Answered step by step

Verified Expert Solution

Question

1 Approved Answer

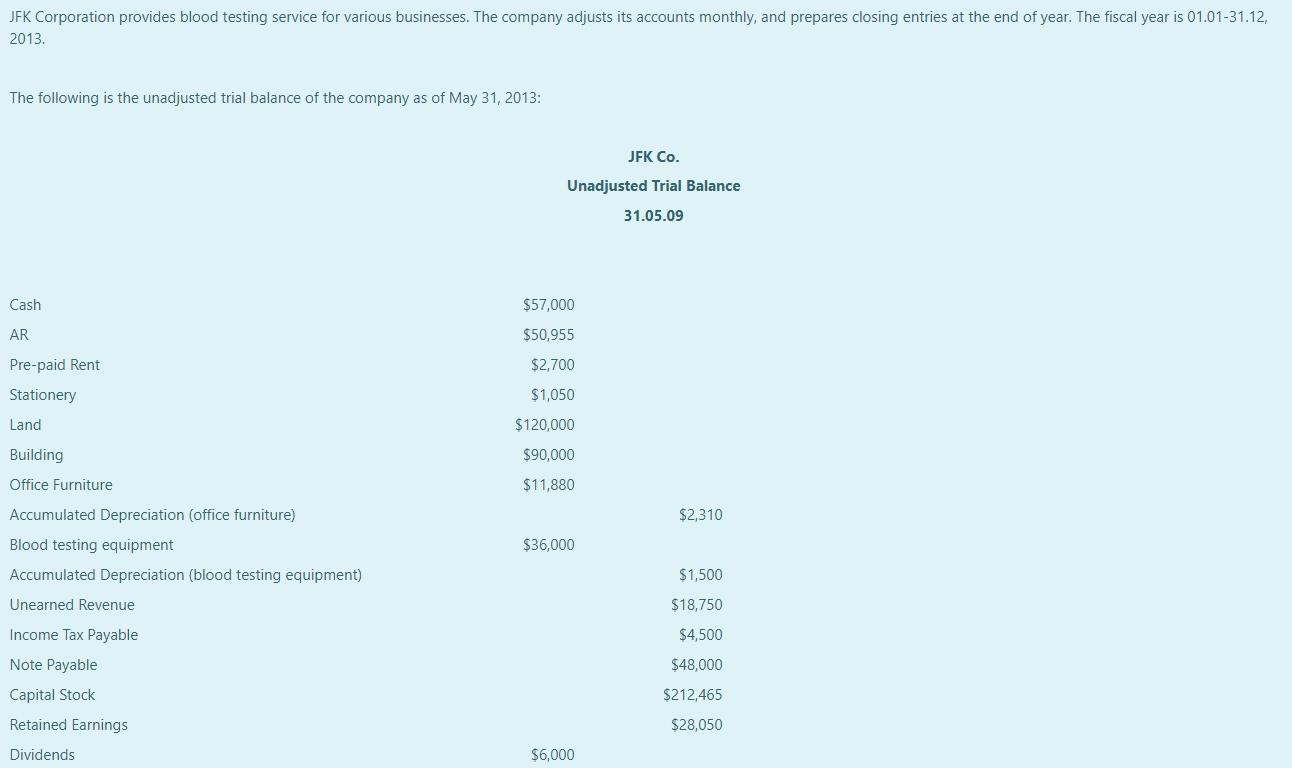

JFK Corporation provides blood testing service for various businesses. The company adjusts its accounts monthly, and prepares closing entries at the end of year.

