Answered step by step

Verified Expert Solution

Question

1 Approved Answer

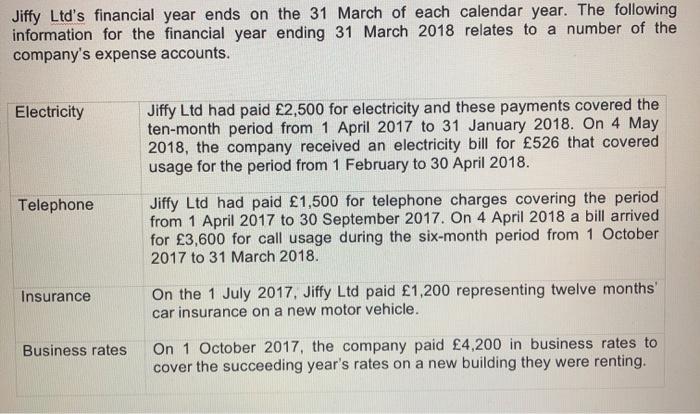

Jiffy Ltd's financial year ends on the 31 March of each calendar year. The following information for the financial year ending 31 March 2018

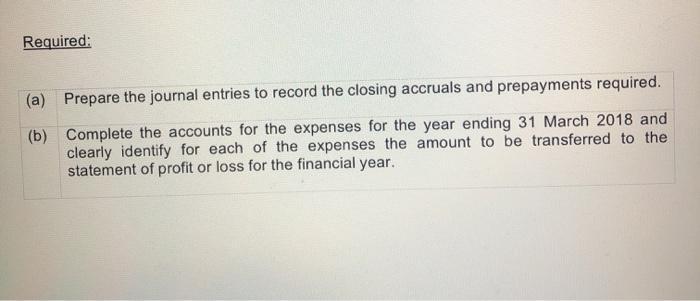

Jiffy Ltd's financial year ends on the 31 March of each calendar year. The following information for the financial year ending 31 March 2018 relates to a number of the company's expense accounts. Electricity Telephone Insurance Business rates Jiffy Ltd had paid 2,500 for electricity and these payments covered the ten-month period from 1 April 2017 to 31 January 2018. On 4 May 2018, the company received an electricity bill for 526 that covered usage for the period from 1 February to 30 April 2018. Jiffy Ltd had paid 1,500 for telephone charges covering the period. from 1 April 2017 to 30 September 2017. On 4 April 2018 a bill arrived for 3,600 for call usage during the six-month period from 1 October 2017 to 31 March 2018. On the 1 July 2017, Jiffy Ltd paid 1,200 representing twelve months' car insurance on a new motor vehicle.. On 1 October 2017, the company paid 4,200 in business rates to cover the succeeding year's rates on a new building they were renting. Required: (a) Prepare the journal entries to record the closing accruals and prepayments required. (b) Complete the accounts for the expenses for the year ending 31 March 2018 and clearly identify for each of the expenses the amount to be transferred to the statement of profit or loss for the financial year.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a To record the closing accruals and prepayments required youll need to make adjusting journal entri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started