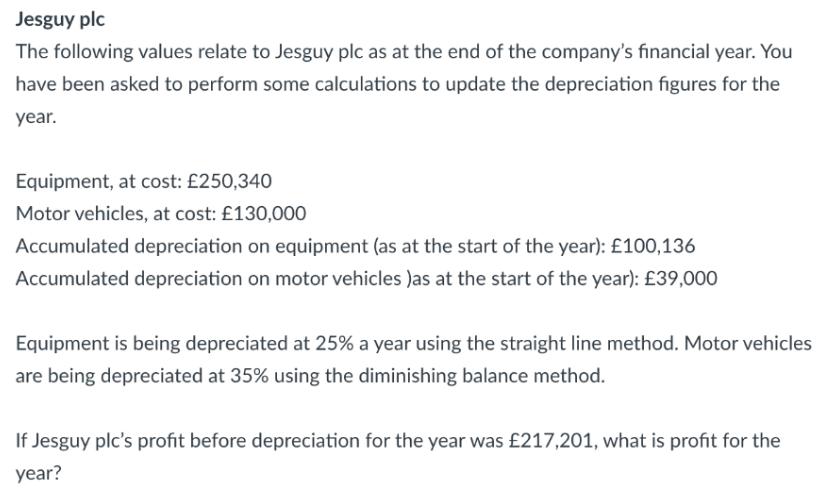

Jesguy plc The following values relate to Jesguy plc as at the end of the company's financial year. You have been asked to perform

Jesguy plc The following values relate to Jesguy plc as at the end of the company's financial year. You have been asked to perform some calculations to update the depreciation figures for the year. Equipment, at cost: 250,340 Motor vehicles, at cost: 130,000 Accumulated depreciation on equipment (as at the start of the year): 100,136 Accumulated depreciation on motor vehicles )as at the start of the year): 39,000 Equipment is being depreciated at 25% a year using the straight line method. Motor vehicles are being depreciated at 35% using the diminishing balance method. If Jesguy plc's profit before depreciation for the year was 217,201, what is profit for the year?

Step by Step Solution

3.33 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

Step 14 We must first determine the depreciation for the year in order t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management for Public Health and Not for Profit Organizations

Authors: Steven A. Finkler, Thad Calabrese

4th edition

133060411, 132805669, 9780133060416, 978-0132805667

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App