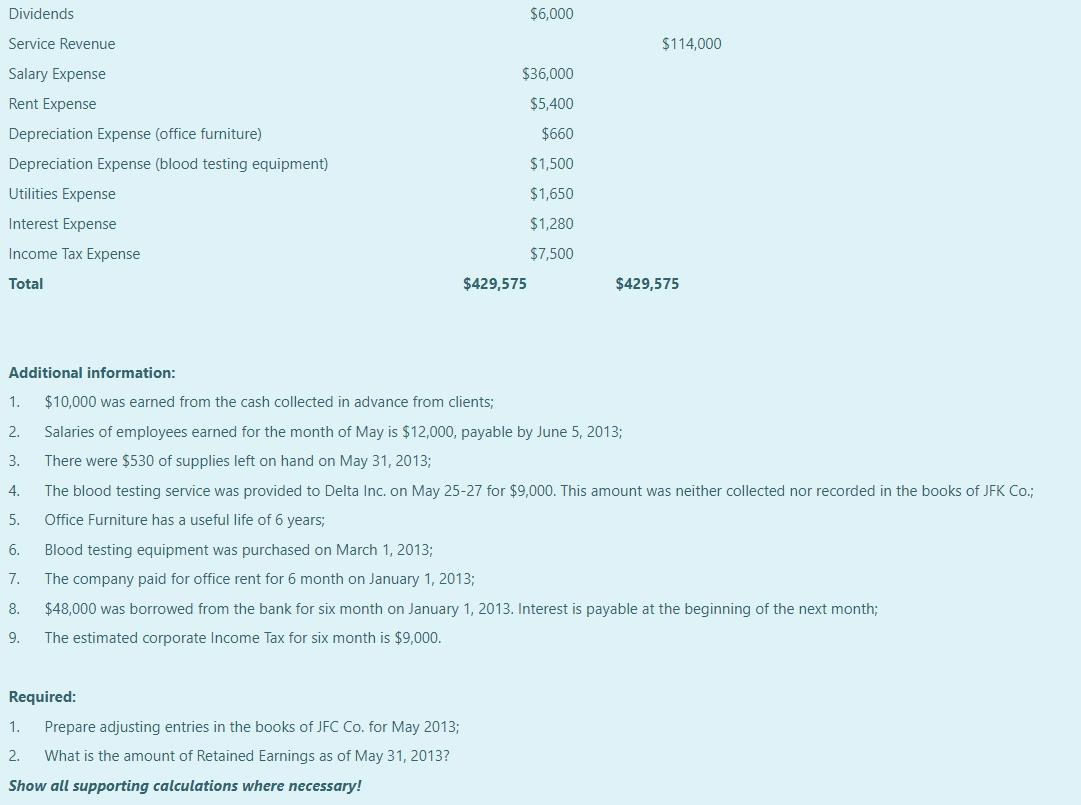

JFK Corporation provides blood testing service for various businesses. The company adjusts its accounts monthly, and prepares closing entries at the end of year. The fiscal year is 01.01-31.12, 2013. The following is the unadjusted trial balance of the company as of May 31, 2013: Cash AR Pre-paid Rent Stationery Land Building Office Furniture Accumulated Depreciation (office furniture) Blood testing equipment Accumulated Depreciation (blood testing equipment) Unearned Revenue Income Tax Payable Note Payable Capital Stock Retained Earnings Dividends JFK Co. Unadjusted Trial Balance 31.05.09 $57,000 $50,955 $2,700 $1,050 $120,000 $90,000 $11,880 $36,000 $6,000 $2,310 $1,500 $18,750 $4,500 $48,000 $212,465 $28,050 Dividends Service Revenue Salary Expense Rent Expense Depreciation Expense (office furniture) Depreciation Expense (blood testing equipment) Utilities Expense Interest Expense Income Tax Expense Total 1. 2. 3. 4. 5. 6. 7. 8. 9. $6,000 $36,000 $5,400 $660 $429,575 Additional information: $10,000 was earned from the cash collected in advance from clients; Salaries of employees earned for the month of May is $12,000, payable by June 5, 2013; There were $530 of supplies left on hand on May 31, 2013; Required: 1. Prepare adjusting entries in the books of JFC Co. for May 2013; 2. What is the amount of Retained Earnings as of May 31, 2013? Show all supporting calculations where necessary! $1,500 $1,650 $1,280 $7,500 $114,000 $429,575 The blood testing service was provided to Delta Inc. on May 25-27 for $9,000. This amount was neither collected nor recorded in the books of JFK Co.; Office Furniture has a useful life of 6 years; Blood testing equipment was purchased on March 1, 2013; The company paid for office rent for 6 month on January 1, 2013; $48,000 was borrowed from the bank for six month on January 1, 2013. Interest is payable at the beginning of the next month; The estimated corporate Income Tax for six month is $9,000.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Prepare Adjusting Entries Date Account 20130531 Unearned Revenue Service Revenues To record earned ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started