Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jesse has various investments in his portfolio and has provided the following details: REQUIRED: 1. On May 15, 2017, Jesse purchased a bond issued

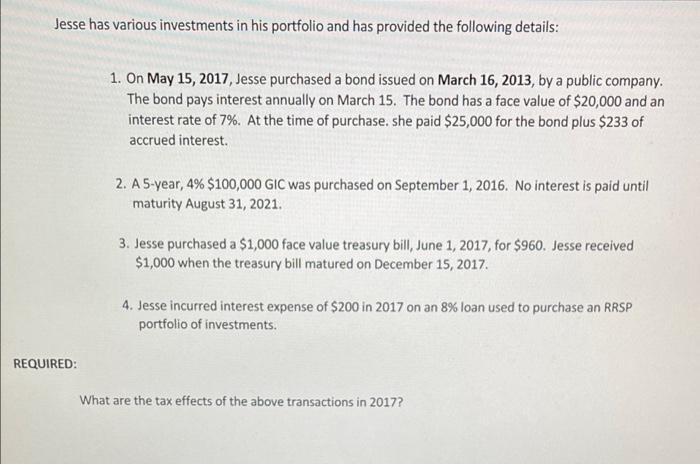

Jesse has various investments in his portfolio and has provided the following details: REQUIRED: 1. On May 15, 2017, Jesse purchased a bond issued on March 16, 2013, by a public company. The bond pays interest annually on March 15. The bond has a face value of $20,000 and an interest rate of 7%. At the time of purchase. she paid $25,000 for the bond plus $233 of accrued interest. 2. A 5-year, 4% $100,000 GIC was purchased on September 1, 2016. No interest is paid until maturity August 31, 2021. 3. Jesse purchased a $1,000 face value treasury bill, June 1, 2017, for $960. Jesse received $1,000 when the treasury bill matured on December 15, 2017. 4. Jesse incurred interest expense of $200 in 2017 on an 8% loan used to purchase an RRSP portfolio of investments. What are the tax effects of the above transactions in 2017?

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started