Question

Jetson Ltd imports inventory from Germany Ltd and on 1 June ordered goods worth Euro 200000 The inventory is delivered on 15 July and payment

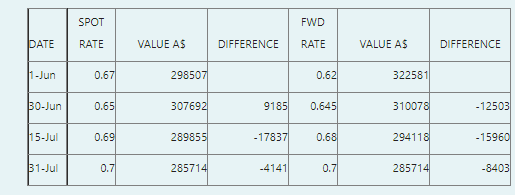

Jetson Ltd imports inventory from Germany Ltd and on 1 June ordered goods worth Euro 200000 The inventory is delivered on 15 July and payment is made on July 31. Jetson Ltd took out a hedge on 1 June to buy Euro on 31 July. Jetsons year-end is June 30. The following rates and contract values apply to this hedge:

What is the A$ inventory amount capitalised on 15 July upon its arrival? Hint: Give due consideration to both (i) the spot transaction for the underlying accounts payable recognition, and (ii) the classification, measurement, recognition and treatment of the cumulative gains or losses applicable to the forward contract, up to 15 July. You can assume that the forward contract is an effective hedge for the inventory purchase.

a. 322581

b. 302358

c. 261392

d. 318318

e. 289855

f. 305815

SPOT FWD PATE RATE VALUE AS DIFFERENCE RATE VALUE AS DIFFERENCE 11 - Jun 0.67 298507 0.621 322581 30-Jun 0.65 307692 9185 0.645 310078 -12503 15-Jul 0.69 289855 -17837 0.68 294118 - 15960 31-Jul 0.7 285714 -4141 0 0.7 285714 -8403

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the A amount capitalized on 15 July upon the inventorys arrival we need to account for both the spot rate on the date of delivery and the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started